April Truck Orders Drop 10% to Lowest Level in 18 Months

This story appears in the May 11 print edition of Transport Topics.

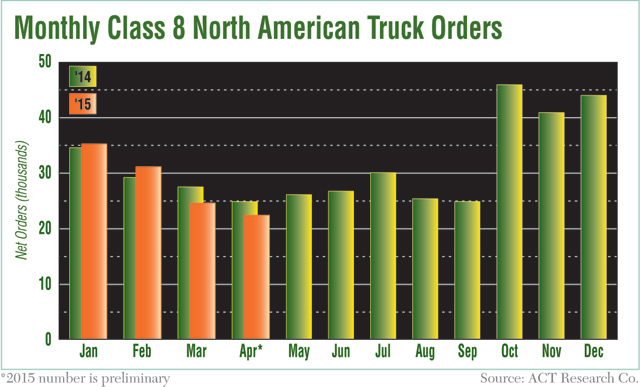

Truck orders slipped 10% last month from the same period a year ago on a preliminary basis to the lowest level in 18 months, as Class 8 buying trends return to typical seasonal patterns.

The ACT Research North American total of 22,400 marked the second monthly decline on a year-over-year basis. However, orders now have topped 20,000 for 19 months in a row. Consultant FTR gauged April’s order book at 22,076 units.

Orders dropped for the fourth consecutive month since December’s total of 44,037 units ended the

second-busiest year ever. Since then, the average decline from month to month was 12%, including an 11% drop last month compared with March. “Rather than simply a harbinger of weakness, the slower order intake should be taken in a broader context,” said Kenny Vieth, president of ACT, based in Columbus, Indiana. He explained that orders now are in the typical second- and third-quarter order trough, with an expected uptick in the fourth quarter.

“We expect, from here until this coming October, that orders won’t keep pace with production,” he told Transport Topics on May 6.

Bloomington, Indiana-based FTR estimated that May orders could drop below 20,000.

A dealer executive outlined current business levels and prospects to TT this way: “We expect order intake to taper into the summer months as fleets fulfill their needs for the year,” said Greg Arscott, vice president at the Pete Store, a Baltimore-based dealership, adding that deliveries will “remain strong” through the fourth quarter.

“We are on pace to post a 50%-plus year-over-year increase in deliveries for 2015,” said Arscott, whose company has 13 dealerships in six states. “Orders and deliveries were very robust in the first quarter.”

Multiple sources linked the latest order numbers to the still-extensive Class 8 backlog.

“The softness seen in April is not out of line in context of remaining build slots that are available in 2015,” said David Leiker, a Robert W. Baird & Co. analyst. “All planned production slots for 2015 are likely to be filled by midsummer, given recent order rates.”

Stephen Volkmann, a Jefferies & Co. analyst, said that “a softening of orders is not unexpected” because about 80% of production slots this year now are filled.

“At the end of March, we had about a 185,000 [order] backlog,” Vieth said, a buildup that he said was the result of orders that were pulled forward from October through February.

During that period, Vieth said, the message driving the market was, “If you want the truck that you want, and you want the build slot you want, don’t dally.”

The ratio of order backlog to truck builds now stands at an elevated 6.6 months, Vieth said, basing his comment on final March 2015 order totals. In March 2014, the comparable ratio was 4.9 months and the backlog was 117,000 units.

“Backlogs are so high that production rates are supported all the way into the third quarter,” said Don Ake, FTR vice president of commercial vehicles.

“Along with ACT, we also believe orders will pick back up into the fall as trucker fundamentals remain very strong,” Volkmann wrote in his report.

“With the broader trucking industry remaining healthy, we anticipate a reacceleration in orders to occur in the fall around 2016 delivery plans,” Leiker said.

Long-term optimism also exists.

“We see continued volume strength, coupled with margin expansion, as the next chapter in the ‘stronger for longer’ truck [sales] story,” Volkmann noted.

Ann Duignan, a J.P. Morgan Chase analyst, wrote that “demand will remain above normal for this cycle.”

She cited multiple reasons for long-running demand, including the relatively old North American truck fleet, the return of large fleets to the market and Navistar International Corp.’s growing market presence.

However, U.S. economic growth and North American currency trends also are pressing on the market, Vieth noted,

Asked whether a slowing economy would affect orders, he said, “It depends on whether or not the slowdown is something that is transitory or something more permanent. We believe the underlying economic growth forces are still in place.”

As a result, he said, there should be enough freight generated to keep demand for new equipment healthy throughout 2015.

“We have seen a pullback in orders from Canada and Mexico as the dollar has appreciated, relative to those currencies,” Vieth said. Historically, fleets in those countries account for nearly 20% of orders.