Bloomberg News

US Stocks Rally, Sending Nasdaq to Record High

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

U.S. stocks jumped, with tech shares pushing the Nasdaq Composite to a record high. The dollar fell for a fifth day and Treasuries dipped.

The S&P 500 Index headed toward its fifth-straight increase as Amazon.com Inc. shares reached $3,000 for the first time and Tesla Inc. extended a five-day rally to almost 40%.

The dollar slid to the weakest since June 10 as risk-on sentiment sapped demand for havens and drove equities higher.

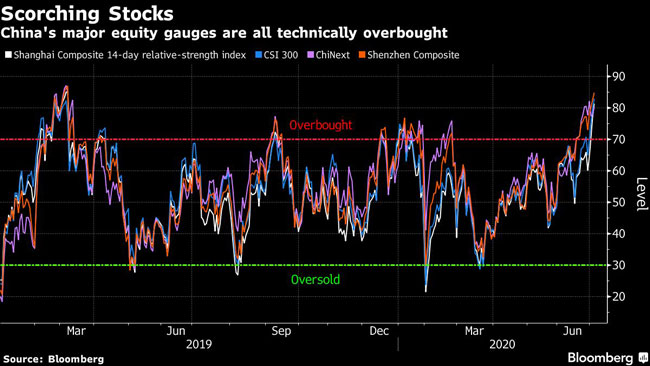

The Stoxx Europe 600 Index climbed 1.6% while developing-nation stocks added 2.5% as a huge rally in Chinese markets pushed a global equity benchmark toward a one-month high.

Stock markets started the week in an upbeat mood after a front-page editorial in China’s Securities Times on July 6 said that fostering a “healthy” bull market after the pandemic is now more important to the economy than ever. The Shanghai Composite Index posted its biggest advance since 2015, fueling bullish spirits around the world, even as investors kept a wary eye on the coronavirus infections sweeping across parts of the U.S.

“Investors have recognized that as bad as the economy in the U.S. is, it’s not as bad as what people thought it would look like in March and April,” said Nancy Prial, the co-chief executive officer at Essex Investment Management. “The market has started to sense we might see better than anticipated results fairly broadly across a wide spread of companies.”

The MSCI World Index is now at the highest level since early June, with investors putting their faith in an economic recovery powered by historic government stimulus.

But of course there’s a long way to go before the economy gets back to normal. Goldman Sachs Group Inc. cut estimates for U.S. growth this quarter and said consumer spending appears likely to stall this month and next. Still, economists led by Jan Hatzius said other economies have proved it’s possible to resume activity and changes in behavior such as wearing masks will help too.

Elsewhere, copper was on the cusp of erasing this year’s losses after virus-related disruptions tightened supplies. Ten-year Treasury yields rose to about 0.7%, while precious metals advanced.

Alicia Levine, chief strategist at BNY Mellon Investment Management, said she’s telling clients to stay in the stock market amid stimulus measures from the Federal Reserve and U.S. government.

“That is still our message,” Levine said in an interview on Bloomberg TV and Radio. “It’s extraordinary. I think we’re all scratching our heads, but the market is telling me you’ve got to be in it.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More