Straight Trucks’ Market Share Gains on Highway Tractors

This story appears in the May 29 print edition of Transport Topics.

While the grand total of U.S. Class 8s in operation is growing ever so slightly, there are major shifts within the newest segment of that population, including more straight trucks at the expense of highway tractors, according to a recent report on vehicle registrations.

The automotive division of IHS Markit also said commercial vehicle registration data show that large fleets with more than 500 trucks have curtailed their truck purchases and that the year’s first quarter was especially tough on the Northeast region.

First-quarter registrations of new U.S. commercial vehicles, Classes 3-8, declined by 3.7% to 165,893 units but with results linked directly to size: The smallest vehicles did well whereas the largest did poorly.

Gary Meteer, director of commercial solutions for IHS, said the buying habits of large over-the-road fleets is driving many of the changes.

“Coming out of the Great Recession in 2010 and 2011, the big fleets pulled the commercial vehicle market out of recession, but now the big fleets are not buying and it’s pulling the truck market down,” he said.

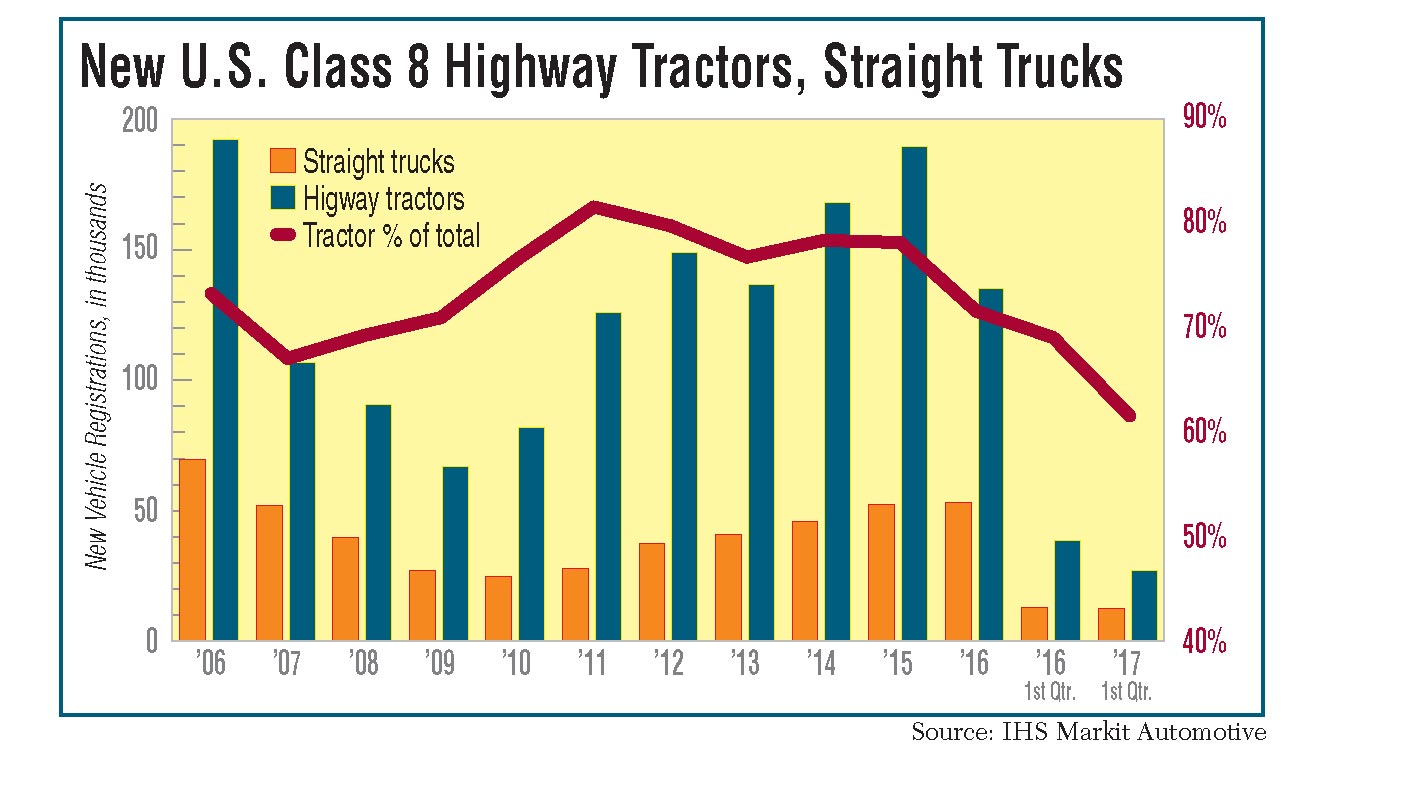

The IHS Markit data show that 61.7% of Class 8 registrations were highway tractors during the first quarter, with the rest being large straight trucks such as dump trucks, cement mixers and trash haulers. In the 2016 first quarter, the tractor proportion was 69.2%.

From 2010 through 2015 the full-year tractor proportion of new heavy-duty registrations ranged from 76.7% to 81.7%.

IHS Markit looks at registrations of new vehicles just placed into service and the number of all vehicles registered with a state government, no matter the age.

On March 31, U.S. fleets owned 4.04 million heavy-duty trucks, both highway tractors and straight trucks, a 1.7% increase over the 3.97 million trucks from the same date in 2016. Most of that growth was front-loaded, though.

The Class 8 roster grew by 63,000 vehicles through Sept. 30, 2016, and by just 5,000 new trucks from October through March.

“It’s replacement vehicles, exactly,” Meteer said of the new Class 8 registrations.

In first-quarter registrations of new vehicles, they plunged 21.5% to 43,990 heavy-duty trucks from 56,030 during last year’s first three months. IHS uses the early-year results to produce a forecast for the first 12 months.

As the first quarter is usually a slow time for registrations, the IHS forecast calls for just a 12.6% decline in new heavy-duty registrations this year to 180,000 vehicles from 206,000 for all of 2016.

“2017 will just be disappointing, but not a bad, bad year” as was 2009, Meteer said, referring to the 94,465 new Class 8s registered during the trough of the recession.

Kenny Vieth, president of ACT Research Co., said results from 2011 through 2015 were indeed a “tractor/sleeper cab market” but that vocational sales also have been doing well. The distinction, Vieth said, is that vocational sales are “flat to incrementally better,” but at least doing better than highway tractors, which recently have been in decline.

ACT mainly tracks orders for new vehicles, which Vieth said lead sales by about six months. Based on order increases, such as those cited by Daimler’s Nielsen and others, Vieth said second-half sales of new heavy-duty trucks should be significantly better than January-to-June levels.

“We’re either going to have more sales coming or a lot of inventory piled up,” Vieth said.

He also said more small fleets are ordering because the time between order placement and expected purchase date is fairly short, a practice common among smaller fleets. Large fleets, he said, are more likely to order many trucks spread out over a longer time.

The IHS Markit report also looked at truck trailers, 24 feet long or more, and found registrations of new units probably has peaked.

New U.S. trailer registrations have increased for three straight years through 2016, which was a record at 290,040 new units.

The first quarter reversed that trend, declining 20.5% to about 75,000 units from 95,000 in the 2016 first quarter.

Meteer said it is hasty to proclaim a major trend based on one quarter, but he did note that 2016 was unusual in that trailers often move in tandem with highway tractors, but 2016 was counter-cyclical in that respect.