Tonnage Springs 9.5% Higher in April

Truck tonnage jumped 9.5% in April compared with the same period a year ago, according to American Trucking Associations’ monthly for-hire truck tonnage index.

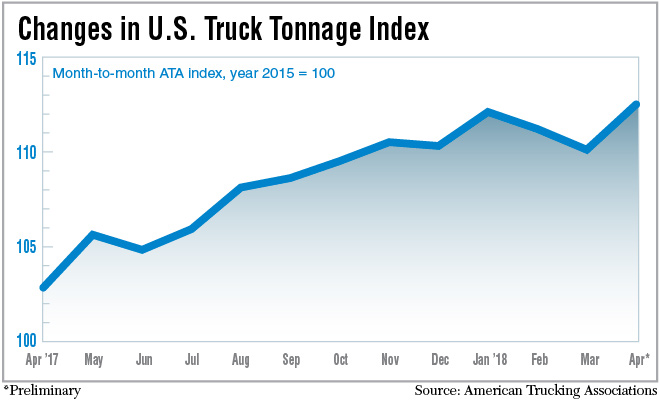

During the first four months of 2018, ATA’s seasonally adjusted for-hire truck tonnage index rose 8%, topping the 3.8% rise seen in the same period in 2017.

On a sequential basis, the index in April increased 2.2% to 112.5 from March’s 110.1. The March value was revised to a 1% drop from a 1.1% decline. ATA calculates the tonnage index based on surveys from its membership.

Costello

“Truck freight tonnage remains robust,” ATA Chief Economist Bob Costello said. “And I don’t think we’ve even seen the traditional spring freight season yet. People are just getting around to buying grills, lawn mowers and yard tools.

“Plus, the produce season was delayed due to a cold snap in early spring. Longer term, strength in consumption, factory output and construction should keep truck freight tonnage solid for the quarters ahead.”

ATA also tracks a not-seasonally adjusted index, representing the change in tonnage actually hauled by fleets before any adjustment. That index equaled 109.2 in April, a 4.8% drop from the March index value of 114.7.

The tonnage numbers are in line with other indicators of a strong spring for the trucking industry.

Domestic freight business grew at a double-digit rate as shown in the Cass Freight Index Report for April. St. Louis-based Cass Information Systems breaks the index into two channels: shipments volume and freight shipment expenditures.

The shipments index in April grew more than 10% year-over-year, “yet another data point confirming that the strength in the U.S. economy continues to accelerate,” according to Donald Broughton, founder of equity research firm Broughton Capital and an analyst and commentator for the Cass Indexes.

The expenditures index grew close to 13%. Cass processes more than $25 billion in annual freight payables.

Another sign of the extraordinary level of activity is truck utilization running at 100% as reported by FTR Transportation Intelligence. The active truck rate measures seated trucks available for use in relation to the demand for trucks.

The rate has been at 100% since last November and looks to stay there until December, said Avery Vise, vice president of trucking research.

“Carriers are hiring as many drivers as possible and ordering a lot of trucks,” Vise said.

Sales of Class 8 trucks through April tallied 69,479, up nearly 37% compared with the same period last year, according to WardsAuto.com.

The electronic logging device mandate that began last December is one reason for the high utilization rate, Vise notes, but the industry has been adapting with shippers and carriers working more efficiently together and expanding the use of techniques such as drop and hook.

Meanwhile, increased demand in some markets and regions kept carriers busy even when activity cooled elsewhere. Load board operator DAT Solutions reported that “produce harvests across the Sun Belt, from California to the Carolinas, added to capacity pressure” though “freight volumes cooled in the Northern states, more than offsetting any gains to the South.”'

These “trends kept national average rates unchanged for dry van and refrigerated truckload freight” earlier this month, according to DAT.

National economic indicators for April also showed an economy that was chugging along.

Activity in the manufacturing sector expanded, and the overall economy grew for the 108th consecutive month, according to the latest Manufacturing ISM Report on Business from the Institute for Supply Management.

The institute reviews 18 manufacturing industries, such as appliances and furniture, to track the overall strength of the sector. In April, 17 of the indexes reported growth, and price increases occurred across 17 of 18 industry sectors.

The Federal Reserve’s Industrial Production and Capacity Utilization indexes also moved forward in April. The production index rose 0.7 percent for its third consecutive monthly increase, while capacity utilization climbed 0.4 percentage point. The Fed reported that total industrial production in April was 3.5% higher than it was a year earlier.

The Census Bureau reported that housing starts in April were at a seasonally adjusted annual rate of 1,287,000, a decline of 3.7% from March but an increase of more than 10% from April 2017.

Retail sales rose in April to $497.6 billion, up 0.3% from March, and up 4.7% from April 2017, according to the Census Bureau. The retail sales numbers are early estimates. Retail e-commerce sales for the first quarter were $123.7 billion, up 16.4% from the same period a year ago.