Tesla Unveils Model Y Crossover, but Delivery Time Reignites Cash Concerns

Elon Musk’s unveiling of a new electric vehicle that Tesla Inc. won’t deliver to customers for another year and a half rekindled concerns about the company’s cash position.

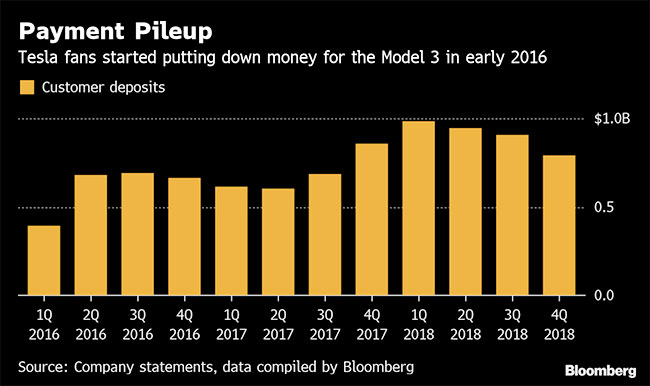

The Model Y crossover the chief executive officer debuted late March 14 in Hawthorne, Calif., will start being delivered to customers in the fall of next year, later than some analysts anticipated. The company immediately began taking $2,500 pre-orders, a bigger ask than the $1,000 it has charged to reserve a Model 3 sedan.

“More expensive customer deposits for Model Y are likely to reinforce bear concerns about Tesla’s cash,” Toni Sacconaghi, an analyst with Sanford C. Bernstein Co., said in a report March 15. “We expect initial orders to be notably lower than Model 3.”

Tesla fell as much as 5% March 15 to $275.40, which would be the lowest close since Oct. 22. The shares are down about 16% this year.

At Tesla’s design studio, Musk showed off a blue prototype of the midsized Model Y, which is roughly 10% bigger than its best-selling Model 3. Initially, three higher-end editions of the new vehicle will be available, with a standard version scheduled to arrive in spring 2021 that will be priced at $39,000 and equipped with a 230-mile battery.

By showing the Model Y now and yet keeping customers waiting until the second half of next year, Tesla risks undermining momentum for the Model 3, which catapulted the automaker up the sales charts and helped Musk post back-to-back quarterly profits for the first time. Investors are counting on the Model Y to help the company better meet the demands of consumers who are increasingly ditching sedans for roomier crossovers and SUVs.

Tesla CEO Elon Musk (Patrick T. Fallon/Bloomberg News)

“The biggest surprise was Model Y initial shipments will begin in the fall of 2020, a year later than we had anticipated,” Gene Munster, a managing partner of venture capital firm Loup Ventures, wrote after the event. “This timing likely implies the company is postponing the costly Model Y ramp in 2019 to conserve cash.”

Musk, 47, took the stage before a crowd of customers and fans, but was uncharacteristically subdued. He spent much of his presentation talking about the company’s struggles with manufacturing.

“He was not the usual charismatic Elon Musk. He was super low-key,” said Michael Harley, executive editor of Kelley Blue Book, who was at the event. “He was almost apologetic. It was a bit of a reality check. People in the crowd like the car, but Musk only spent a fraction of his time talking about it.”

Only one of the new models was driven onto the stage, where it shared the limelight with other, older vehicles. At the 2016 unveiling of the Model 3, by contrast, Musk showed off three cars and flashed the rising number of customer deposits on screen as they rolled in from people eager to be among the first in line to reserve them.

At the Model Y’s unveiling, Musk said nothing about taking orders or deposits, although Tesla’s website allows people to submit fully refundable pre-orders.

The costlier call for Model Y orders relative to Model 3 reservations “suggests Tesla remains in a precarious cash position,” Jeffrey Osborne, an analyst at Cowen & Co. with the equivalent of a sell rating on the shares, wrote in a report. “We remain concerned about the company’s liquidity.”

The Model Y is making its official debut after a rough patch for both Tesla and Musk. In late February, the company announced it would finally offer a $35,000 version of the Model 3, though it linked the ability to do so with a plan to close almost all of its stores and pivot to online-only ordering.

Patrick T. Fallon/Bloomberg News

This blindsided employees and investors alike, and Tesla backtracked 10 days later, saying in a blog post that more stores would remain open but vehicle prices would have to rise by about 3% on average worldwide.

Tesla ended last year with about $3.7 billion of cash and equivalents, but the company has since had to pay off a $920 million convertible bond. Musk has warned a loss is likely this quarter, and the carmaker has a $566 million note coming due in November.

“The company appears to have to raise cash to meet the November debt payment and working capital needs,” Loup Ventures’ Munster said. “While this raise would fuel concerns around the company’s prospects and would be negative for shares of TSLA in the near-term, it would put the company on track to bridge the gap between meeting its debt requirements and volume production of Model Y early in 2021.”