Trucking Stocks Rebounding at Mid-Year Despite Economic, Political Uncertainty

This story appears in the June 26 & July 3 print edition of Transport Topics.

The share prices of trucking companies have been on the upswing since mid-May, recouping some of the gains from the bustling start of the year that were lost during a weak spring. While carriers generally are trading higher than a year ago, investors are once again waiting for clarity on the state of the U.S. economy before they send stocks soaring — or plummeting.

Stock analysts said that in 2016, corporate executives tended to hold back on investment, preferring to see first who the winners would be in the November election before moving on expansion plans. That contributed to an anemic year for shipping. The winners have been known since November — Republicans in the White House, Senate and House of Representatives — and that produced a surge in optimism and trucking stock prices through the end of the year.

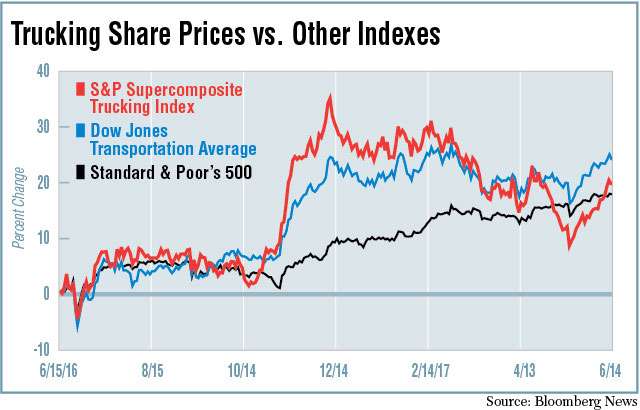

Trucking company shares performed better than the overall transportation sector in general, and transports outperformed the Standard & Poor’s 500.

The surge resulted from “expectations of a more favorable business climate,” said Jason Seidl, who follows freight transportation for Cowen & Co.

For the economy as a whole, the Federal Reserve on June 14 expressed optimism by raising its key interest rate for the third time in six months. It bumped up rates a quarter-point to a range of 1.25%, which could lead to higher borrowing costs for businesses.

Certainty on clear changes in economic policy related to trucking, though, has not followed, so carrier stocks — as measured by the S&P Supercomposite Trucking subindex — are down from Jan. 1, and the Dow Jones Transportation Average has been seesawing, showing neither a clear gain nor loss.

The trucking subindex opened the year at 364.1 and closed at 349.4 on June 14.

“We had the Trump bump, and then a correction. A lot of investors are biding their time, and trucking stocks are kind of expensive now,” said Thom Albrecht, a longtime transportation analyst and now an industry consultant with Sword & Sea Transport Advisors. “There were a lot of [earnings] misses in the first quarter — especially on the truckload side.”

Albrecht said he expects trucking earnings to improve, but the question is, how good will it be? “Maybe it will only last four or five quarters. It might not be a multiyear party,” he said in an interview with Transport Topics.

As with most domestic firms, trucking would benefit from the tax reform that is on the policy agenda of President Donald Trump, Seidl said, adding that the adoption of Trump’s $1 trillion infrastructure plan would definitely send earnings and share prices upward.

Absent the enactment of those much-desired changes, motor carriers improved on the margin, according to Seidl. “April was better than the first quarter, and May was better than April,” he said.

He anticipates the much-discussed federal electronic logging device mandate that is scheduled to take effect in December will trim truckload capacity, “but not massively and not immediately.” The exception might be if January to March 2018 has lots of bad weather, and coupling that with the regulatory change could produce big trouble.

“I know several shippers who are worried about that,” Seidl said.

Looking at freight rail stocks, Seidl does not expect coal to return to its once-exalted space.

“The recent increase in coal shipping is a dead-cat bounce. Coal is not a growth commodity and will go away over time,” Seidl said.

U.S. fossil fuel production fell 7% from 2015 to 2016. Most of this decline was from coal production, which decreased 18% and fell to its lowest level since 1978, according to the Department of Energy. Relatively low natural-gas prices, especially in the first half of 2016, and relatively flat electricity demand contributed to the decline in coal production, the agency’s Energy Information Administration said.

Among non-asset-based logistics providers, Seidl said the largest providers, such as XPO Logistics, C.H. Robinson Worldwide and Expeditors International should survive the challenge from new, disruptive, technology-heavy companies such as Uber, Amazon.com, Transfix and Convoy. However, small-to-medium brokers could face significant challenges, he said.

Albrecht said investors “want to like trucking stocks,” but they have been fooled by multiple “head fakes,” where freight looks like it will accelerate but doesn’t. Assuming more modest growth in gross domestic product and freight, companies that are currently profitable should remain so, he said, but that doesn’t lead to higher stock prices. Alternatively, the economy might really take off, but that is far from certain.

On a sectoral basis, he noted improvements among flatbed carriers and said the less-than-truckload group is, on average, doing better than truckload carriers.

The biggest prize, though, is e-commerce.

Albrecht said e-commerce has spread well beyond parcels and moved into “bulky, heavy items,” including furniture, gun safes, kayaks, power tools, vacuum cleaners and treadmills. A company that can make itself indispensable in e-commerce will be in a strong position to generate earnings, he said.

Valuations of transportation stocks for the 52 weeks ended June 14 mainly appreciated, but at three companies, the share prices doubled:

• XPO Logistics had a gain of 121.9% during that time. The less-than-truckload and logistics company had been on a growth spree, mainly through acquisitions, but had not been profitable until the second quarter of last year. The share price rose to $61.11 from $27.54 during the 52-week period.

• Saia Inc., also an LTL carrier, posted a 102.9% gain in share price to $50.60 from $24.94. Unlike most other trucking stocks, it did not give up its Trump bump but built on it instead.

• Railroad CSX Corp. had a 101.5% gain to $53.18 on June 14 from $26.39 a year earlier. While consistently profitable, the company had a poor operating ratio relative to its peers. The stock price surged in January based on rumors that railroad executive Hunter Harrison would be hired as CEO — which came true in March.

The two largest price declines were in the truckload sector, with Celadon Group Inc. falling 74.5% to $2.55 on June 14 from $10 over 52 weeks and USA Truck dropping 66.3% to $6.58 from $19.51.

Celadon is reauditing financial reports related to claims of inaccurate valuations of used trucks and must restate some earnings reports. USA Truck has had a string of quarterly losses and a major shake-up among its executives, who are now trying to turn around the company.

Beyond the string of daily prices, the year’s first half has featured four major stock events, mainly in the truckload sector.

Schneider, No. 7 on the Transport Topics Top 100 list of for-hire carriers in the United States and Canada, and the second-largest truckload carrier on the list, launched its initial public offering of shares April 6. Family-owned since 1935, the company also has substantial operations in intermodal transportation and logistics.

In the same month as the Schneider IPO, truckload carriers Swift Transportation and Knight Transportation announced April 10 that they would merge in a deal valued at $6 billion. Swift ranks No. 6 on the for-hire TT100 and Knight ranks No. 29. Swift is already North America’s largest truckload carrier.

A majority of shareholders for the companies still need to vote on the deal.

On Feb. 28, Daseke Inc., a group of open-platform and specialized carriers, also went public through a special-purpose acquisition com- pany, or SPAC, process. The company ranks No. 44 on the for-hire TT100 list and is the second-largest flatbed/heavy-haul/specialized carrier on the list behind Landstar System.

Company management said they will use the proceeds from going public to acquire more operating companies to roll into Daseke.

The same day, truck and engine maker Navistar International Corp. completed a deal announced in December. The manufacturer sold 16.6% of its shares to Volkswagen AG for $256 million, providing VW’s Truck & Bus division entry into the North American heavy-duty truck market.