Bloomberg News

Oil Jumps Past $45, Dow Eclipses 30,000

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Oil reclaimed heights not seen since the pandemic shocked markets in the spring, with the start of the U.S. presidential transition and improved vaccine prospects infusing optimism across markets.

Prices rose as much as 5% to the highest since early March in New York. The forward curves for both West Texas Intermediate and Brent have shown marked signs of strengthening thanks to rising demand from Asia and the prospects for a vaccine rollout. The rally accelerated with the start of a formal transition process to President-elect Joe Biden sending the Dow Jones Industrial Average past 30,000 for the first time, closing at 30,046.24.

“The fact that we have more certainty on what hopefully is an orderly transition is putting some wind in the sails for crude,” said Stewart Glickman, energy equity analyst at CFRA Research. “The biggest issue ahead is how willing they’ll be to cross the aisle and enable a stimulus package to happen. That’s going to be a primary driver” for prices.

The start of the transition process for the U.S. presidency offers a welcome sense of certainty following disputes over the outcome of the Nov. 3 election. Additionally, reports that Biden is planning to tap former Federal Reserve chair Janet Yellen for Treasury Secretary is also raising hopes for more economic stimulus that could provide a much needed demand boost.

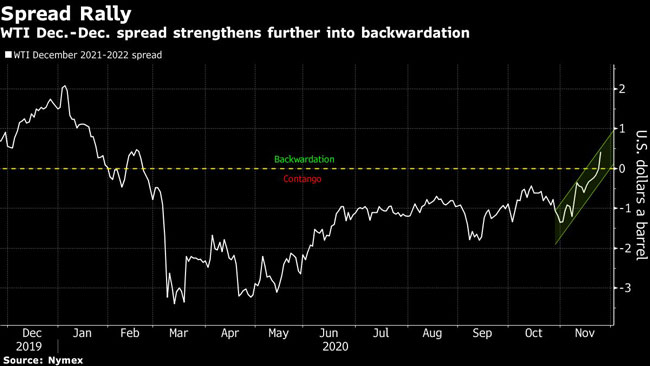

Elsewhere, a rebound in Chinese local flights is aiding demand for jet fuel, the hardest-hit oil product. That broad recovery has helped drive the market’s return to the bullish structure known as backwardation, where the nearest contracts rally more than the later-dated ones in a sign that supply and demand are returning to balance.

One of the most significant shifts in the shape of the forward curve is the strengthening of the so-called WTI red spread, with futures for December of next year at a premium relative to December 2022. The move to backwardation often attracts passive flows into the market, leading to further price rallies.

“Demand has real potential to pick up rather quickly to the extent that these vaccines roll out,” said John Kilduff, a partner at Again Capital LLC. “If we can get a close above $45, it will be very positive, because we’ve been stuck in this range for months.”

RELATED: Diesel Rises 2.1¢ to $2.462 a Gallon

But while the market may be strengthening on the outlook for improved demand in the near future, the pandemic’s effects are still rippling around the globe. Total SE said it will halt its Donges refinery for several months as it’s currently unprofitable due to weak demand. Several refineries in the U.S. have shut because of the collapse in fuel demand.

The price recovery in recent weeks is also spurring demand for the types of investment products that blew up when crude collapsed earlier in the year. WisdomTree said it plans to list a series of triple leverage WTI and Brent exchange-traded products this week.

In the U.S., crude inventories are expected to have remained flat last week, according to a Bloomberg survey, after two weeks in a row of storage builds. The industry-funded American Petroleum Institute will reports its figures ahead later Nov. 24 of a U.S. government tally.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More