Special to Transport Topics

Tire Technology Offers Cost Savings, Reduced Maintenance for Fleets, Industry Reps Say

Technology is rapidly evolving and continuously emerging across many facets of the trucking industry, and tires are no exception. Tire manufacturers report that the connectivity and digital capabilities they provide offer improved efficiencies, cost savings and reduced maintenance for their fleet customers.

Traditionally, tires are a fleet’s second largest maintenance expense behind fuel, said Johnny McIntosh, general manager of services and solutions at Goodyear Tire & Rubber Co. “Anything you can do to help fleets better manage those tire assets is important,” he said.

Tire technology can involve services and products, said Adam Murphy, vice president of marketing for Michelin Americas Truck Tires. The leading trend on both fronts centers on smart tires and maintenance-system connectivity.

Each “smart” tire possesses an implanted radio frequency identification tag, a sensor that monitors conditions such as tire pressure and temperature. All Tier 1 tire manufacturers are testing or have released an RFID-equipped smart tire for commercial fleets.

Smart tires allow fleets “to automate, simplify and improve their tire asset management processes,” Murphy said, noting nearly all Michelin commercial truck tires, BFGoodrich and Uniroyal tires come with RFID sensors to enable “complete tire life-cycle monitoring and reporting for fleets.” Michelin owns the BFGoodrich and Uniroyal brands.

Smart tires generally send real-time information to a database, often cloud-based, so fleets can track tire stats for short-term and long-term operational and efficiency improvements.

In the short term, drivers or fleet managers can receive alerts if a tire needs more air or requires replacement. Planning for and addressing maintenance issues before they occur reduces downtime from tire failures.

Longer term, RFID-tagged tires provide fleets with a history, and over time, fleet managers can see the improvements in efficiency, said Joseph Saoud, president of truck and bus radial and retread tires at Bridgestone Americas Tire Operations.

Eventually, repeated efficiency enhancements equate to lower tire maintenance and ownership costs, he said.

In addition, the technology presents tire inventory tracking benefits by eliminating human error, Saoud said. With connected tires, fleet managers no longer need to perform physical inventory checks and can see in their database where all of their tires are at any given time. This helps control inventory shrink and asset distribution.

Manufacturers continue testing the best implementation practices and placement for RFID tags and other types of sensors, especially when considering tires’ retreading potential. “We’re looking at the different forms of putting the sensors on a tire [so] it does not get impacted through the retread process or the heat generated from baking the tread,” Saoud said.

Connected systems and tire sensors still are part of an emerging field within the tire industry, and some fleets might think that such innovations are initially too cost prohibitive. But as RFID and other sensing technologies continue to advance and become more widely adopted, “the cost has come down significantly so you can implement it on a large scale,” Saoud said.

Retreads are another area in which Tier 1 manufacturers have focused on innovating because retreadability helps to control fleet costs, said Michelin’s Murphy. The company introduced its MD XDN 2 Pre-Mold retread less than two years ago as a drive-position retread designed for long wear life, durability and traction for regional and medium-duty vehicles.

But new, fully assembled retreads aren’t the only advancement. Manufacturers report more attentiveness to boosting original tire quality to improve the ability for casings to be retreaded, sometimes up to three times, which decreases the cost of ownership.

“Over the years, the casing has only gotten better” on original tires and has enhanced retreadability, said Bridgestone’s Saoud, who also referred to customer feedback and testing on the company’s Bandag retreads as evidence that the number of miles traveled on one tire has improved.

Along with RFID and sensing technology, the tire maker representatives said innovations in their support services help fleets get a better handle on inventory.

The online Bridgestone Solutions Portal provides information on inventory and tire performance, and it works retroactively to get insight from past performance, Saoud said.

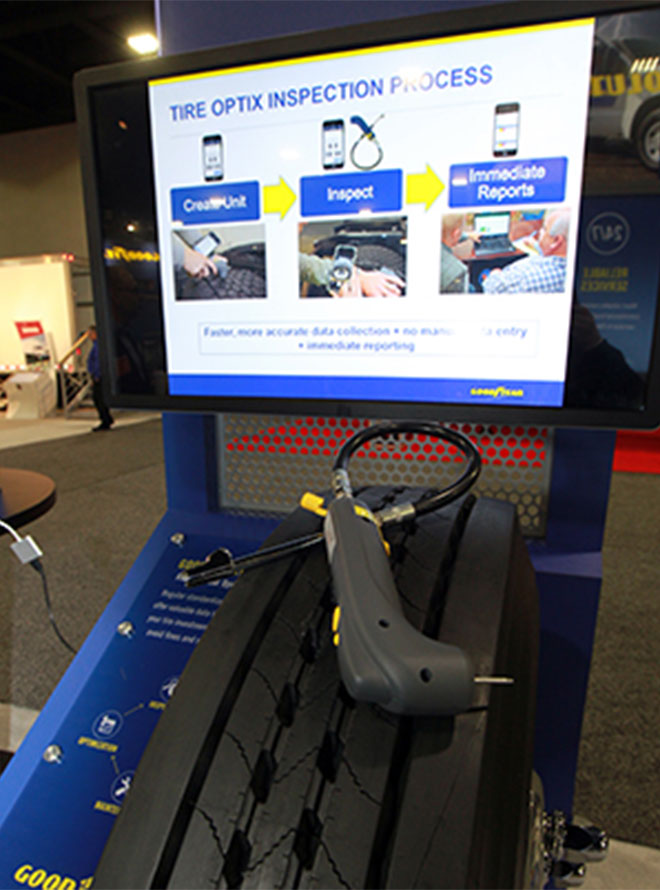

Earlier this year, Goodyear launched Tire Optix, which is a subscription-based tire management program that incorporates a cloud-based platform and mobile app. Goodyear dealers can subscribe to this service to measure tread depth and tire pressure with a Bluetooth-enabled digital tool that sends data to the platform. Dealers can access all the information via an app on their mobile device.

“Just a minute later, the cloud processes that … and the reports are sent in an e-mail,” Goodyear’s McIntosh said.

Goodyear Tire Optix by John Sommers II for Transport Topics

The system generates reports for points that need immediate attention, a dashboard of everything that was observed during inspection and charts and graphs providing a visual representation of the data. The instant report generation replaces manual systems that often would take a day to provide fleets with information.

“We’ve seen tremendous change in our ability to deliver actionable reports immediately to our customers versus what we used to do in the past,” McIntosh said.

The Tire Optix system also enhances accuracy because the digital inspection tool takes more precise and consistent measurements than humans could. With the Bluetooth tire gauge, “there’s no eyeballing that meter to see if it’s closer to 18/32 or 17/32,” McIntosh said.

The goal of the system is to provide a consistent approach with those “innovative” technologies to manage tires at the company’s 2,300 dealer locations in the United States and Canada, said McIntosh. Better service consistency leads to better fleet maintenance and predictability, he said.

Meanwhile, manufacturers’ online platforms eventually will allow drivers and fleet managers to immediately rate the service they received and provide feedback.

“Right now nobody in the industry is capturing that information,” Bridgestone’s Saoud said, noting it’s “extremely important” to help the service network understand where there are opportunities to improve.