China Halts Some US Farm Imports, Threatening Trade Deal

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

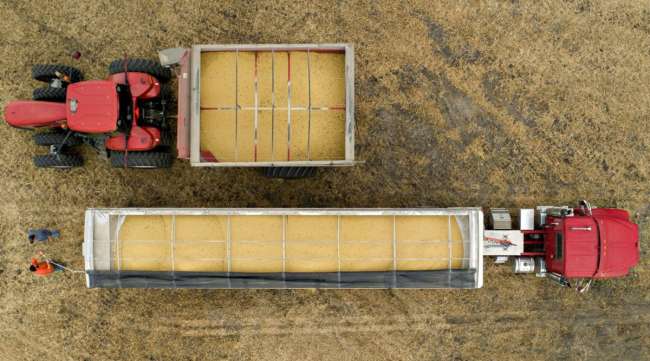

Chinese government officials told major state-run agricultural companies to pause purchases of some American farm goods, including soybeans, as Beijing evaluates the ongoing escalation of tensions with the U.S. over Hong Kong, according to people familiar with the situation.

State-owned traders Cofco and Sinograin were ordered to suspend purchases, according to one of the people, who asked not to be identified discussing a private matter. Chinese buyers also have canceled an unspecified number of U.S. pork orders, one of the people said. Private companies haven’t been told to halt imports, according to one of the people.

The halt is the latest sign that the hard-won phase-one trade deal between the world’s two biggest economies is in jeopardy. While Chinese Premier Li Keqiang last month reiterated a pledge to implement the agreement that was inked in January, tensions have continued to escalate since then amid a standoff over Beijing’s move to tighten its grip on Hong Kong.

Beijing’s move eroded the risk-on sentiment that had been prevailing over markets. The S&P 500 Index was little changed, while soybean futures in Chicago gained 0.4% after falling as much as 0.8% earlier. Shares of Archer-Daniels-Midland Co. were down 1.7% at $38.64.

“The market has already seen the deteriorating relationship between China and the U.S. and many think that with the slow progress of Chinese commodity buying so far, the trade deal’s future was already in jeopardy,” said Michael McDougall, a managing director at Paragon Global Markets in New York.

Hong Kong

The measures to halt imports come after President Donald Trump on May 29 lobbed a barrage of criticism at Beijing after it moved to impose controversial new national security legislation on Hong Kong. Critics say it will crack down on dissent and undermine the “one country, two systems” principle that has kept Hong Kong autonomous of the mainland since the 1997 handover from the British.

Cofco and Sinograin are China’s key importers of farm goods. They had been making pricing inquiries for 20 to 30 cargoes of U.S. soybeans on May 29 but held off on going through with purchases after Trump indicated he would punish Chinese officials, one of the people said. Beijing is waiting to see what steps Trump takes before deciding its next move, one of the people said.

Nobody from the commerce ministry responded to a fax seeking comment. Officials from Sinograin and Cofco also didn’t respond to calls.

Trump’s Threats

Trump said the U.S. would begin the process of stripping some of Hong Kong’s privileged trade status, without detailing how many changes would take effect and how many exemptions would apply. He also promised sanctions against Chinese and Hong Kong officials “directly or indirectly involved” in eroding Hong Kong’s autonomy, though stopped short of giving specifics.

COVID-19 has placed significant strain on many freight networks. So how are third-party logistics providers adapting to meet these challenges? Host Seth Clevenger chats with two 3PL executives who have had firsthand experience contending with this crisis. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

Equity investors had reacted positively to Trump’s remarks, as he didn’t provide any details or timeframe for what actions might come next. It’s unclear how soon the U.S. would move on a range of options, from sanctioning Chinese officials to imposing tariffs on Hong Kong to attacking the territory’s financial stability.

While Trump has periodically threatened to call off the “phase one” trade deal, his top economic advisers have suggested it would continue. Larry Kudlow, director of the National Economic Council, told CNBC on May 28 that the trade agreement “does continue to go on for the moment and we may be making progress there.”

The two sides have traded blows over a range of issues from the coronavirus to Taiwan in recent weeks, and China’s Foreign Minister Wang Yi warned during high-profile legislative meetings in Beijing that some in America were pushing relations to a “new Cold War,” and urged the U.S. to give up its “wishful thinking” of changing China.

China had agreed to buy U.S. farm goods worth about $36.5 billion for 2020 as part of the phase-one trade deal signed in January. However, the coronavirus outbreak roiled those plans, with China only managing to import $3.35 billion in American agricultural products in the first three months of the year, the lowest for that period since 2007, according to data from the U.S. Department of Agriculture.

Still, as China started to gradually reopen its economy from the virus-led lockdown, it had increased its pace of imports, including a more-than 1-million ton cargo of American soybeans in just two weeks in May, and rare purchases of U.S. soybean oil and ethanol.

But then tensions between the U.S. and China began escalating, with Trump blaming the Asian nation for misleading the world about the scale and risk of the coronavirus outbreak. The fallout filtered through to the commodities markets, with China opting to buy Brazilian soy instead of American beans.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More