Class 8 Registrations Rise in 2014 to Highest Level in Eight Years

This story appears in the Feb. 23 print edition of Transport Topics.

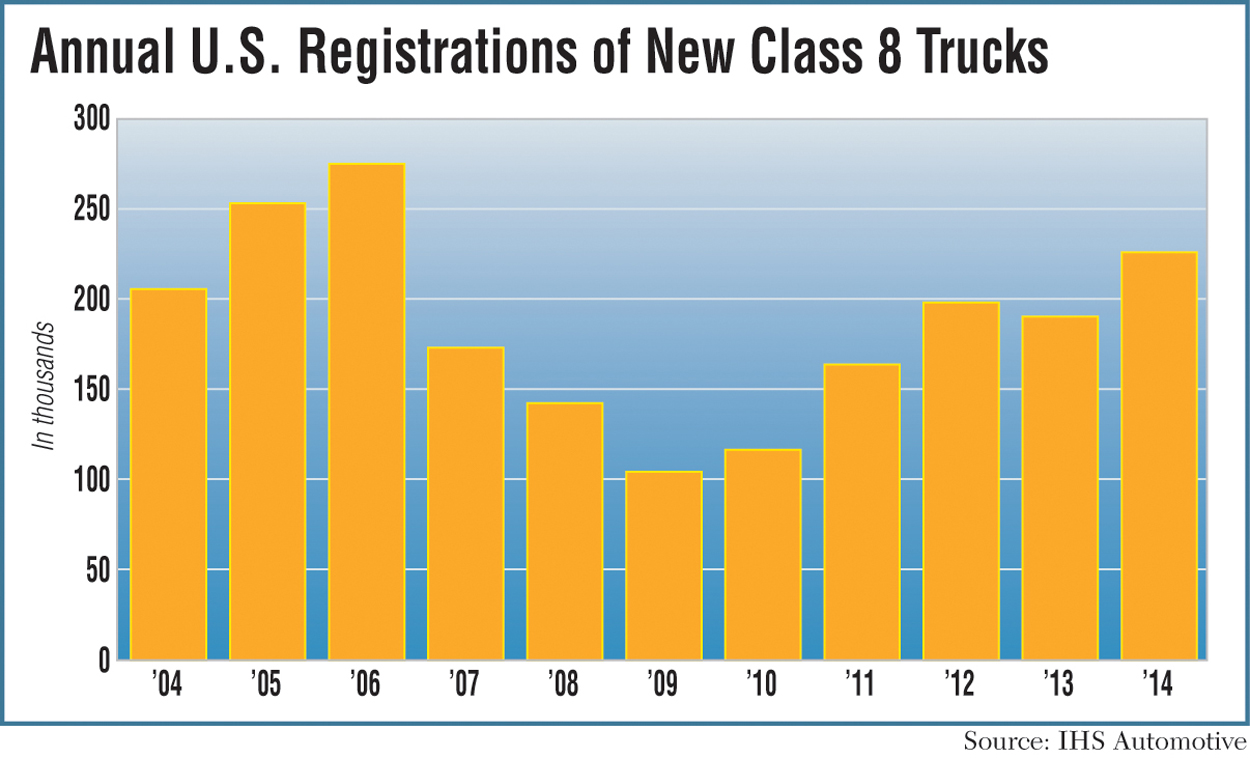

Registrations of new Class 8 trucks rose in 2014 to the highest level in eight years as rising freight demand continued to spur investments in new equipment, IHS Automotive reported.

The recent increase in new vehicles helped boost the total U.S. population of registered Class 8 trucks to 3.78 million at the end of the year, the highest level on record according to Polk’s data and up 3.8% from a year earlier.

Last year’s total of 226,228 new registrations in the United States was 19% higher than 2013 and the most since 2006, according to IHS’ quarterly Polk report on commercial vehicles.

“It was a great year,” said Gary Meteer Sr., director of global commercial vehicle products at IHS. “The business has really been driven by big fleets coming back into the market.”

He said large carriers have been taking advantage of more profitable business opportunities by hauling more freight themselves rather than brokering it out to smaller trucking companies.

The expansion of rental and leasing businesses also has contributed to the growth in new registrations, he said.

In the fourth quarter alone, IHS counted 58,560 new registrations, just under the 59,822 recorded in the third quarter. Those were the two best quarters for new registrations since the end of 2006, when equipment purchases spiked ahead of tighter federal emissions standards.

New-truck registrations surged 23% in 2014 among fleets operating more than 500 trucks, which accounted for 48% of all new registrations last year.

At the same time, new registrations rose 9% at fleets operating between two and 500 vehicles.

Single-truck businesses registered 49% more new trucks than the previous year, but those firms represented only 11% of all new registrations.

Meteer said that while IHS’s registration data show growth in the number of registered trucks, it’s not a perfect indication of total trucks in operation because some vehicles that are awaiting resale continue to appear in the vehicle population for a certain amount of time and aren’t actually in use.

Used Class 8 transactions in-creased 3.8% in 2014 from the previous year, the report said.

Meteer said the overall freight environment has been conducive to equipment investments.

“The economy is pretty good,” he said. “People are spending and people are buying, so demand for goods is fairly high.”

Truck tonnage rose 3.5% in 2014 and ended the year at a record level, according to American Trucking Associations’ advanced seasonally adjusted for-hire index.

Meteer said fleets’ confidence in the freight market has improved over the past few years.

“There’s nothing on the horizon that’s painting a gloomy picture, so people are investing,” he said.

The Class 8 market peaked at 275,092 new registrations during the 2006 “pre-buy” before plummeting to 104,569 in 2009. Since then, the market has seen a “nice, steady climb” before finally surpassing the 200,000 mark last year, Meteer said.

IHS has not finalized a projection for 2015 registrations, but Meteer said he expects “moderate growth” over the level seen in 2014.

However, he predicted that the availability of manufacturing capacity and component supplies could put a ceiling on how high the market goes.

Home Run Inc., a flatbed carrier based in Xenia, Ohio, said it bought 25 new trucks last year, 20 of which were replacement purchases and five of which represented the fleet’s expansion.

The family-owned business, which hauls building materials, is moving forward with a similar buying plan this year, said Gregg Harlow, president of the 250-truck fleet.

Some of Home Run’s shipper customers are expecting to grow their businesses this year, he said.

“We are hearing positive things from our customer base,” he said. “There’s some optimism there.”

Dick Witcher, CEO of Minuteman Trucks, an International dealer in Walpole, Massachusetts, said factory backlogs have increased, extending the amount of lead time necessary to deliver a new vehicle once a customer orders it from a dealer.

“This has been a very dramatic change from the volumes we’ve had over the past seven years,” he said.

Witcher, who also is past chairman of American Truck Dealers, said the improved quality of today’s new trucks is supporting some of the sales activity.

The new engines with advanced emission-control systems are much more reliable today than when they were first introduced, he said.

Witcher also said modern trucks are safer, cleaner and more fuel-efficient than older models.

He expects the market growth to continue in 2015.

“We’ve got a lot of orders in our order bank, and we’re seeing a lot of progress,” he said.

IHS said Freightliner remained the industry leader in new Class 8 registrations with 34.4% market share in 2014, followed by Kenworth with 13.7% and Peterbilt with 13.1%.

For all Classes 3-8 commercial vehicles, new registrations totaled 655,393 in 2014, up 14% from the previous year.