Special to Transport Topics

Supply Chain Visibility Now Paramount Post-Pandemic

[Stay on top of transportation news: Get TTNews in your inbox.]

It was roughly four years ago when the outbreak of COVID-19 disrupted daily life and business operations in countless ways. While the logistics challenges and inventory shortages caused by the pandemic have since faded, that time of upheaval has brought lasting changes to supply chain management.

The pandemic hastened advancements in freight visibility in such a way that shippers, consumers and regulators are requiring a more holistic view into how goods are produced and delivered.

This more complete view of the supply chain will be key as federal and state regulators call upon industries to slash greenhouse gas emissions. It also will enable shippers to better manage logistics amid weather-related or geopolitical disruptions.

“Many supply chain leaders have learned how to build resiliency and better absorb shocks despite continued disruptions like the Red Sea crisis and labor strikes at the ports,” said Stephen Dyke, principal solutions consultant at supply chain visibility firm FourKites. “With real-time visibility into static goods — wherever they may be — it has become easier to manage through volatility.”

At the same time, the business insights gained from this visibility data are helping shippers better evaluate their carrier networks, logistics providers, suppliers and fulfillment strategies, he added.

Dyke

“They can better collaborate with these partners and make smarter decisions based on benchmarks and [key performance indicators] that many shippers didn’t have five years ago,” Dyke said. “And these practices are here to stay.”

Historically, supply chain visibility has been defined as the ability to gain insight into assets and inventory in transit, understand what exceptions are occurring and know when shipments will arrive at their destination, said Eric Fullerton, senior director of product marketing for supply chain visibility provider Project44.

“That definition might have worked two years ago, but not now,” Fullerton said. “The old school definition enables you to see and understand all goods, assets and inventory at the [stock-keeping unit] level and make decisions based on that data. But the mature, next-level evolution is much more about making inventory decisions by exposing and understanding how your network is delivering goods to customers and essential parties to run a more efficient and sustainable business.”

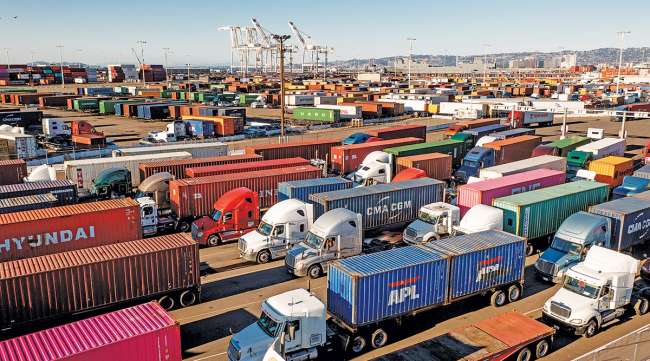

Motor carriers and logistics providers are adopting technology to provide improved freight visibility to their customers. (Shaunl via Getty Images)

How Supply Chain Visibility Has Evolved

The pandemic accelerated industry efforts to provide better visibility into the supply chain. However, the impetus to improve that visibility started well before COVID-19 took hold in the spring of 2020.

When shippers observed that consumers were able to track their Amazon packages from departure from a warehouse to their doorsteps, that led them to question whether they could have similar visibility into when their truckload of freight would arrive.

That opportunity became even more apparent during the pandemic, when e-commerce volumes surged dramatically.

Cicerchi

“More and more people were making online purchases and had expectations of knowing and receiving [estimated time of arrival] updates [and] status updates for relatively inexpensive parcels,” said Dan Cicerchi, general manager of transportation management for Descartes, a supply chain technology solution provider.

In 2009, Cicerchi and his business partner founded MacroPoint, a global multimodal visibility platform, which they later sold to Descartes in 2017.

Events at the onset of the pandemic also served as a catalyst. The shutdown of China’s manufacturing operations, as well as closures or reduced operating hours at U.S. ports, led to longer lead times for imported products to reach their final destinations. They also resulted in significantly higher demurrage costs for shippers.

As the pandemic morphed and social distancing restrictions loosened, supply chain visibility also evolved. After manufacturing facilities reopened and port congestion eased, inventory levels skyrocketed because shippers had accelerated their purchases to ensure that they wouldn’t run out of goods and materials, as they had in 2020. But in 2022, inventory levels became bloated.

Containerships at the Port of Los Angeles. Shippers incurred high demurrage costs during the pandemic with reduced operating hours and staff sizes at U.S. ports. (Port of Los Angeles)

“All of a sudden, inventory became the most important part. And so it started evolving more to inventory visibility — not just inventory in motion, but inventory at rest and understanding how much inventory do we have and then trying to add in-transit visibility,” said Bart De Muynck, a supply chain adviser and expert who was previously an executive at Project44. He also worked at supply chain research firm Gartner, where he led the logistics technology team.

Nowadays, disruptive events, such as a limit on how many vessels can transit the Panama Canal because of drought, Russia’s invasion of Ukraine and Houthi attacks on ocean vessels passing through the Red Sea, are fueling the trend toward greater supply chain visibility.

The Future of Supply Chain Visibility

One of the byproducts of this evolution of supply chain visibility is that shippers are expected to be able to provide visibility to their own customers, which they have started to do — to varying degrees of success.

“It certainly is table stakes now, where it’s really expected to have real-time data and insights, and then be able to optimize your investments and other technology to make sure that you’re doing all those kind of micro-optimizations,” Descartes’ Cicerchi said. “We learned and saw what Amazon did on the one end of the spectrum of optimizing a supply chain for a differentiated advantage, and now all other industries — all other companies — are needing to move the needle to optimize their supply chains for that advantage just to stay in the game.”

Stedl

Motor carriers and logistics providers also have been embracing technology that has helped provide shippers greater visibility into their inventories and freight in transit.

“The whole ecosystem changed with the ‘Uberization’ of the supply chain, [with] carriers gaining access to digital tools that enable power only at scale. Rate transparency is enabled through additional tools that shippers can utilize as well, but that is ultimately driven by the carriers embracing the tech,” said Jared Stedl, chief commercial officer at Paper Transport, a truckload carrier, intermodal provider and freight brokerage.

These visibility tools are especially valuable during supply shortages and disruptive events.

“They became increasingly important when inventory was low, and shelves were bare,” Stedl said. “The degree of importance continues when there are disruptions like the Red Sea issues.”

Greg Hewitt of DHL Express considers whether the trucking industry is prepared for a greener future. Tune in above or by going to RoadSigns.ttnews.com.

Paper Transport, based in De Pere, Wis., ranks No. 98 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Shippers are realizing that they can use the data collected at the execution level to manage logistics and planning throughout the whole supply chain, such as making more accurate predictions for the lead time of an ocean vessel sailing from Shanghai to Long Beach, Calif.

“A lot of these changes are for good and here to stay: Increased investments in digital solutions for supply chain planning and execution, combined with more focus on risk management and contingency planning, will continue to have a lasting positive impact,” said Bernhard Schmaldienst, director of visibility products at Transporeon.

Transportation technology provider Trimble completed its acquisition of Transporeon in April 2023.

Enabling all supply chain participants to collect and share real-time visibility data also paves the way toward streamlining logistics operations, Schmaldienst said.

Logistics managers have been building more resilient supply chains to better manage disruptions and volatility. (IronLink Logistics via Facebook)

“The big opportunity lies in integrating your visibility data with all other operational processes like transport execution or yard operations,” Schmaldienst said. “If a traffic jam delays your delivery, and your customer is automatically notified, and the time slot at the dock is automatically rebooked, this really increases efficiency. Or when a port congestion delays your overseas shipment and your transportation system recognizes and books an alternative road delivery from an existing safety stock in your local warehouse to ensure your customers’ production is running smoothly.”

Looking ahead, proposed regulatory changes and greater automation are two factors that are poised to continue the trend toward more sophisticated options for supply chain visibility.

Shippers may contend with regulations that rely on having visibility into a product’s traceability, according to De Muynck. These include regulations such as the European Union’s Deforestation Act, which calls on companies to ensure that their products didn’t originate from deforested lands, and the Food Safety Modernization Act in the U.S., which addresses the traceability of food. Additional regulations by the EU and the state of California call for companies to lower supply chain emissions.

Meanwhile, the trend toward automation, itself accelerated by the adoption of artificial intelligence and machine learning, is also spurring advances in supply chain visibility.

“Leveraging machine learning in AI has been critical for us,” Cicerchi said. “We do it in our pre-tender visibility — trying to help our customers decide which [logistics service provider] I should offer a shipment to based on past experience, price, performance, availability of inbound capacity and all that.”

Machine learning and AI also can be leveraged post-tender as well, he added, and Descartes has been training AI models focused on estimated times of arrival and fraud detection.

As these technology advances improve consistency and efficiency across the supply chain, expect visibility to become even more sophisticated, sources said.

“Part of what supply chain visibility should do is empower you to make better decisions about your network, including understanding where you have visibility and where you don’t,” Project44’s Fullerton said. “It should provide you an opportunity not to look only at individual goods, but at the health of your entire network. Good visibility enables you to build a stronger network that delivers goods to end destinations faster and more efficiently and helps your business run at a higher velocity.”

Want more news? Listen to today's daily briefing below or go here for more info: