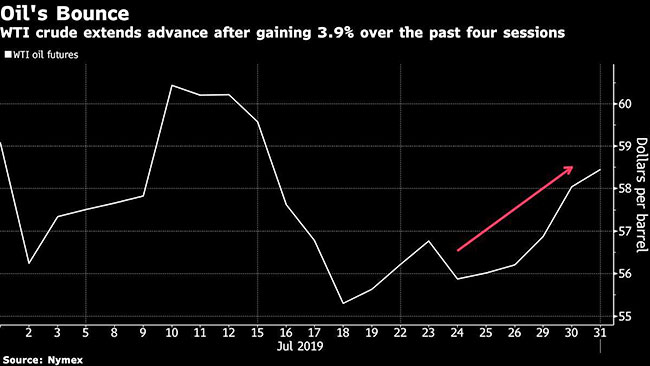

Oil Trades Near Two-Week High on Tighter Supply, Mideast Risks

[Stay on top of transportation news: Get TTNews in your inbox.]

Oil traded near a two-week high in New York amid signs of a further drop in U.S. stockpiles and ongoing concerns that political friction in the Persian Gulf could disrupt exports.

Futures rose as much as 1.1%. American crude inventories dropped by 6.02 million barrels last week, according to an industry report. If confirmed by government data July 31, it will be a seventh weekly decline. BP is avoiding sending ships through the Strait of Hormuz, CEO Bob Dudley said July 30, in a sign Middle East tensions could affect the flow of crude. Libya’s oil production dropped to the lowest in five months after an issue with a pipeline connected to its biggest field.

Oil is little changed this month after swinging between gains and losses as global growth concerns compete with the standoff in the Persian Gulf. While optimism that the U.S. Federal Reserve will cut interest rates is brightening the outlook for oil demand, a new round of trade talks between China and America showed little evidence of progress.

“Supply fundamentals still remain supportive of oil prices, and are tightening given the effectiveness of U.S. sanctions that have reduced Iran’s crude oil exports to a trickle,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA. But for “oil to move higher, the market is going to need a positive economic catalyst.”

West Texas Intermediate for September delivery rose as much as 62 cents to $58.67 a barrel on the New York Mercantile Exchange and traded at $58.65 on July 31. Prices are up for a fifth day, after climbing 2.1% on July 30, the biggest gain since July 10.

Brent crude for September, which expires July 31, added 54 cents to $65.26 a barrel on the ICE Futures Europe exchange, after rising 1.6% on July 20. The more-active October contract was at $65.19, up 56 cents. The September contract traded at a $6.85 premium to WTI for the same month.

A steady decline in U.S. crude inventories has alleviated some demand concerns. American stockpiles have dropped for six weeks through July 19, the longest run of losses since January 2018. Government data July 31 is forecast to show supplies fell by 2.75 million barrels, according to a Bloomberg survey, less than the American Petroleum Institute’s estimate.