Truck Turn Times Slow One Minute in August

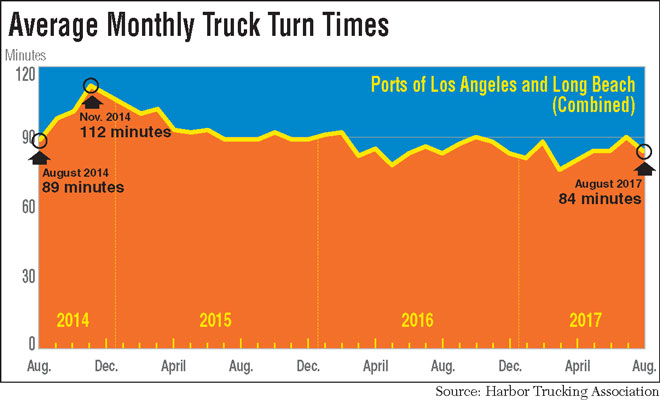

LONG BEACH, Calif. — The average truck turn time at the nation’s two largest ports slowed one minute in August compared with last year, even while more containers flowed into the terminals this year.

Draymen spent 81 minutes at the Port of Long Beach and 86 minutes at the Port of Los Angeles, on average, equaling a portwide total of nearly 84 minutes.

Harbor Trucking Association and Geostamp compile the data using GPS devices and geofencing to track the time from when a truck enters the queue to when it crosses the exit gate.

HTA Executive Director Weston LaBar said more than 9 million industry-standard 20-foot equivalent containers, or TEUs, went through the two ports during the past 12 months.

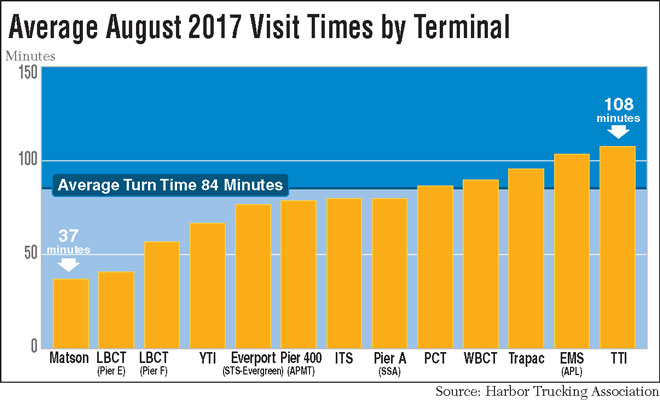

“When you look at the situation overall, it only deteriorated one minute, so things are not terrible,” LaBar said. “The problem is that certain terminals perform really well and some terminals don’t. And if the terminals that aren’t performing as well are also the ones getting the majority of the volume, which is the case right now, we need to work with those terminals to improve the turn times.”

#ICYMI #POLB had a very busy August; imports surged more than 10 percent. Read more: https://t.co/00ZfLMoPbE — Port of Long Beach (@portoflongbeach) September 18, 2017

In Long Beach, the longest turn time was 108 minutes at Total Terminals International.

In Los Angeles, American President Lines’ terminal operator Eagle Marine Services was the slowest with a 104-minute average.

Total Terminals International became the busiest terminal after a significant increase in business from the 2M Alliance — Maersk Group and Mediterranean Shipping Line — and Hyundai Merchant Marine.

CMA CGM committed to giving Eagle Marine Services more business in 2017.

It is the fourth consecutive month that Total Terminals International and Eagle Marine Services were the slowest.

“TTI has never really been a great terminal, and it’s gotten much worse,” Quik Pick Express President George Boyle said “There are not enough appointments available. And the management isn’t engaging with the industry the way the others have. Whereas at [SSA Terminals] Pier A, there are guys who are creative about free flow. We’ve also had a good experience and response at [Yusen Terminals International].”

The quickest terminals were the lightly used Matson terminal at 37 minutes and the automated Middle Harbor terminal at 41 minutes. In Los Angeles, Yusen Terminals topped the list at 67 minutes.

Terminal operators face a steep challenge to shorten turn times while processing record-high numbers of containers.

The Port of Los Angeles set an August record with 845,857 TEUs, up 6.1% year-over-year. It also was the second-largest total of any month in the port’s history.

Loaded container imports increased 5.1% to 432,479, and exports rose 4% to 159,197.

#PortofLA has best August ever as container volumes climb

6%. On track for record-breaking year. #AmericasPort https://t.co/7urAUm0PSr — Port of Los Angeles (@PortofLA) September 13, 2017

The Port of Los Angeles handled 6.1 million TEUs through August, 9% higher than at the same point last year, when the Western Hemisphere record of 8.8 million was set.

“We are grateful to our terminal operators, labor force, supply chain stakeholders and our cargo owners for the record-breaking container volume trend we have been experiencing over the past 20 months,” Port of Los Angeles Executive Director Gene Seroka said. “We plan to build on this momentum and confidence by focusing on innovative new ways to improve efficiencies, including a first-of-its kind information portal system with GE Transportation that will be introduced at all of our container terminals in the coming months.”

Meanwhile, the Port of Long Beach recorded the second-busiest August in history. Container traffic grew 8% year-over-year to 692,375 TEUs.

Loaded container imports grew 11% to 355,715, but loaded exports dropped 26% to 117,290. Empty containers going back to Asia climbed 37% to 219,370.

“We are on pace to have our highest import year ever and one of our best years, period,” Harbor Commission President Lou Anne Bynum said. “Our inbound traffic during this peak season signifies optimism among retailers for the holiday season. Simply put, shoppers are buying more, and retailers are restocking their shelves.”

Nearly 4.9 million TEUs have gone through Long Beach through August, a 6.6% increase from last year.

“The modest economic growth we’ve seen since the Great Recession has been replaced this year by robust gains,” Port of Long Beach Executive Director Mario Cordero said, “at least when measured by goods coming into the United States.”