ATRI Says Total Fleet Costs Rise; Wages, Equipment Up, Fuel Dips

Motor carrier operating costs rose 1.6% to $1.703 per mile last year, as higher costs for new equipment, driver wages and maintenance wiped out savings from lower fuel prices, the American Transportation Research Institute reported.

Costs per mile increased from $1.676, according to the report released Sept. 28, which tracked expenses for 2014 compared with 2013. Expressed in costs per hour, the amount rose to $68.09 from $67.

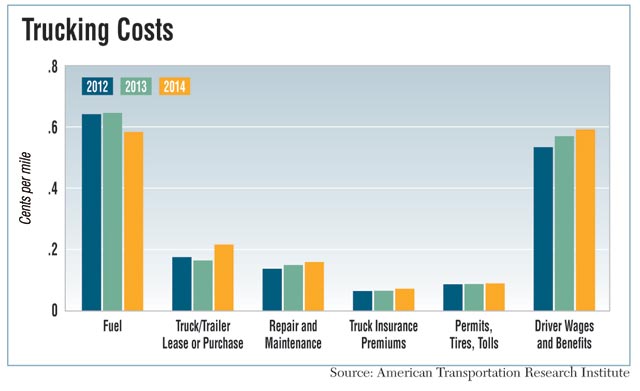

Equipment purchase and lease costs on a per-mile basis increased 32% to 21.5 cents from 16.3 cents, reflecting the second-best year ever for truck orders and sales. Repair and maintenance rose 1 cent per mile to 15.8 cents, and driver wages increased 2.2 cents per mile to 46.2 cents, the report said.

Despite a decline in fuel prices that shaved 6.2 cents per mile off operating costs, diesel remained the largest expense for fleets at 58.3 cents per mile. That was ATRI’s lowest reported fuel cost since 2010.

“Due to an economic-based freight demand increase and growing repair and maintenance costs,” the report said, “carriers are moving quickly to replace older equipment.”

Complex economic considerations are affecting purchase and maintenance decisions, the report noted, as some fleets can’t always afford new trucks or fix older ones.

“Smaller carriers may be forgoing non-critical repair and maintenance tasks as a cost-saving strategy in order to stay competitive,” the report said.

ATRI Vice President Dan Murray detailed how equipment purchase and maintenance costs can rise simultaneously.

“It’s really surprising at face value that both are rising,” he said.

Fleets told ATRI, he said, that repair and maintenance costs are rising because of the growing complexity of onboard systems, particularly in-cab diagnostics and engine components in new tractors.

In addition, labor rates for technicians are skyrocketing, he said, due to the same sort of shortage that has been seen among the driver corps.

Steve Tam, a vice president at ACT Research, said it was plausible that maintenance costs are rising for new trucks because of more complex systems, including diesel particulate filters, which have been needed to meet federal emissions standards since 2010.

“Failures of DPF equipment are expensive,” he said, and difficult to predict.

Economist Noel Perry, managing director at consultant FTR and a former trucking executive, said the simultaneous rise of new truck and maintenance costs appeared to be an “anomaly” due to accounting flaws.

He offered possible explanations, including that engine maintenance costs were spiking from emissions compliance. Another was a steep increase in new truck prices from 2013 to 2014.

On the wage front, ATRI’s report said “recent increases in [lower-paid] new entrant truck drivers somewhat masks moderate increases in existing driver wages. It is anecdotally understood that veteran driver pay has increased in an effort to retain good drivers.”

One noticeable change was an increase to 25% of fleets that use team drivers, compared with 19% in the prior survey.

ATRI surveyed owners of nearly 54,000 tractors for the analysis, which included a mix of truckload, less-than-truckload and specialized carriers, with TL operators representing the majority of respondents. That matches the industry’s overall composition since truckload predominates. More than seven in 10 respondents’ fleets were less than 250 power units.

In addition to calculating fuel, wage and equipment costs, the report also gauged insurance expenses, which rose 0.7 cent per mile, or 10%. Other costs such as driver benefits, permits, tolls and tires were little changed.

Truckload, LTL and specialized carriers such as tank and flatbed fleets also were assessed.

Costs rose 11% for specialized operators, while TL and LTL costs each dipped 1%.

ATRI expects more increases.

“It is likely that the trucking industry will continue to see overall operating costs rise in spite of projected fuel price decreases,” ATRI said, due to higher driver, equipment, maintenance and insurance costs.