Senior Reporter

Class 8 Sales Continue to Rise in October, Post 31.6% Gain

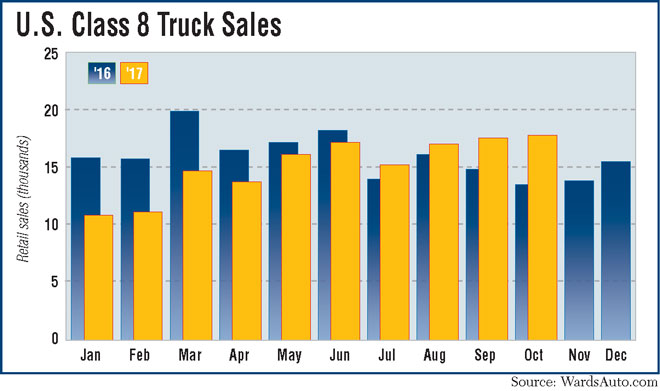

U.S. Class 8 retail sales continued climbing in October, reaching nearly 18,000, WardsAuto.com reported, but other analysts noted that the market is softer and more volatile than is typical at this time of year.

Sales hit 17,928, a 31.6% increase compared with 13,618 a year earlier — which was the low point in 2016.

This October’s total is the high point of the year and the fourth month in the past five with sales exceeding17,000, according to Ward’s.

Year-to-date, however, sales were 152,409, down 6.5%.

“The good news is, yes, retail sales continue the trend of being considerably stronger than last year,” Don Ake, vice president of commercial vehicles for research company FTR, told Transport Topics.

“However, when you think back to what was happening last year at this time, the market was weakening and going downhill. This was when the panic was setting in last year; the numbers were going down and people were thinking it was a major correction,” Ake said.

That year-ago period turned out to be a minor correction, he said.

October’s sales measured on a per-day basis have fallen 6% from September, he added. “That is not good. There’s a softer market for trucks in the fourth quarter than was expected.”

That comes amid strong big-picture economic fundamentals, plus rising freight demand and freight rates, he said, and the discrepancy has him puzzled.

“From a forecasting point of view, [October] makes me nervous,” he said.

ACT Research Co. forecast total sales will be flat this year compared with 2016, then rise 25% in 2018.

October’s sales underscore there is some volatility in the market, ACT Vice President Steve Tam said. “That is exacerbated by truck makers using incentives to sell trucks and build market share.”

Meanwhile, all truck makers except one posted higher year-over-year sales in October.

Freightliner claimed a leading 35.3% of the market with sales of 6,334, up 44.9% from a year earlier.

Freightliner is a unit of Daimler Trucks North America.

Peterbilt Motors Co. notched the second-highest share, 17.2% on sales of 3,076 — up a leading 48.7% compared with the 2016 period.

Kenworth Truck Co. earned a 15.4% share on sales of 2,769, up 31.4% year-over-year.

Peterbilt and Kenworth are brands of Paccar Inc.

Kenworth customer Melton Truck Lines Inc., based in Tulsa, Okla., is working to smooth out its current four-year trade cycle that consists of two heavy years and two light years, Chief Financial Officer Robert Ragan said.

“We are running a few trucks 4½ years in an attempt to more evenly distribute the dispositions over each of the four years. This year, we only purchased 150 trucks but in 2016 we purchased 450. Next year, we are purchasing 250,” Ragan said.

Melton, a flatbed carrier, historically has tried to grow 6-8% a year. “Next year, we are selling 175 trucks, so for a net gain of 75 trucks,” Ragan said.

Melton, which operates 1,300 trucks, primarily buys Kenworth’s T680s and some Freightliner Cascadias.

Also, International posted a 15.6% share on sales of 2,801 trucks, a 28% increase compared with the 2016 period.

International is a unit of Navistar International Corp.

Volvo Trucks North America earned an 8.4% share on sales of 1,500, a 6.1% year-over-year increase.

“We anticipate the strong Class 8 retail environment to continue through the remainder of 2017, with 2018 shaping up to be even stronger as a result of both regional haul and longhaul demand,” said Magnus Koeck, Volvo Trucks North America vice president of marketing and brand management. “We’re seeing fleets more interested in utilizing innovative technologies, like Remote Diagnostics for proactive diagnostic and repair planning, to reduce costs through improved uptime.”

Mack Trucks posted a 5.9% share after selling 1,063 trucks, down 6.9% from October 2016.

“At Mack, retail sales through October remain solid, and we’re on track to maintain the market share gains we made in 2016. This is due in part to the ongoing interest from customers in Mack’s fully integrated powertrain featuring the mDRIVE automated manual transmission, along with our industry leading uptime solutions,” said John Walsh, vice president of global marketing and brand management for Mack Trucks.

DTNA’s Western Star niche brand sold 373 trucks in October for a 2.1% share. That was 50 more than a year earlier.

Other truck makers did not respond to a request for comment.

Staff reporter Burney Simpson contributed to this story.