Rail Profits Rise, But Intermodal Growth Not Certain

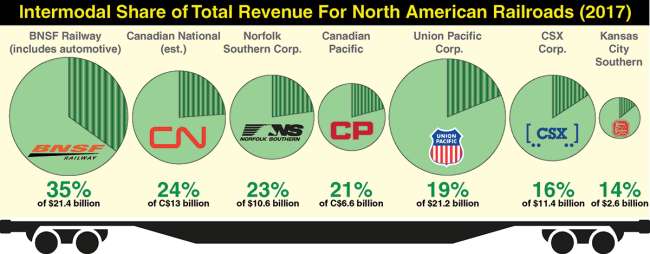

As motor carriers enjoy the fruits of the tight freight environment, railroads are continuing their push to boost earnings while they adjust to a market that increasingly is shifting toward intermodal. Statistics illustrate the railroads’ progress.

Through the first half of 2018, rail intermodal shipments in North America increased 6.7% from a year earlier, according to data from the Intermodal Association of North America. That growth puts rail intermodal well on its way to surpassing last year’s record 17.9 million shipments.

SEE THE RANKINGS: 2018 Top 50 Global Freight Carriers

Meanwhile, railroad profitability has been on the rise. Combined operating income at all of the Class I railroads improved 8.3% to top $16 billion in the first half, company reports showed. The railroads do not disclose specific profitability figures for intermodal or any other type of freight hauled.

Industry experts cited a variety of factors, including that strong freight environment, to fill in the more complicated mosaic of a rail industry in transition.

“We are in a market that favors intermodal,” Cowen & Co. analyst Jason Seidl said. “Railroads will take on business at much more favorable rates. Shippers have a very long memory of when things got very difficult in terms of finding capacity during peak season last year. This is a very good opportunity for railroads, and they are taking advantage of it.”

A Norfolk Southern train. (Transport Topics)

For example, Norfolk Southern’s intermodal revenue per shipment so far in 2018 rose 11% and volume grew 8%, the largest increases among major railroads. Burlington Northern Santa Fe Railway, the rail intermodal volume leader, boosted shipments by 5.6%.

While the overall trend shows improved intermodal volume and rail profitability, there isn’t a strict relationship between the two, as evidenced by CSX’s industry-leading 35% improvement in operating income despite the lowest intermodal volume increase of 2%.

The rails’ own capacity limitations and ongoing service difficulties also are prominent factors.

“Every shipper we talk to wants to do more intermodal, wherever they can,” said Kevin Sterling, a Seaport Global Securities analyst. “They are saying, ‘I’ll take stinky service as long as it moves.’ However, there is a ceiling. There is not much relief for them because of constrained rail capacity.”

Lee Clair, managing partner of Transportation and Logistics Advisors, cited several other reasons why intermodal growth has its limits.

One is that most freight that can switch off the highway to the rails already has done so on routes where intermodal can be competitive.

Rail intermodal growth will be constrained, he said, in part because of the limited number of lanes served. In addition, he noted that intermodal growth in recent years has struggled to exceed general economic improvement.

Clair singled out Canadian National Railway as an intermodal market leader.

“Their margins keep getting better as intermodal grows,” he said.

Harrison's Ideas Continue to Influence Railroad Operations

By Rip Watson

Special to Transport Topics

The railroads in 2018 are operating under the shadow of the late Hunter Harrison, whose precision scheduled railroading strategy, or PSR, has transformed industry performance.

Harrison most recently was CEO at CSX Corp., serving from March 2017 until his death in mid-December. Previously, he refined his PSR strategy at Canadian Pacific Railway Ltd., and Canadian National Railway Co. before that.

PSR intensifies asset utilization and demands more operational discipline, such as switching customer plants on a fixed schedule set by the railroad to lower costs. At the same time, the blueprint calls for raising revenue and service levels.

It worked in Canada. At CP, the company’s operating ratio — or operating expenses as a percentage of revenue — was reduced 23 percentage points between 2012, when Harrison took over there, and 2015. No U.S. railroad has come close to that pace of improvement, or CN’s lowest-ever quarterly operating ratio of 53.3.

Today, Harrison’s former co-workers are in charge of both Canadian railroads, and at CSX. Just before his death, Harrison installed former CN colleague and current CEO Jim Foote as chief operating officer.

CSX’s operations and profits didn’t show the same improvement in the two full quarters when Harrison was CEO, with about 1% improvement. However, in the first half of 2018, CSX improved its OR by 7.2 percentage points to 61.0.

Transportation and Logistics Advisors Managing Partner Lee Clair believes a wide variety of metrics is important. The operating ratio is “nice to know” to indicate whether performance is getting better or worse, but measures such as return on assets or return on equity are more important from a financial standpoint.

When pressed by financial analysts about operating ratios during second-quarter conference calls, two CEOs supported a broader set of metrics and stated a willingness to make changes.

“There’s a couple of key measures that we care about. One is return on invested capital. Are we efficiently using resources and being wise with investor capital? And the other is OR. Are we efficiently dropping top line to the bottom line?” said Lance Fritz, CEO of Union Pacific, whose operating ratio worsened to 63.8 from 63.5.

“There are a number of things that we’re already doing that we’ve learned from somebody else — whether it’s the CSX or the CP or CN. We’re learning from anyone that we can in terms of better ways to run the network, better ways to generate productivity and efficiency,” Fritz said. “We’ve got all of those projects teed up, lined up. We will take those excess costs out, which is why we’re so confident that we’re able to hit that 60 operating ratio in 2020."

Those projects include some network reconfiguration and idling 25% of the company’s less-efficient locomotives.

“We’re certainly not satisfied with the status quo of our operations, and we’re pushing change in a lot of different areas,” said James Squires, CEO at Norfolk Southern, whose OR improved to 66.9 from 68.7 in the first two quarters. It’s on pace to reach target 65 OR before 2020.

“We’re always open to outside practices and outside perspectives, and we do bring those in from time to time,” he said.

Canadian National Railway has said its intermodal profits now are comparable with its other business. CN’s intermodal service was redesigned more than a decade ago, when the late Hunter Harrison was CEO.

“There is no excuse for intermodal not to be extremely profitable” for any railroad, Clair said. “Everyone has complained over time that intermodal doesn’t make enough money.”

The reason for historical misperception is outdated cost allocation methods for assets such as locomotives, track, people and terminals, Clair added.

Seidl also said intermodal still isn’t the most profitable business for railroads. He believes that’s because intermodal shippers have more options due to truck competition. Non-intermodal freight tends to be a duopoly, with two carriers in each region having far more control over pricing.

Looking into 2019 and 2020, however, Sterling believes intermodal and rail profits will continue to grow as service improves and still more capacity is added.

“If the railroads can improve service, they can capture business permanently,” he said. “Shippers don’t want to switch back and forth between modes.”

Intermodal faces another challlenge. It still represents a mere 2% of the freight market, according to American Trucking Associations.

On the other hand, the recent activity has been accompanied by a broad level of rail executive optimism about strong results, for intermodal and profitability alike.

Union Pacific CEO Lance Fritz described business this way on a July 24 conference call:

“We see the underlying strength of the business. As the truck tightening has occurred, what we’ve seen is a pretty significant return from that investment that we’re making and ensuring [beneficial cargo owners] know what we can provide. We are seeing new customers as well as stronger volumes from existing customers.”

At Kansas City Southern, CEO Patrick Ottensmeyer told Transport Topics that the company expects intermodal volume growth to continue.

“With the launch of several new intermodal services in the past two years, and the continued capacity crunch in the trucking industry, we do see continued intermodal penetration, in particular in the U.S.,” he said.

“We’re looking to take advantage of the capacity that we do have and to grow where we can, certainly with an emphasis on volume growth, but also pricing in this environment,” Norfolk Southern CEO James Squires said. “Right now is the time to make sure that you have the workforce in place to handle the business, so that you can grow when that’s possible. I think our plan will be the right plan for our shareholders in the future.”

Canadian Pacific also was bullish on its intermodal business.

“Canadian Pacific’s intermodal franchise has been a source of strength this year, with revenues up 10% in the first half of 2018,” said Jonathan Wahba, vice president of sales and marketing. He credited new ocean carrier business and expanded services in the United States and Canada.

“With truck capacity continuing to tighten in the anticipation of a strong fall peak, CP expects to see further growth, in both domestic and international intermodal, through the remainder of the year,” Wahba said.

There is one exception to that feel-good story for intermodal — CSX.

“We are far from where we want to go. Our intermodal network needs a ton of work in order to become the efficient part of the system that it needs to be,” said CEO James Foote, using the word “dysfunctional” to describe the current franchise.

He noted that the changes won’t be made during the 2018 peak season so that disruption is minimized. CSX’s plan calls for reconfiguring the network as well as operational changes that could include terminal closings. He didn’t offer a specific timetable, but he said the goal is to achieve similar profitability to CN’s network.

He also addressed culture, saying more employees need to have the same dedication as UPS workers, who will run after a truck if a shipment is forgotten.

Over the next several years, technology could be a key opportunity for the railroads, just as it is for truckers.

In one sense, railroads could have an advantage relative to trucks in moving toward more autonomous operation because the rails control their own right of way, Seidl said. However, he noted that regulatory and union issues would have to be addressed.

“We are going to eventually see more automated trains in North America,” he said, citing the current introduction of positive train control on major routes as the first step in that direction. Hazardous materials shipments, however, won’t ever be automated, he said.

Seidl added that intermodal also could be a beneficiary of automated terminal operations that will enhance drayage efficiency.

Railroads will need to concentrate on technology opportunities because the industry’s market share has been shrinking in all freight categories except intermodal, Clair said.