China Buys More US Soybeans as Agriculture Trade Woes Ease

China, the world’s largest consumer of soybeans, bought American-grown oilseed for a second week after largely shunning U.S. supplies earlier this year in a trade war between the countries.

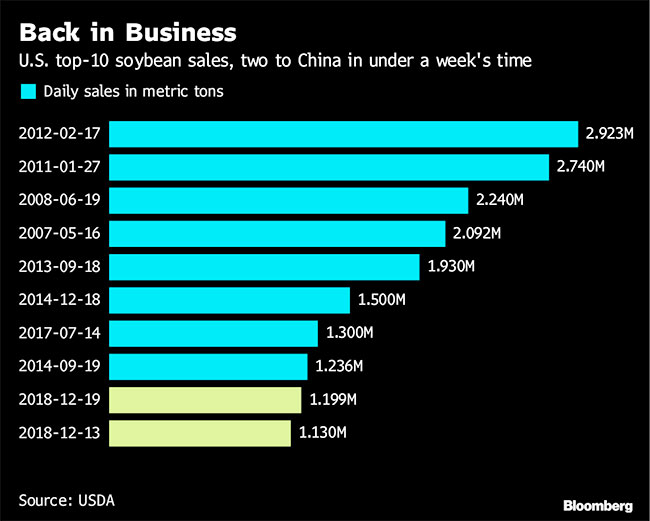

On Dec. 19, the U.S. Department of Agriculture said in a statement that exporters sold 1.119 million metric tons to China for delivery by Aug. 31. China’s Cofco said in a statement that it made two purchases.

The latest sales and at least 1.4 million tons reported by USDA follow a temporary truce in the trade war that had all but halted Chinese purchases of American beans. Government data show China buys 30 million to 35 million tons of U.S. soybeans in a normal year.

The exports to China have prevented the market from crashing but haven’t pushed prices significantly higher, said Virginia McGathey, president of McGathey Commodities Corp. in Chicago. Investors are looking for “some real resolution” to the trade war and a large-scale movement of supplies out of the United States, she said.

On the Chicago Board of Trade, soybean futures for March delivery fell 0.5% to $9.1615 a bushel, erasing a brief rally after the sale was announced. Aggregate trading for this time rose 19% above the 100-day average, according to data compiled by Bloomberg.

“China remains an important market for U.S. soybean farmers, and we view these recent sales, while relatively small, as important steps forward in our overall trade relationship,” U.S. Soybean Export Council Chief Executive Officer Jim Sutter said in an e-mail Dec. 18.

Before the USDA statement Dec. 19, a person with direct knowledge of the transactions said China’s state stockpiler, Sinograin, and food company Cofco purchased about 10 cargoes of soybeans from the U.S. Gulf region Dec. 18. Market speculation put those sales at as many as 20 cargoes, or about 1.2 million tons, shipped mostly through Pacific Northwest and Gulf terminals, Arlan Suderman, chief commodities economist in Kansas City, Mo., for INTL FCStone, said before the official figures were announced.

“We are seeing firmer bids based off of additional Chinese purchases,” Tiffany Heier, a station manager at the Verona location for the James Valley Grain cooperative in North Dakota, said in an e-mail.