Business Expectations Index Drops to Record Low

[Stay on top of transportation news: Get TTNews in your inbox.]

A gauge of service industries’ business expectations fell in August to the lowest level since the survey started in October 2009, according to the IHS Markit monthly report.

Orders from abroad contracted and softened by the fastest pace in five years of survey-taking, indicating the biggest part of the U.S. economy joined factories with sluggish growth.

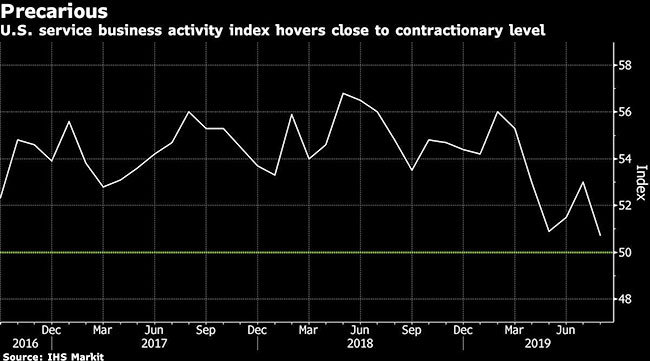

The overall business activity index slowed to 50.7 from 53 in August — the weakest pace of growth in three-and-a-half years.

“Only on two occasions since the global financial crisis have the U.S. PMI surveys recorded a weaker monthly expansion, and these were months in which business was hit by the government shutdown and bad weather in 2013 and 2016, respectively.” said Chris Williamson, economist at IHS Markit. “This time, trade wars and falling exports appear to be the main drivers of weakness, exacerbating fears of a broader economic slowdown both at home and globally.”

While the overall index is still expanding, deflation is seen in the measures of both input prices and prices charged. Input prices contracted for the first time. Prices charged by service firms contracted at the sharpest pace in close to 10 years of survey history.

“Anecdotal evidence suggested the decline in costs was linked to the recent cut in interest rates and lower purchase prices,” according to the report.

Outstanding business and new business from abroad both contracted and by the sharpest pace on record.

The August decline follows the Institute for Supply Management’s manufacturing purchasing managers’ index showing U.S. factory activity contracted in August for the first time in three years.

Together, the figures point to growing U.S. economic risks. A global manufacturing gauge from IHS Markit showed a fourth consecutive monthly decline Sept. 3.

Sluggish global economies and trade friction between the U.S. and China have been more pronounced in manufacturing — over half of the nations covered by the survey showed a contraction.

“A major factor behind the deterioration was the spreading of the manufacturing downturn to the service sector, via weakened household and business confidence,” Williamson said.