Senior Reporter

Aftermarket Seeks to Keep Up as Truck Makers Broaden Approach

LAS VEGAS — Truck makers are wrestling with how to invest in automation, electrification and traditional powertrains — all at once.

Additionally, more trailers will use telematics to relay diagnostic information and secure parts while new relationships will form between suppliers and technology startups, according to experts at the Heavy Duty Aftermarket Dialogue.

The forum on Jan 28 was attended by a record 400 people to learn about the future of trucking and how the aftermarket could prosper in it. That’s because the aftermarket is changing.

#HDAD19 Aftermarket Industry Economy & Outlook: John Blodgett says MacKay’s U.S. overall industry parts pricing forecast is up about 3% for 2019, and Canada is up about 1.5 - 2.3%.

— Heavy Duty Manufacturers Association (@HDMADialogue) January 28, 2019

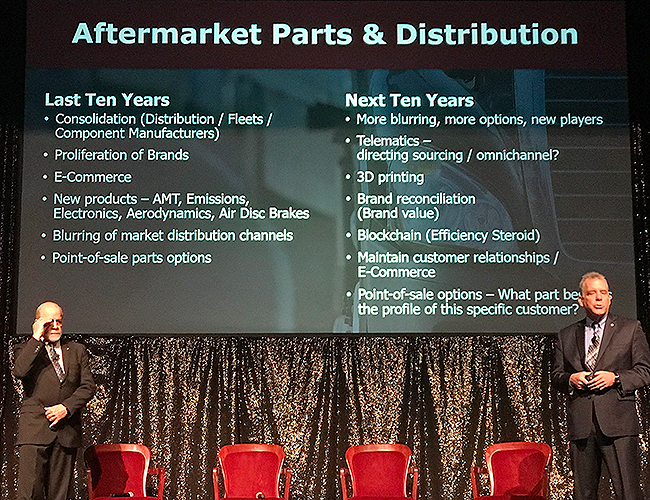

“We see more blurring, more confusion coming. We anticipate some brand reconciliation,” said John Blodgett, vice president of sales at consulting firm MacKay and Co., which teamed with the Heavy Duty Manufacturers Association to organize the dialogue the day before Heavy Duty Aftermarket Week opened here.

“[Supplier] companies must decide what is going to be core to original equipment manufacturers, and how can you add value to them,” said Ken Davis, founder of Greentree Advisors and a former president of the vehicle group at Eaton Corp.

It starts with diagnostics, and diagnosing the fault codes to determine if they are software-related or hardware-related, Davis said.

Nielsen

“Trucks today have 400 sensors on them, 100 million lines of code and, worse yet, six SIM cards. It’s like having six cellphones on a vehicle,” said Roger Nielsen, CEO of Daimler Trucks North America.

“What we need from the supply base is changing, and the expertise from the supply base is changing,” he added.

As for trailers, Great Dane CEO Dean Engelage said use of telematics will increase. His company will look to leverage that information to have parts available, practically, on demand.

“The vision we have is tying all the telematics and sensors into our aftermarket network to — with geofencing — alert the nearest location of the need for a particular part or service opportunity, and have that automatically happen,” he said. “It should result in a lot more efficiencies and uptime because you are not waiting for parts, you are forecasting parts.”

It’s about having a smarter trailer support a smarter truck, about getting a little bit better, a little bit bigger, he said.

Engelage

Part of that is imagining what would happen if Amazon.com got into the trailer business, “and positioning ourselves to win that as well,” Engelage said.

One question from the audience was how is the aftermarket going to gain access to all that data.

“The ability to understand what is happening with the drivetrain dynamically, through all this information, will give us a greater level of artificial intelligence and we will be able to do more prognostics and diagnostics,” Davis said. “The people who can pull that data off relative to telematics, or working with the OEMs’ warranty centers, and diagnose the data and provide valued solutions [to parts problems] are the ones who are going to win.”

At the same time, the industry already faces a privacy issue as data fusion commingles parts diagnostics with fleet data.

“We may know where every truck in America is using GPS, but there are quite a few parcel delivery companies that won’t let us look at that data. Even though we have it, we don’t have it,” Nielsen said.

HDMA President Tim Kraus (left) and John Blodgett of consulting firm MacKay and Co. at HDMA's Heavy Duty Aftermarket Week event. (Roger Gilroy/Transport Topics)

One group that is likely to suffer in this fast-paced and increasing flow of information is independent service facilities, he said. “Now, it is difficult enough. How do we broaden that? I don’t have the answer.”

ALSO AT HDMA: Fleets Seek Aftermarket Companies That Are Easy to Do Business With

Davis suggested even more partnerships will emerge between traditional aftermarket suppliers and tech-oriented startup companies as truck makers move into automation and electrification.

Nielsen said there was no business case for electrification without incentives because of the cost of batteries and levels of power density. But there is so much incentive money available in California “there is pressure to bring electrification to market.”

Electrification will have a significant impact on the current supply base, said Davis. It will be the people who build mechanical drivetrains and parts versus those who build electric drivetrains only. “And that transition is coming.”

There is already a business case built around safety for partially automated vehicles, he said. An example is relying on automated lane keeping to reduce sideswipes or running off the road.

“There’s definitely bets being made,”Nielsen added.

He said suppliers should “educate yourself, get tight with the fleets, dealers, OEMs and decide where do you have a base of expertise which you can grow into as we go forward.”