Warning Signs Flash for Detroit as Jeep Wranglers Pile Up on Dealer Lots

An unexpected spike in inventory of Fiat Chrysler Automobile NV’s iconic Jeep is stoking concern that the American SUV boom that has fueled Detroit automakers’ profit is reaching its limits.

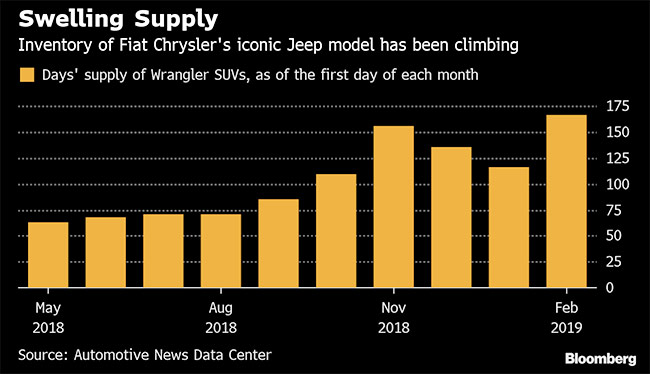

Dealers had 166 days’ supply of Jeep Wranglers at the beginning of this month, up from 116 days at the start of the year and 120 days a year ago, according to data from Automotive News. Inventory of the rugged SUV was almost double the days’ supply of cars and light trucks industrywide.

The Wrangler glut is worrisome because Fiat Chrysler has been going almost all-in on trucks and SUVs, killing off many of its sedans to pad profit margins. Ford Motor Co. and General Motors Co. are following with similar moves. But with new models piling into every nook and cranny of the SUV market, industry sales are slowing and rising interest rates are making it tougher to afford new vehicles that have never been costlier.

“Auto companies used to be in a position where demand outstripped supply,” Morgan Stanley analyst Adam Jonas said by phone. “Supply is now keeping up with demand, and possibly getting to a point where it exceeds demand. We’re probably not there yet, but we’re getting closer.”

Anxiety that Detroit automakers may be overbuilding has weighed on their shares, Jonas said. All three companies slumped by more than the S&P 500 last year, and Fiat Chrysler has trailed the benchmark index in 2019.

Fiat Chrysler says it intentionally has built up supply of Wranglers. Its factory in Toledo, Ohio, has downtime scheduled for the first half of the year to prepare assembly lines for a new plug-in hybrid version. There also is a seasonal uptick in demand during the spring and summer months, when drivers can enjoy warmer weather by removing the roof and doors.

“We’re going to continue actions to manage dealer inventories in Q1 and Q2,” CEO Mike Manley said during Fiat Chrysler’s Feb. 7 earnings call. “By the end of the first half, I expect our retail days of supply to be in line with our sales run rate.”

Wrangler inventory has kept creeping up, even as the model had its best January ever and set an annual sales record in 2018. The model, which traces its roots to World War II-era all-terrain vehicles, is emblematic of American consumers’ growing preference for more rugged autos — and car manufacturers’ efforts to cash in.

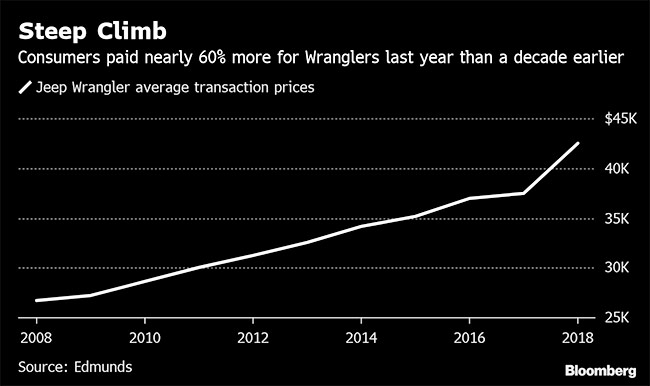

Deliveries keep climbing despite a hefty mark-up for new tech features and powertrains boasting better fuel economy. A new Wrangler cost $42,473 on average in 2018, up from $37,460 in 2017 and $26,721 in 2008, according to market researcher Edmunds.

This is part of a broader trend that will be difficult to keep up as borrowing costs rise. Edmunds said new-vehicle average-transaction prices climbed to $36,576 last month, a January record. Interest rates also rose to the second-highest level in 10 years.

Fewer bargains and cheap-financing options may be pushing some buyers out of the market for new cars, Edmunds analyst Jeremy Acevedo said.

“These facilitating factors that have really been a boon for the industry and in a lot of ways shaped our choices — those are drying up,” he said.

Stepped-up production has raised some dealers’ eyebrows — even in markets where buyers aren’t complaining about sticker shock.

“I’m in a more affluent area, and we haven’t seen any issue, although we’ve got plenty of stock,” said David Kelleher, a Philadelphia-area Jeep, Ram and Chrysler dealer. “I think the production schedules are very aggressive right now, on all vehicles.”

Fiat Chrysler retooled its Wrangler manufacturing line in Toledo to boost capacity as SUV sales surged. Former CEO Sergio Marchionne said in October 2017 he would crank up production to more than 300,000 units.

But the SUV boom will be tested as total sales moderate. The National Automobile Dealers Association expects industrywide deliveries to dip to 16.8 million cars and trucks this year, down from about 17.3 million in 2018.

And as the market shrinks, showrooms will be more crowded with new models. LMC projects that automakers will be offering 191 SUV models by 2024. That’s up from just 100 in 2014.