Chip Delivery Times Shrink in August

[Stay on top of transportation news: Get TTNews in your inbox.]

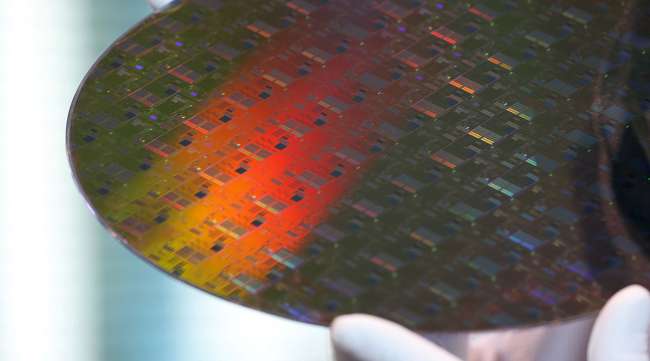

Chip delivery times shrank again in August, a sign the global shortage is easing further, but some types of semiconductors remain hard to find.

Lead times — the gap between when a chip is ordered and when it is delivered — averaged 26.8 weeks in August, according to research by Susquehanna Financial Group. That was a day shorter than they were in the prior month.

The shorter wait times reflect slowing demand for some kinds of technology — namely, phones and personal computers — according to Susquehanna analyst Chris Rolland. But parts of the market remain overheated, with orders coming in faster than chipmakers can fill them.

“We believe over-ordering trends and inventory builds have yet to work through the system,” he said in a research note.

The chip industry often struggles to match supply with demand, partly because the components take months to manufacture. Semiconductor makers also are serving a much larger swath of the economy these days, with chips going into cars, factory equipment and appliances.

In the past, investors have viewed extended lead times as a sign that the industry was building up too much inventory — a precursor to a slump. But the supply chain disruptions caused by the pandemic created unprecedented shortages. Getting back down to 10- to 14-week wait times would be “healthy,” Rolland said.

Want more news? Listen to today's daily briefing above or go here for more info

The wait for some power management, microcontroller and optoelectronic devices remains extended, Rolland said. Companies such as Microchip Technology Inc. and Infineon Technologies AG are still scrambling to fill those kinds of orders.

Other chipmakers, though, are already suffering from a drop-off in demand. That includes Nvidia Corp. and Intel Corp., which rely heavily on the PC market.

Chip investors already have been bracing for a steep downturn. The Philadelphia Stock Market Semiconductor Index has fallen 33% this year.