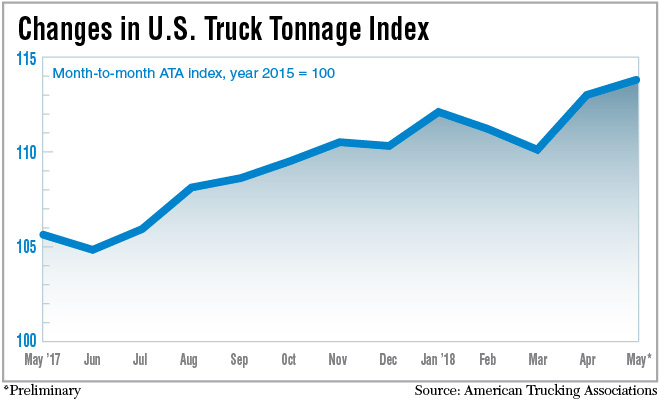

Truck Tonnage Continues Robust Run, Climbing 7.8% in May

Truck tonnage rose 7.8% in May compared with the same month last year, according to American Trucking Associations’ advanced seasonally adjusted for-hire Truck Tonnage Index. The index was up 0.7% in May compared with April.

The index equaled 113.8 in May, up from 113.0 in April. The index value for April was revised to an increase of 2.7% from the originally reported 2.2% rise.

The May increase, while healthy, is down from the year-over-year increase of 9.9% that occurred in April. Tonnage has increased 8% through the first five months of 2018 compared with the same period a year ago. The index rose 3.8% in the first five months of 2017.

“This continues to be one of the best, if not the best, truck freight markets we have ever seen,” ATA Chief Economist Bob Costello said. “May’s increases, both sequentially and year-over-year, not only exhibit a robust freight market, but what is likely to be a very strong GDP reading for the second quarter.”

In the near term, though, freight growth will moderate due to strong year-to-year comparisons, Costello said.

ATA’s not-seasonally adjusted index, representing the change in tonnage actually hauled by fleets before any seasonal adjustment, was valued at 118 in May, a rise of 7.6% above the previous month.

ATA calculates the tonnage index based on surveys of its membership.

Other calculators on the well-being of the trucking industry also were looking strong.

The FTR Trucking Conditions Index was at 11.5 in April and has been in double digits since January, FTR Chief Operating Officer Jonathan Starks said. Anything above zero is considered a positive environment for trucking.

“We expect it to get stronger in the back half of the year. It should stabilize a little in 2019 as capacity comes into the market. But we still will be positive for 2019,” Starks said.

The trifecta of strong demand, tight capacity and strong rates has made this a carrier’s market, he said.

Also, FTR’s tracking of truck utilization shows all trucks are being used and that any driver who wants to move freight can find freight to move, Starks said. Indeed, 2018 is shaping up to be a year with 100% truck utilization for all 12 months.

“In 2019, we will see that come down from the 100% rate but it will still be a good market for carriers,” he said.

Analyst Noel Perry is less optimistic than Starks, though he agrees that the market is strong. Carriers need tonnage to keep growing for a sustained time to lock in the gains they are enjoying this summer, he said.

“We need 4-6% growth in the third and fourth quarters for this to continue into 2019,” said Perry, principal at Transport Futures in Cornwall, Pa., and chief economist with Truckstop.com.

And he cautions there are signs that the economy could hit a rough patch. Need an example? Let’s start with Italy leaving the European Union, then consider that energy prices and inflation could keep rising and then there’s the potential for the battle over tariffs escalating into a full-blown trade war, he said.

“There are enough reasons for worry that no one should mail in their results for the rest of the year,” Perry said.

Still, broad economic statistics are showing positive signs for the freight industry.

Manufacturing is looking good, with the Institute for Supply Management reporting its PMI index in May registered 58.7%, an increase of 1.4 percentage points from April. The PMI considers such topics as new orders, production, employment and inventories.

Of 18 industries tracked by ISM, 16 showed growth in May while none declined, the institute found.

The Federal Reserve’s Industrial Production Index hit 106.2 in May, up from 105.9 in April. The index measures output for all facilities in the United States for manufacturing, mining, and electric and gas utilities. The index has grown since September 2016.

There were 1,350,000 housing starts in May, up 5% from April and more than 20% above the May 2107 rate, according to the Census Bureau.

Retail sales came in at $502 billion in May, an increase of 0.8% from April and up nearly 6% from May 2017, the Census Bureau reported.