Bloomberg News

US Economy Hits Record Lows in April Retail, Factory Data

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

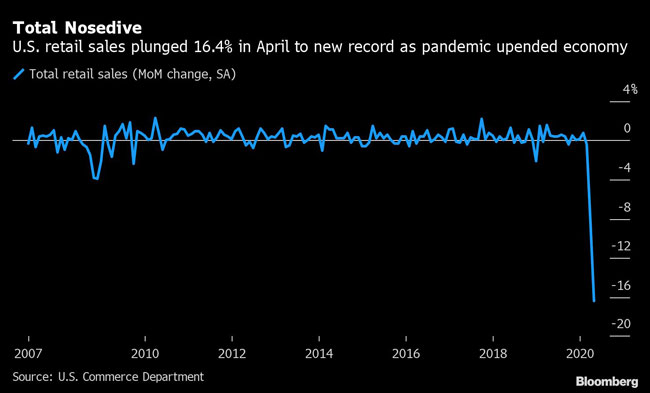

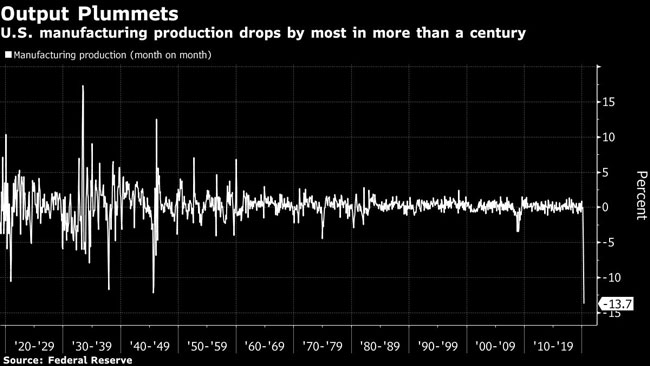

U.S. retail sales and factory output registered the steepest declines on record in April, illustrating a recession so deep that it likely will take years to fully recover.

Revenue at retailers and restaurants fell 16.4% from the prior month, almost double the 8.3% drop in March, which previously was the worst in data back to 1992, according to a Commerce Department report released May 15. That compared with the median projection for a 12% decline.

A separate report from the Federal Reserve showed industrial production decreased 11.2% last month, the steepest monthly drop in the 101-year history of the series. Manufacturing output plummeted by a record 13.7% amid declines in all major industries, the Fed said.

With most Americans stuck at home and unemployment the highest since the Great Depression era, people sharply reduced their spending in the month. The figures May 15 show how the breadth of the damage extends from factory floors to households and suggest the economy has a deeper hole to climb out of than previously thought. Further store closures and bankruptcies across the nation risk exacerbating the situation.

One bright spot in the data was a surprise increase in consumer sentiment, which rose amid widespread virus-relief payments and discounts for big-ticket items. At the same time, pessimism deepened about the longer-term outlook for incomes and the economy.

In retail sales, all but one of 13 major categories decreased, led by a 78.8% drop at clothing stores and a 60.6% decline at electronics and appliance outlets. The only category to record a gain was nonstore sales — including online sellers such as Amazon.com — which increased 8.4%.

Receipts at food and beverage stores, which saw sales surge in March as Americans stocked up on essential goods, fell 13.1% in April. Sales at restaurants and bars were down 29.5% from the prior month, with receipts about half the level of April 2019.

A separate report May 15 showed New York state manufacturing remains in distress, with a gauge of May factory activity shrinking at the second-fastest pace in records back to 2001. Other data showed U.S. job openings plunged in March to the lowest level since May 2017.

U.S. stocks pared losses as a surge in oil lifted energy companies, offsetting trade concern and weak economic data.

A sharp drop-off in consumer spending is one of the main drivers behind estimates for gross domestic product this quarter to post the sharpest drop in records dating back to 1947. With states starting to loosen some business curbs, though, spending will likely pick up in the coming months.

The monthly sales total of $403.9 billion was the lowest since 2012. Retail sales were down 21.6% from April 2019 after a 5.7% year-over-year decrease in March.

The so-called “control group” subset of sales, which excludes food services, car dealers, building-materials stores and gasoline stations, fell 15.3% from the prior month. In more normal times, the measure is viewed as a better gauge of underlying consumer demand, though that’s less the case now.

Want more news? Listen to today's daily briefing: