Staff Reporter

Region Results Mixed, Leading to 1¢ Diesel Drop Nationwide

[Stay on top of transportation news: Get TTNews in your inbox.]

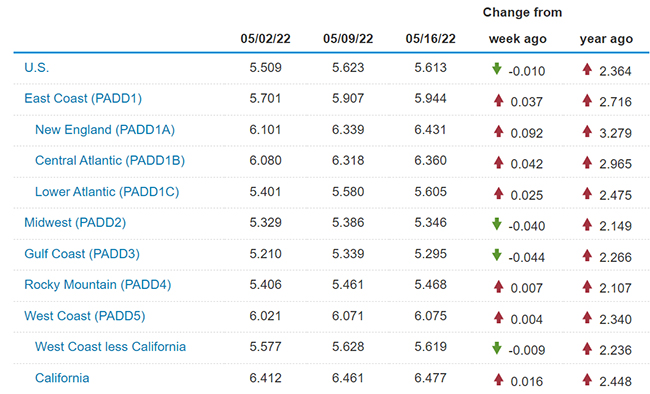

The national average price of diesel dipped after a two-week surge, dropping 1 cent to $5.613 a gallon, the Energy Information Administration reported May 16.

This week’s respite comes after trucking’s main fuel rose 46.3 cents over the previous two weeks to hit an all-time high of $5.623 a gallon. A gallon of diesel now costs $2.634 more than it did at this time in 2021.

The EIA reported the cost of diesel increased in seven of the 10 regions in its weekly survey and decreased in three. New England saw the biggest increase at 9.2 cents to $6.431 a gallon. The West Coast experienced the smallest increase at 0.4 cents to $6.075 a gallon. The Gulf Coast saw the largest drop at 4.4 cents to $5.295 a gallon.

The price of a gallon of gasoline increased in all 10 regions for a nationwide jump of 16.3 cents to $4.491 a gallon. New England once again saw the biggest increase at 22.3 cents to $4.587 a gallon. The Rocky Mountain experienced the smallest increase at 5.2 cents to $4.283 a gallon.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Russia has faced rebuke and sanctions from much of the Western world because of its invasion of Ukraine. But the country is a major global exporter of fuel. It has put pressure on countries still interested in importing its fuel to trade in the ruble — a move that would help stabilize its currency and economy against the economic sanctions. The Russian state-owned energy corporation PJSC Gazprom has already cutoff natural gas to Poland and Bulgaria for not following the demands.

Cowen and Co. said in a report May 17 the reason for the impact to East Coast has to do with inventory levels, which hit 30-year lows in early May. The report noted several refineries are operating notably below capacity due to issues with the ability to import the semi-refined oil feedstock, which is historically imported from Russia, among other capacity constraints.

“U.S. diesel pricing continues to stay elevated, passing along significant costs to shippers via fuel surcharges,” Cowen analyst Jason Seidl wrote in the report. “We believe sustained high diesel pricing will ultimately benefit the railroads and IMCs as shippers explore different modes of transport.”

The report concluded that eastern railroads like Norfolk Southern Corp. and CSX Corp. would benefit from such a change. Hub Group Inc. and J.B. Hunt Transport Services Inc. are also well positioned via shifts to intermodal over the short and long run.

Seidl

J.B. Hunt Transport Services Inc. ranks No. 4 on the Transport Topics Top 100 list of the largest for-hire carriers in North America. It also ranks No. 5 on the TT list of the 100 largest logistics companies. Hub Group ranks No. 13 on the TT Top 100 list of the largest for-hire carriers.

“To mitigate the burden of inflated fuel prices on the owner-operators, Pride has introduced a fuel cap program,” Pride Group Enterprises said in a statement provided to Transport Topics. “With the cost of equipment and repairs being at an all-time high, we also offer full maintenance rental programs where our drivers can rent trucks from us without worrying [about] maintenance costs of the trucks.”

Pride noted the fuel cap it set for Canadian operations is $1 a liter while the U.S. fuel cap is $3.15 a gallon. This is to help owner-operators have a stable and steady income. Pride added fuel and equipment cost is a significant concern within the industry with so many truckers leaving the amid an increasing driver shortage as they feel they cannot make enough money with inflation.

“Pride also aims to outfit its logistics divisions with an all-electric fleet within the next five to seven years,” the statement continued. “We recognize that this will be a challenge, but it is a journey we have committed to take. Our fleet is currently in the realm of 500 units with major growth plans, we aim to have an all-electric fleet with zero emissions by the year 2030. We want to lead this change and invite other carriers to join us and be part of this change.”

Want more news? Listen to today's daily briefing below or go here for more info: