PSA’s Board Approves Merger With Fiat Chrysler

[Stay on top of transportation news: Get TTNews in your inbox.]

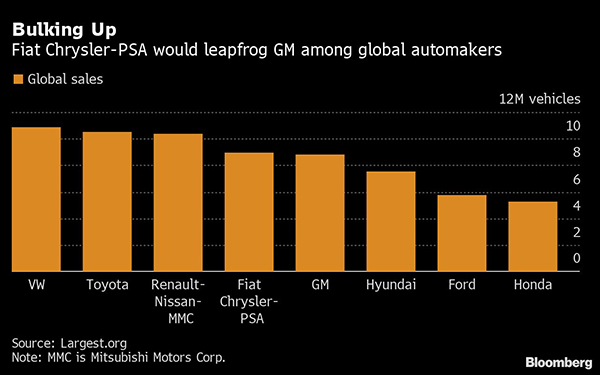

The board of Italian-American automaker Fiat Chrysler Automobiles NV approved a merger with PSA Group of France to create the world’s fourth-biggest auto manufacturer, people familiar with the situation said.

Fiat Chrysler’s board met Dec. 17 to consider the deal, following the unanimous endorsement by PSA’s board earlier, said the people, asking not to be identified discussing confidential matters. The companies are expected to announce the signing of a binding memorandum of understanding before the opening of equity markets in Europe on Dec. 18, the people said.

PSA and Fiat Chrysler representatives declined to comment.

The merger would forge a regional powerhouse to rival Germany’s Volkswagen AG and have a stock-market value of about $46 billion — surpassing Ford Motor Co. The tie-up would also bring together two auto-making dynasties, the billionaire Agnelli clan of Italy — led by Fiat Chairman John Elkann — and the Peugeots of France.

When the two companies revealed their merger discussions six weeks ago, they sketched out a plan for a 50-50 Netherlands-based holding company led by PSA Chief Executive Officer Carlos Tavares, with Elkann as chairman.

The combination will give Peugeot-maker PSA a long-sought presence in North America and should help Fiat gain ground in developing low-emission technology. Yet it doesn’t fix all of the their shortcomings, Juergen Pieper, an analyst at B. Metzler Seel Sohn & Co. told Bloomberg Television.

The combined business will still lack “very good premium brands” as well as “a good position in China,” he said.

PSA and Fiat have been in talks on and off for months, and were exploring a partnership to share investments and build cars in Europe as early as March, Bloomberg reported at the time.

Shares of Fiat Chrysler advanced 1.7% as of 3 p.m. in New York, giving the company a market value of $24.1 billion. PSA rose 0.9% earlier in Paris, valuing the French carmaker at about $22.3 billion.

China’s Dongfeng Motor Corp., which owns 12% of PSA, will see its stake in the combined company decline to 4.5% as a result of the merger and the sale of a portion of its holding to the French carmaker, people with knowledge of the matter said.

Dongfeng’s stake in PSA has attracted attention because of the possibility it could interfere with U.S. regulatory approval for the deal. U.S. economic adviser Larry Kudlow said last month the Trump administration intends to review the proposed merger because of the Chinese carmaker’s stake in the combined company.

Want more news? Listen to today's daily briefing: