Analysts Make Threatened Tariff Hikes Baseline of Economic Forecasts

After months of predicting a trade deal between the world’s largest economies, economists at some of the biggest financial institutions are growing increasingly pessimistic.

Goldman Sachs Group Inc., Nomura Holdings Inc. and JPMorgan Chase and Co. are among those that have rewritten their forecasts as President Donald Trump threatens to impose a 25% tariff on arbout $300 billion of additional Chinese imports.

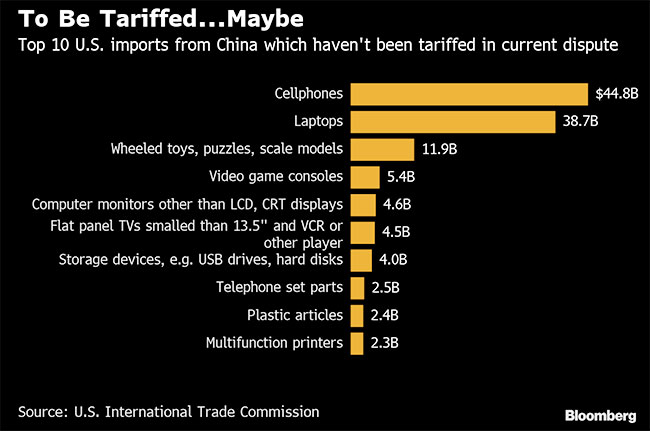

Analysts at Nomura have made that hike in duties — which would mean practically all of China’s exports to the United States are hit by tariff hikes — their baseline forecast. They see it as a 65% probability before year-end, and most likely to come in the third quarter.

“The U.S.-China relationship has moved further off track over the past two weeks after a period of what appeared, on the surface, to be steady progress towards reaching an admittedly narrow agreement,” Nomura economists wrote in a note. “We do not think the two sides will be able to get back to where they seemed to be in late April.”

The effect of the conflict between the nations is spreading from trade and investment flows to the technology sector and more. Shares in voice recognition company Iflytek Co. plunged after news it is on a list of Chinese technology firms that may face restrictions from the United States. That follows on from big falls in the share prices of surveillance companies Hangzhou Hikvision Digital Technology Co. and Zhejiang Dahua Technology Co. on May 22, when it was reported they were on the list.

Goldman Sachs economists warned that without signs of progress over coming weeks, implementation of the further tariffs easily could become their base case.

“While we still think an agreement is more likely than not, it has become a close call,” they wrote.

Bloomberg News

Those duties would have a material hit to inflation and lift the core PCE price measure in the United States by 0.6 percentage point, on top of the 0.2 percentage point already felt from tariff hikes. It also would, combined with limited Chinese retaliation, hit U.S. gross domestic product by 0.5% and Chinese GDP by 0.8% over a three-year period, Goldman’s team estimated.

Direct trade effects of the new tariffs would be positive for the United States but negative for China, Goldman said. The United States will be hurt more by the hit to real incomes from faster inflation and tighter financial conditions, they calculated.

It’s not just Wall Street sounding more pessimistic. A senior Chinese government researcher said May 22 that China and the United States could be stuck in a cycle of “fighting and talking” until 2035. Zhang Yansheng, who previously worked at the nation’s top economic planning body and now is a prominent Beijing think tank, said none of the key American demands can be “realized in the short term.”

JPMorgan analysts on May 17 said their new baseline is for the status quo — that is, all the rounds of tariff hikes to date from the two countries — staying in place well into 2020.

“We also take seriously the alternative, more severe scenario of moving into a full-blown tariff war, i.e. 25% U.S. tariffs on the remaining $300 billion Chinese imports in the second half of 2019,” the JPMorgan team wrote.

Such a move would see the yuan slide through 7 per dollar, JPMorgan chief China economist Zhu Haibin said on a conference call on the new projections earlier this week.