Senior Reporter

UPS Reports Strong Q2 Earnings as Deliveries Surge

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

UPS Inc. reported strong results in the second quarter, as a surge in deliveries to homes and businesses helped lift the company through a three-month period that has found many people staying home and ordering goods online.

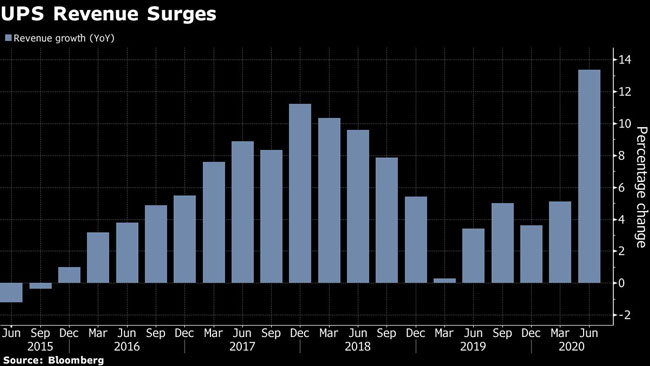

The Atlanta-based carrier on July 30 said Q2 net income increased 4.9% to $1.78 billion, or $2.04 a share, compared with $1.68 billion ($1.95) a year ago. Quarterly revenue surged by 13.4% to $20.4 billion compared with $18 billion last year.

Through the first six months of 2020, UPS posted net income of $2.73 billion ($3.16) compared with $2.79 billion ($3.23) in 2019. Revenue for the first six months of 2020 was $38.5 billion, compared with $35.2 billion in 2019.

The company’s Q2 numbers exceeded Wall Street’s expectations; analysts were forecasting EPS of $1.06 a share on revenue of $17.34 billion, according to Zacks Investment Research.

Tomé

“At the beginning of the second quarter, we assumed demand would slow. Instead, we saw just the opposite,” UPS CEO Carol Tomé said in her first earnings call since becoming the company’s leader this spring. “Due to ongoing COVID-related sheltering-in-place, retail store closures, and changes in U.S. consumer spending fueled by the economic stimulus, we experienced unprecedented demand and record-high volume levels. As a result, our second-quarter performance was stronger than we expected.”

The coronavirus pandemic and states’ stay-at-home mandates led to a boom in online deliveries of various goods. UPS said Q2 demand for domestic residential deliveries rose 62.5%. It also said average daily domestic package volumes jumped 22.8% to reach 21.1 million packages a day, compared with 17.2 million last year. International shipments for Q2 rose to 3.3 million daily, compared with 3 million a year ago. The company attributed much of that increase to strong outbound demand from its customers in Asia and an increase in cross-border e-commerce in Europe.

“UPSers are keeping the world moving during this time of need, and I want to thank our team for their hard work and outstanding efforts to serve our customers, our communities and each other,” Tomé said.

Even with the sharp increase in domestic deliveries, UPS noted that its domestic adjusted profit margin fell to 9.3% from 11% a year ago due in part to the fact that residential service has fewer packages per stop than commercial service, requiring drivers to travel farther between stops.

“Moving forward, we are focusing on efficiency and revenue quality to improve U.S. operating margins longer term,” Chief Financial Officer Brian Newman said.

With the increase in volume, Tomé said UPS is considering an increase in shipping rates, especially on larger customers. “While retailers may squawk at price increases that come their way, large retailers have a way to spread that across,” she said.

UPS, like its rival FedEx, now is delivering packages seven days a week.

Due to uncertainty surrounding the timing and pace of economic recovery as businesses begin to reopen amid the pandemic, UPS has suspended providing guidance on revenue or earnings.

UPS ranks No. 1 on the Transport Topics Top 100 list of the largest for-hire carriers in North America and No. 2 on the TT Top 50 list of the largest logistics companies in North America.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More