Senior Reporter

September US Class 8 Retail Sales Stay Strong

[Stay on top of transportation news: Get TTNews in your inbox.]

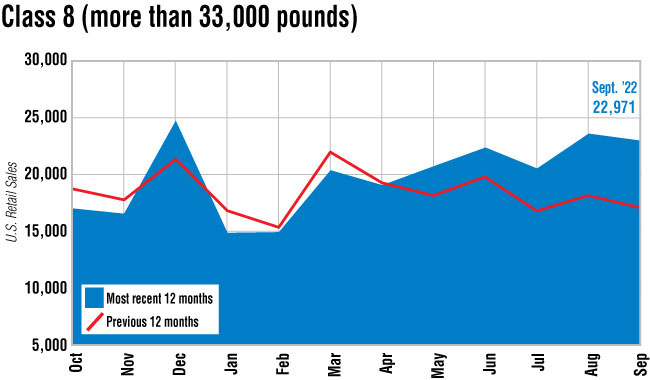

U.S. Class 8 retail sales in September were nearly 23,000 and reached the second-highest total this year, Wards Intelligence reported.

Sales rose 34.1% to 22,971 compared with 17,131 a year earlier. August produced the most sales so far, 23,581, according to Wards.

One industry expert said he is hearing the supply chain issues over the last two years are improving monthly.

“In talking with dealers and truck makers, it appears we will likely see continued supply chain improvements into the first part of 2023, when normal production levels are expected, for most truck makers, to return,” Dan Clark, head of BMO’s Transportation Finance Group, told Transport Topics.

He added he wouldn’t be surprised if the truck makers were also making progress on completing and clearing the inventory of nearly finished trucks that were sidelined missing just a few key components.

“That said, we continue to hear of one-off components that delay completions, and while those are fewer by the month, they still result in uneven delivery schedules,” Clark said. “Nonetheless, the monthly build rate is now on par with pre-COVID levels, clearly resulting in a tailwind for unit sales.”

September’s volume “is a pretty decent number given where the market is at,” said Steve Tam, vice president of ACT Research. “The good news, I guess, is expectations are for a pretty solid finish to the year as far as production is concerned. So retail sales should follow that accordingly.”

ACT forecast North American Class 8 production in 2022 will reach 310,000, then fall to 296,000 in 2023, which he said presented the most bearish outlook in the industry, but “the risk is to the upside.”

One piece of the Class 8 puzzle that continues to be missing, not surprisingly, is cancellations, one truck maker executive said.

“The calls I get today — which are numerous during the day from our dealers and customers — no one is calling to cancel trucks,” Jonathan Randall, senior vice president of sales at Mack Trucks, recently said.

“No one is calling to say ‘I know I told you I was going to take 75, but really I am only going to take 50.’ ”

The call, he said, is, “ ‘I’m going to take 75, and is there another 50 you can get me? Please, I need them desperately.’ ”

In short, the industry demand remains incredibly high, he said, and Mack expects it will be stronger next year — given the production backlog and the average age of the trucks still in use. “We haven’t been able even to meet the replacement demand.”

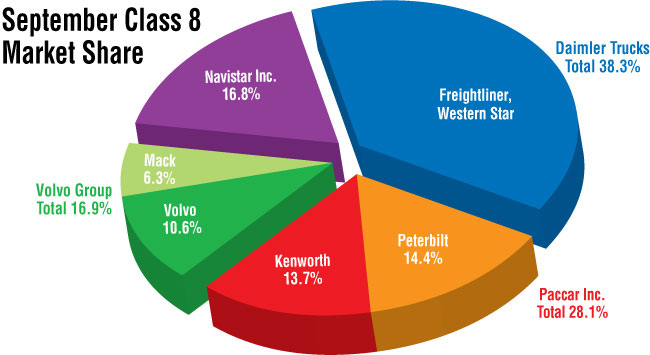

Five truck makers posted double-digit gains, with International up 85%, the largest sales increase, and Peterbilt Motors Co. up 73.7%, the next highest gain.

International is a brand of Navistar Inc.

Peterbilt is a brand of Paccar Inc.

Only Western Star, down 26.6%, and Mack Trucks, down 8%, had fewer September sales compared with a year earlier.

Mack is a brand of Volvo Group.

Western Star is a brand of Daimler Truck North America.

Freightliner, also a DTNA brand, rose 25.2% and continued to hold the top spot with a 36.5% market share and 8,395 sold.

International’s surge led to a 16.8% share with 3,848 sold, the second most.

Peterbilt sold 3,317, the third-highest, good for a 14.4% share.

Volvo Trucks North America, a brand of Volvo Group, rose 42% to 2,432 and a 10.6% share.

Paccar’s Kenworth Truck Co. brand rose 19.8% to 3,146 and a 13.7% share.

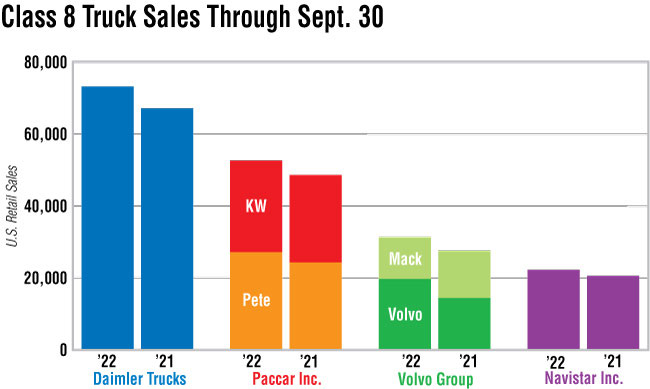

Year-to-date sales increased 9.5% to 179,246 compared with 163,683 a year earlier.

Market shares in this period rose or fell by small increments except for VTNA, which increased its share to 11% from 8.8% compared with the 2021 period.

The diversified financial services company Jefferies in an earnings preview noted, “Freight rates and mileage are normalizing but remain elevated and supportive of continued strong demand in the near-term as freight operators rebuild their fleets after two years of supply constraints and pent-up demand.”

More surprising, Clark said, than the strong truck sales in September was the net order volume that same month, 53,271, which ACT said was an all-time record.

“Particularly with the backdrop of a lackluster peak season and the forecasts for a looming recession next year,” he said. “While the surge in booked orders reflects the truck makers releasing a more complete allocation of build slots for next year, the surge also indicates that pent-up demand for capacity due to extended replacement cycles remains intact.”

Want more news? Listen to today's daily briefing below or go here for more info: