Senior Reporter

White House Not Ruling Out Fuel-Tax Increase for Infrastructure, Secretary of Transportation Says

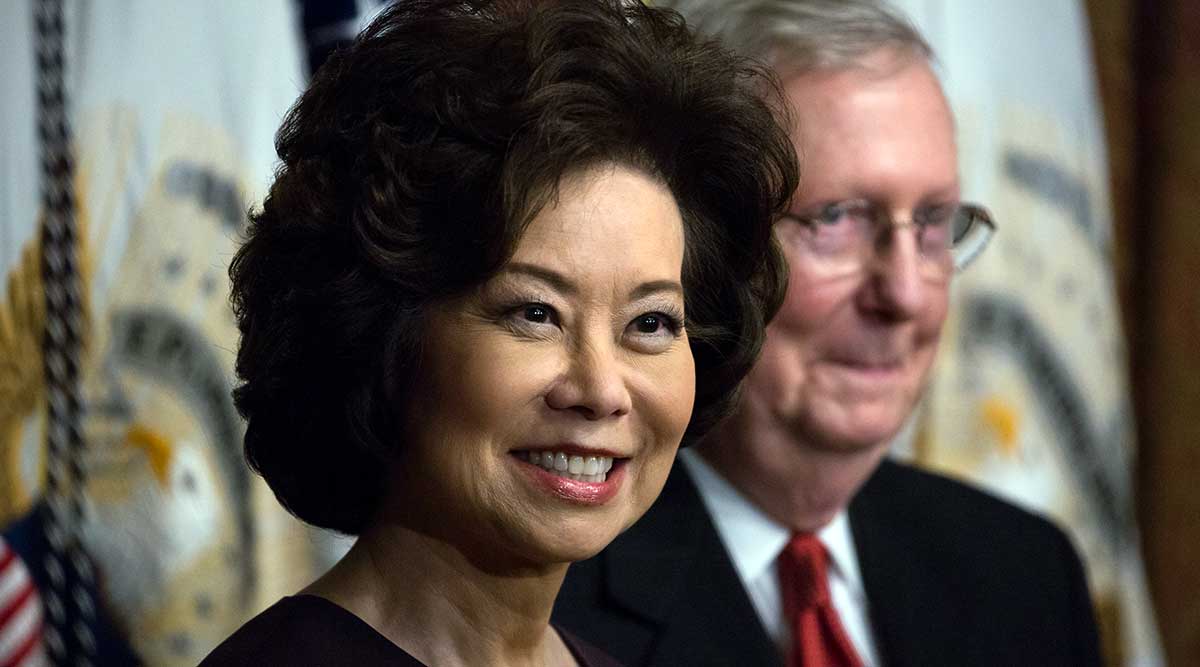

WASHINGTON — Secretary of Transportation Elaine Chao said the administration is considering a variety of options to fund the country's infrastructure, including approving higher federal fuel taxes.

"Everything's on the table," Chao told Transport Topics on May 17 when asked twice if the White House would look to propose raising gas and diesel taxes as part of a long-term plan.

COMING MAY 19: LiveOnWeb Infrastructure Week Reporter Roundtable

The administration intends to preview a long-term infrastructure plan this month, and unveil the plan's legislative text in the fall, the secretary told senators at a hearing.

The suggestion to raise federal fuel taxes would be included in an infrastructure plan that aligns with President Trump's recent remarks in an interview with Bloomberg News. In February, President Trump told Congress to pass a $1 trillion, 10-year plan that would invest in the country's transportation network.

On Capitol Hill, there are signs lawmakers would welcome a proposal to increase fuel taxes. Sen. Tom Carper (D-Del.) called on colleagues and the administration to support a sustainable funding fix for the Highway Trust Fund.

"In just over three years, we will face an insolvency crisis for the Highway Trust Fund. We face this crisis in large part because we haven't raised the gas and diesel taxes in 24 years or adjusted them for inflation," Carper said on May 17. "Revenues have stayed flat, while the construction costs to build roads and bridges keep increasing."

A day earlier, Sen. James Inhofe (R-Okla.) did not rule out raising taxes on fuel.

“There’s a place in there for all of the above,” Inhofe told reporters. “There are a lot of approaches, innovative approaches … everything is on the table.”

The freight sector, including the trucking industry, has urged Congress and the White House to approve an increase in fuel taxes.

The federal 24.4 cents-per-gallon diesel tax and 18.4 cents-per-gallon gas tax have not been raised since 1993. The trust fund relies on revenue from those taxes to assist states paying for infrastructure projects.