Trump Budget Would Raise $16 Billion to Protect Pensions

This story appears in the June 5 print edition of Transport Topics.

Companies contributing to multiemployer pensions would pay significantly more in premiums under a budget proposal from President Donald Trump released in May.

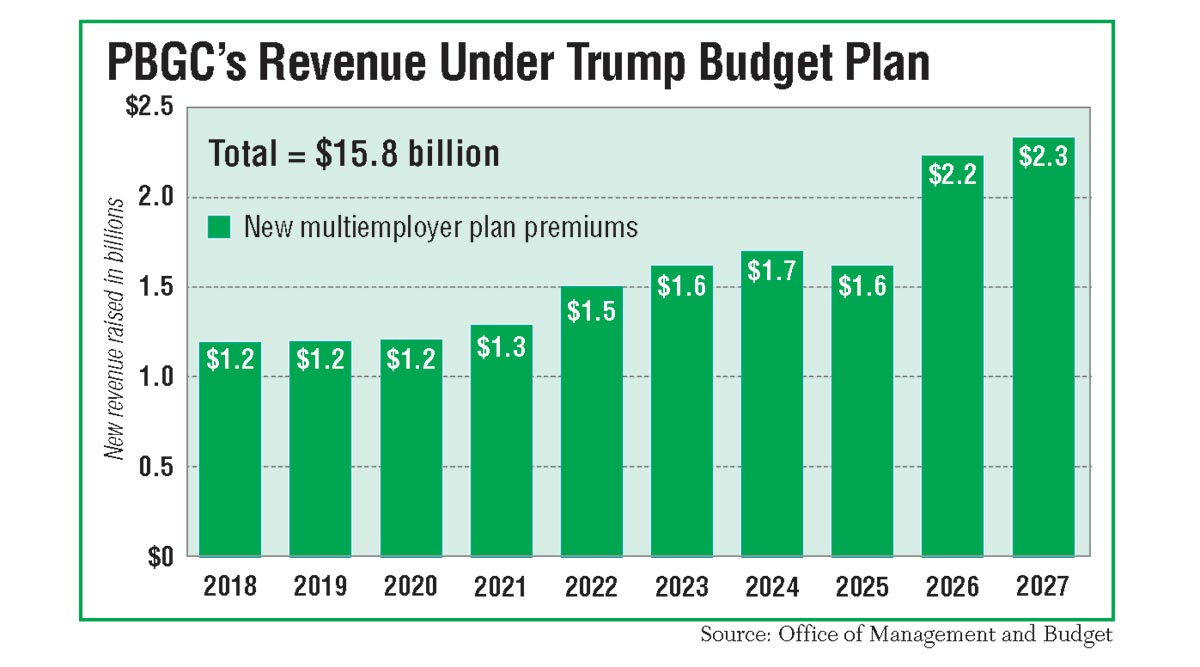

The Pension Benefit Guaranty Corp., a government agency that insures the benefits of retirees, would introduce a variable rate premium and an exit premium in multiemployer pension plans, raising $15.8 billion in revenue over 10 years, according to the plan. In fiscal 2018, the new premiums would raise $1.2 billion and fluctuate up to $2.3 billion by 2027.

An additional $5 billion would be raised by requiring plan sponsors to pay premiums on an accelerated basis.

“This level of additional multiemployer premium revenue is ex- pected to be sufficient to fund the multiemployer program for the next 20 years,” the budget proposal states.

PBGC already institutes a variable- rate premium on single-employer pensions. The current rate is $34 per $1,000 of unfunded vested benefits, up from the $30 rate in 2016, according to PBGC.

An exit premium has never been used before.

More than 10 million American workers are vested in multiemployer pensions. While PBGC was designed to intercede to salvage funds in danger, the agency itself is projected to run out of money by 2025.

“While PBGC’s Single-Employer Insurance Program is on a path towards solvency, the Multiemployer Insurance Program is in dire financial condition,” PBGC Director Tom Reeder said in a statement. “The president’s budget includes a proposal to shore up PBGC’s multiemployer program and do so in ways that encourage better plan funding and continued employer participation.”

UPS Inc., top-ranked on the Transport Topics Top 100 list of the largest U.S. and Canadian for-hire carriers, proposed its own solution in April to ease the burden on PBGC through low-interest, long-term government loans to trustees of troubled pensions to keep their funds afloat.

“Benefits would be reduced up to 20%. This allows plans to have a realistic chance to earn their way out of the funding shortfall. Loan repayments would begin after five years [interest only for the first five years]. A plan may receive up to three loans,” according to the draft, which calls for a 1% interest rate amortized over 30 years.

UPS wrote that the government would need to issue between $22 billion and $30 billion in loans, based on documents filed in 2015 with the Internal Revenue Service. The government also might lend another $30 billion to create a separate “Risk Reserve Pool” to support pensions in critical and declining status over the next 15 years.

“We applaud the administration’s attempt to help fix the PBGC’s troubled multiemployer pension plan trust fund,” UPS spokeswoman Kara Ross said. “However, premium increases do not solve the problems for most troubled plans and their participants. All stakeholders need to come together and find solutions that minimize benefit reductions for participants, ensure the solvency of the PBGC and allow these vital pension plans to survive.”

As of 2016, PBGC’s multiemployer program carried a $58.8 billion deficit and if it became insolvent, retirees could see benefits cut about 90%.

However, the National Coordinating Committee for Multiemployer Plans opposes premium hikes because the group believes there are better approaches fix PBGC. The coalition of management and labor was instrumental in the formation, discussion and passage of the Multiemployer Pension Reform Act in 2014. The law allows the Department of the Treasury to approve applications to allow trustees to reduce benefits to ensure the long-term viability of the pension fund.

“We need for the PBGC to be a credible insurer that can honor its commitments, but to do so in a way that provides for premiums that are affordable and consistent with the value of the insurance provided, and that does not destroy the viability of multiemployer plans,” Michael Scott, executive director of the National Coordinating Committee for Multiemployer Plans, said in a May 23 speech.

Scott told Transport Topics that if the Treasury Department applied the Multiemployer Pension Reform Act as Congress intended, then the $58.8 billion deficit would be significantly reduced, which would make a significant premium hike unnecessary.

“We’re going to have to make technical corrections to the law because it’s clear that Treasury won’t implement it the way it was intended,” he said. “I do not believe that the multiemployer system as a whole could ab- sorb the level of premium increases being contemplated and remain viable.”

Scott pointed out that when the Treasury Department rejected the Central States application, it triggered “a long set of significantly more negative consequences for everyone involved at Central States, [and] other multiemployer plans.”

PBGC told Scott that when Central States goes insolvent within the next decade, the benefit guarantee will drop from a maximum of $12,870 per year for 30-years of service, to a maximum of $643.50 per year.