VW, Daimler and BMW Brace for Tariffs

Investors in European carmakers are once again facing months of share volatility after the U.S. circulated a draft report on tariffs and European Commission President Jean-Claude Juncker signaled a cease-fire in the looming trade war may soon come to an end.

The report is part of the U.S. Commerce Department’s probe into whether to impose levies on automobiles, vans and light trucks as well as car parts. Commerce has until February to hand its findings to President Donald Trump, who previously threatened a 25% tariff on imported cars.

European carmakers, despite exemptions for their output from U.S. and Mexican factories, will be hardest hit, alongside imports from Japan and South Korea, RBC Capital Markets analysts said Nov. 13. Suppliers will have even more difficulties from a similar levy on parts imports, according to the bank, citing an estimate from the American Automotive Policy Council pointing to a $2,000 increase in the cost of a U.S.-manufactured vehicle and a $2,400 rise when tariffs on steel and aluminum are added.

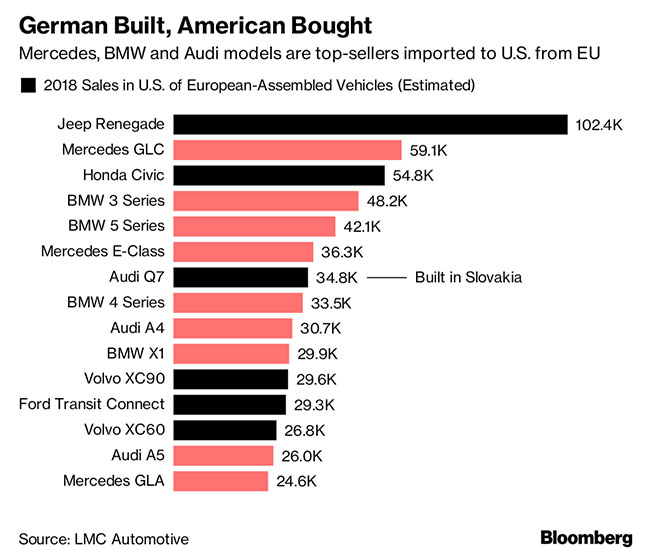

The European Union last year shipped 1.1 million cars to the U.S., led by Volkswagen brands Audi, and Porsche, and BMW. The planned U.S. tariffs would hit autos and parts worth 58 billion euros, the Commission said in June, adding about 10,000 euros to the price of a European-built car.

Flaring trade tensions between the U.S. and the EU led to a temporary truce in July after Juncker met with Trump in Washington. Juncker signaled on Nov. 12 that the hiatus may only last until year-end.

On the brighter side, BMW AG produces about 70% of its sport utility vehicles in the U.S., and Mercedes-Benz-maker Daimler AG about one-third. Among Japanese automakers, over 90% of Honda Motor Co.’s vehicles destined for the U.S. market are manufactured in North America and more than half of those are made by Toyota Motor Corp.

Carmaker shares were flat following the news on the next steps in the U.S. probe. The sector has battled multiple challenges this year, with trade tensions having led to several profit downgrades. The Stoxx Europe 600 Automobiles & Parts Index has slump 22% since the start of the year.