Shipping Container Crunch Shows Signs of Easing, Index Shows

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

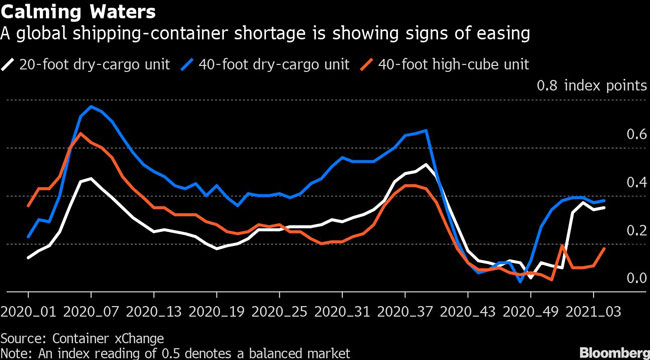

A global shortage of shipping containers that has sent ocean freight rates skyrocketing shows signs of easing, according to an index that tracks the steel boxes used to transport 90% of the global trade in goods.

The Container Availability Index developed by Hamburg, Germany-based Container xChange should stay around 0.35 to 0.38 through Chinese Lunar New Year in mid-February, the online platform said in a statement on Jan. 25. A reading of 0.5 reflects a balanced market, with anything below that mark indicating demand is outstripping supply. The levels had reached lows ranging from 0.06 to 0.13 in December depending on the size of container tracked.

Imbalances around Shanghai, where shortages late last year were particularly acute as Chinese factories returned to full production and exports to the U.S. surged, are headed back to normal levels, Container xChange also said. The index level for Qingdao, for instance, returned to the 0.5 balanced mark, it said.

Shipping liners have tried to realign their containers with the demand on transpacific routes, and “due to the aggressive repositioning of empties back to China by the shipping lines, Chinese New Year stands to become the turning point of equipment shortage.” That holiday runs from Feb. 11-17.

Also helping to alleviate the crunch are Chinese container manufacturers that are running at full production to produce more.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More