Sears Files for Chapter 11 Bankruptcy Amid Plunging Sales, Massive Debt

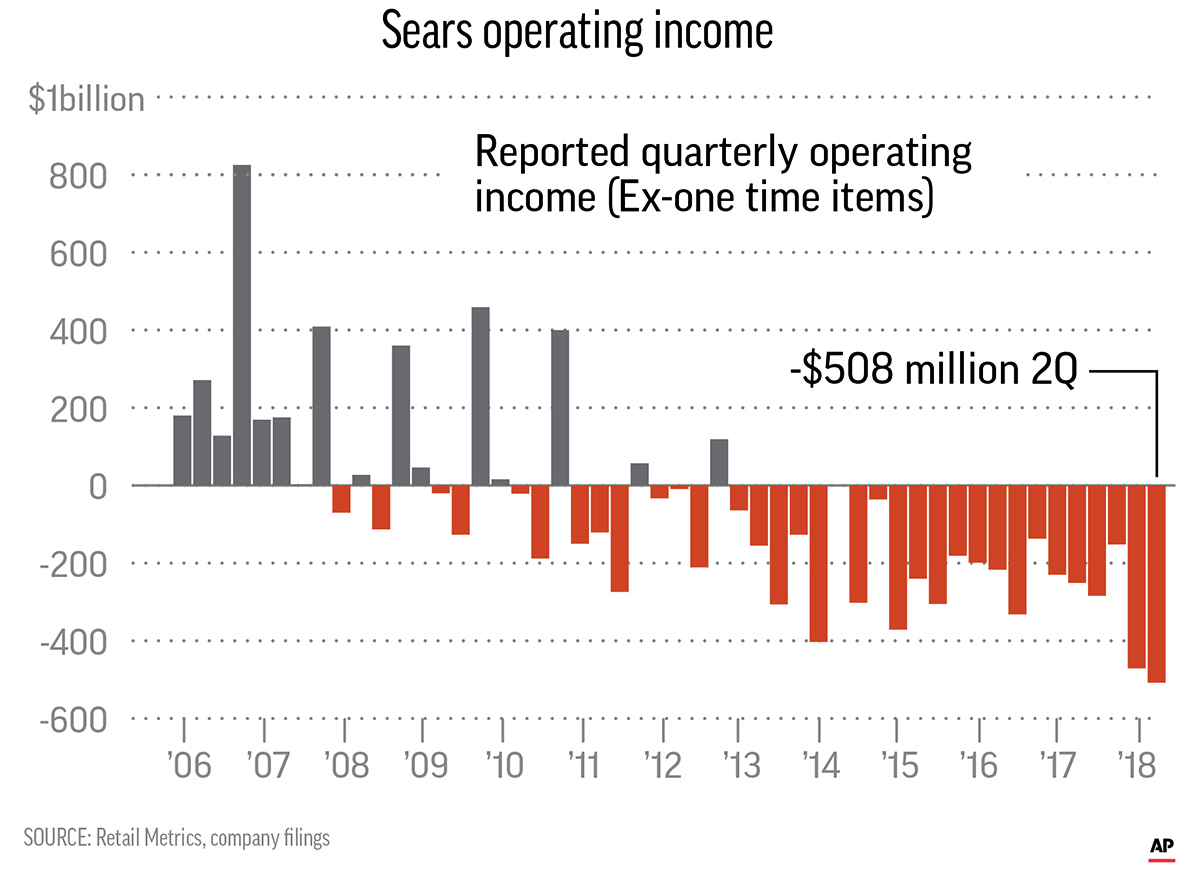

NEW YORK — Sears filed for Chapter 11 bankruptcy protection Oct. 15, buckling under its massive debt load and staggering losses.

The question now is whether a smaller version of the company that once towered over the American retail landscape can remain viable or whether the iconic brand will be forced out of business.

Sears, which started as a mail order catalog in the 1880s, has been on a slow march toward extinction as it lagged far behind its peers and incurred huge losses over the years.

“This is a company that in the 1950s stood like a colossus over the American retail landscape,” said Craig Johnson, president of Customer Growth Partners, a retail consultancy. “Hopefully, a smaller new Sears will be healthier.”

Others don’t share Johnson’s optimism.

“That a storied retailer, once at the pinnacle of the industry, should collapse in such a shabby state of disarray is both terrible and scandalous in equal measure,” said Neil Saunders, managing director of GlobalData Retail, in a note published Oct. 15. “In our view, too much rot has set in at Sears to make it a viable business.”

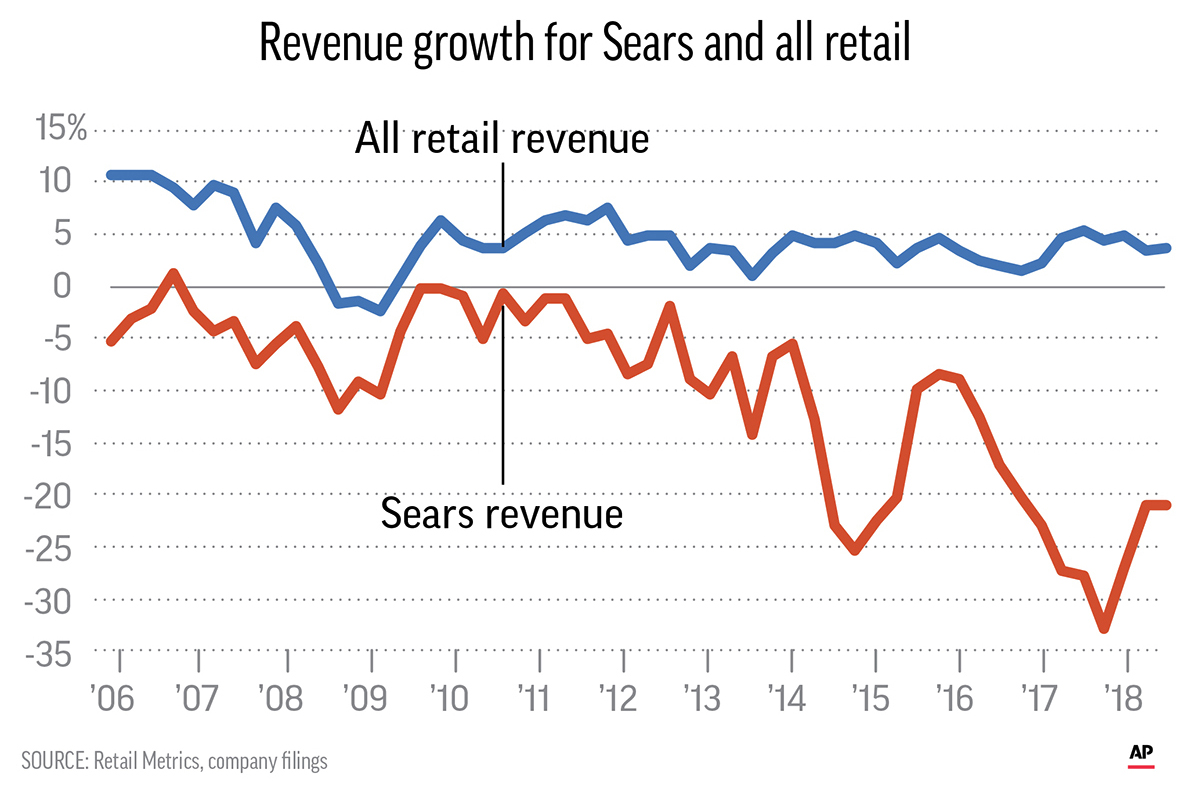

The company has struggled with outdated stores and complaints about customer service even for its once crown jewels: major appliances like washers and dryers.

That’s in contrast with chains like Walmart, Target, Best Buy and Macy’s, which have been enjoying stronger sales as they benefit from a robust economy and efforts to make the shopping experience more inviting by investing heavily in remodeling and de-cluttering their stores.

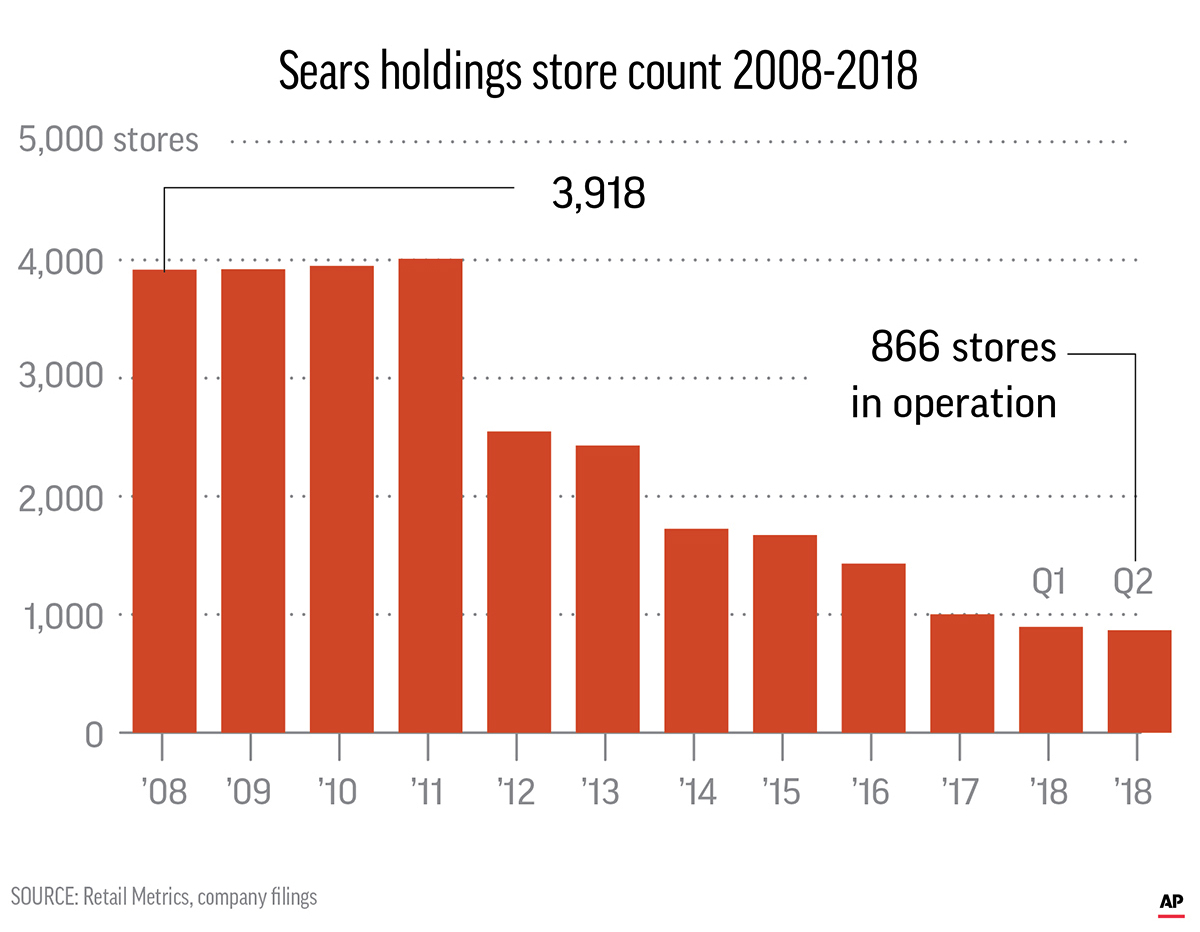

Sears Holdings, which operates both Sears and Kmart stores, will close 142 unprofitable stores near the end of the year, with liquidation sales expected to begin shortly. That’s in addition to the closure of 46 unprofitable stores that had already been announced. Edward S. Lampert, the company’s largest shareholder, has stepped down as CEO but will remain chairman of the board. A new Office of the CEO will be responsible for managing day-to-day operations.

The company said Oct. 15 it has secured $300 million in financing from banks to keep the operations going through bankruptcy. In addition, it’s negotiating an additional $300 million loan from Lampert’s ESL Hedge fund.

The filing listed between $1 billion and $10 billion in assets while liabilities range between $10 billion and $50 billion.

Sears joins a growing list of retailers that have filed for bankruptcy or liquidated in the last few years amid a fiercely competitive climate. Some, like Payless ShoeSource, successfully emerged from reorganization in bankruptcy court. But plenty of others, like Toys R Us and Bon-Ton Stores Inc., haven’t. Both retailers were forced to shutter their operations this year soon after Chapter 11 filings.

Given its sheer size, Sears’ bankruptcy filing will have wide ripple effects on everything from already ailing landlords to its tens of thousands of workers.

Lampert has been loaning out his own money for years and has put together deals to prop up the company, which in turn has benefited his own ESL hedge fund.

Last year, Sears sold its famous Craftsman brand to Stanley Black & Decker Inc., following earlier moves to spin off pieces of its Sears Hometown and Outlet division and Lands’ End.

In recent weeks, Lampert has been pushing for a debt restructuring and offering to buy some of Sears’ key assets, like Kenmore, through his hedge fund as a $134 million debt repayment came due on Oct. 15. Lampert personally owns 31% of the company’s shares, while his hedge fund has an 18.5% stake, according to FactSet.

Sears’ stock has fallen from about $6 over the past year to below the minimum $1 level that Nasdaq stocks are required to trade in order to remain on the stock index. In April 2007, shares were trading at around $141. The company, which once had 350,000 workers, has seen its workforce shrink to fewer than 90,000 people as of earlier this year.

As of May, it had fewer than 900 stores, down from a 2012 peak of 4,000.