Bloomberg News

Rebound in US Retail Sales Slowed in July Amid Virus Surge

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

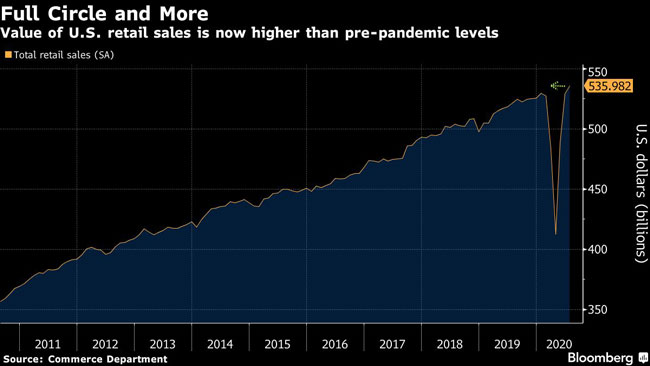

The rebound in U.S. retail sales slowed in July by more than expected, indicating a surge in coronavirus cases and still-high unemployment cooled the economic recovery.

The value of retail purchases increased 1.2% from the prior month after an upwardly revised 8.4% gain in June, according to Commerce Department data released Aug. 14. The median estimate in a Bloomberg survey of economists called for a 2.1% increase in July.

Even so, it was the third straight gain and the total value of retail sales is now above pre-pandemic levels, with July purchases also up 2.7% from a year earlier. That indicates one major part of the economy has returned to near its previous trend, though the mix of spending now is more concentrated in categories like online sales and groceries, while restaurants and apparel stores remain well below typical levels.

U.S. stock futures and Treasury yields remained lower after the report.

The monthly slowdown, compared with June, reflected declines in sales of motor vehicles and building materials, along with weaker gains at restaurants and clothing stores. The report is in line with previous high-frequency data that suggested the economic rebound moderated in July.

“Things have slowed,” Michael Gapen, Barclays Plc’s chief U.S. economist said on Bloomberg Television. “That is consistent with an initial snapback and an ongoing recovery. The July data in total suggest the economy still has momentum. The open question is whether we are going to have enough momentum to carry that through into September and October.”

The so-called “control group” subset of sales, which excludes food services, car dealers, building-materials stores and gasoline stations — and is sometimes seen as a better gauge of underlying trends — rose 1.4% from the prior month, more than analysts projected.

Transport Topics introduces its newest digital interview series, Newsmakers, aimed at helping leaders in trucking and freight transportation navigate turbulent times. Audience members will gain access to the industry's leading expert in their particular field and the thoughtful moderation of a Transport Topics journalist. Our second episode — "The Evolution of Electric Trucks" — featured Nikola founder and executive chairman Trevor Milton. To view the replay, complete this form.

The retail sales report showed nine of 13 major categories rose, with the biggest increase coming at electronics and appliance stores. Such sales jumped 22.9% following a 37.6% gain in June. Sporting goods and hobby stores fell 5% from the prior month, after June’s 27.6% rise.

The drop in purchases at auto and parts dealers contrasted with other data showing a pickup in unit sales during the month. Excluding automobiles, retail sales rose 1.9%.

A separate report Aug. 14 showed productivity in the U.S. rose in the second quarter by the most in 11 years, though the surge reflected the mathematics of a sharper drop in hours worked compared with output.

Murky Outlook

The outlook for consumer spending in coming months is murky. Trillions of dollars in federal stimulus have helped support businesses and unemployed workers during the pandemic, but there’s widespread agreement that additional aid is needed.

The extra $600 in weekly jobless benefits that have propped up incomes and spending for millions of unemployed people in recent months expired at the end of July, and lawmakers have been in a stalemate over another aid package.

President Donald Trump — who trails Democratic challenger Joe Biden in recent polls — signed an executive action last week authorizing an additional $300-a-week federal top-up for those receiving at least $100 in other jobless benefits, but exactly when jobless workers will begin to see those supplemental payments is unclear. He also allowed for a four-month deferral of payroll taxes, which would potentially give workers more spending power, but there are questions over whether employers will go along and whether they’ll have to pay it back later.

Most importantly, the U.S. has yet to get the virus under control, though the spread has ebbed slightly in the last couple of weeks. Several Federal Reserve officials have reiterated the virus’ role in the economic recovery recently, including San Francisco Fed President Mary Daly, who said Aug. 12: “The virus determines the pace of our recovery. That’s the main message: Uncertainty is before us.”

“The economy is showing some good resiliency despite the high numbers of COVID cases,” Gapen said. “I think that can continue but I think it needs some additional federal support to do that.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More