Bloomberg News

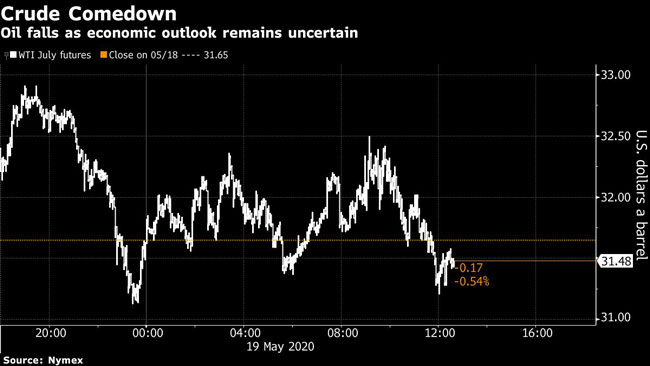

Oil Falls Despite Signs of Tightening Market, Demand Recovery

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Oil prices fell even as supply curbs tightened the market and demand rebounded with the reopening of major economies.

West Texas Intermediate crude for July delivery declined 0.5% in New York after surging 4% earlier in the session. While output cuts by the world’s largest producers are whittling down a supply glut and oil consumption is recovering in China and the U.S., concerns about the pandemic’s long-range economic impacts continue to weigh on the market.

“People are still locked down, and there are still a lot of people without jobs right now,”said Tariq Zahir commodity fund manager at New York-based Tyche Capital Advisors. “I’m not surprised to see a little bit of a sell-off here.”

The dip comes after the U.S. benchmark closed at its highest level in two months May 18, lifted by bullish signals that the market is rebalancing. Citigroup Inc. said the oil surplus weighing on the market in the second quarter is expected to turn into a record deficit in the third as producers slash output.

But investors were disheartened by bearish remarks from Federal Reserve Chair Jerome Powell and Treasury Secretary Steve Mnuchin on May 19. The head of the central bank told a Senate committee that Americans could start losing their homes and warned that long-term unemployment can damage the economy.

“I’m not sure that the markets, in general, were liking what they were hearing necessarily out of the Mnuchin-Powell testimony, in terms of what is coming next here to support the economy,” said John Kilduff, partner at Again Capital. “I think the market might have gotten a little bit ahead of itself.”

WTI futures for June also fell ahead of its expiry May 19. In another indication that the market is finding a new equilibrium, WTI crude for June delivery traded at a premium to the July contract. The structure, known as backwardation, suggests concerns about storage capacity at the key hub in Cushing, Okla., have eased.

On the supply side, shale oil output from the U.S., the world’s biggest producer, is forecast to fall next month to the lowest since late 2018, according to the Energy Information Administration. There also has been a “stunning reversal” in OPEC+ shipments in May, data intelligence firm Kplersaid, after the alliance’s deal to curb production kicked in at the beginning of the month.

“There’s a lot of optimism baked in here,” said Paul Horsnell, head of commodities research at Standard Chartered Bank. “The market has balanced by supply coming off faster than expected.”

In the U.S., Powell said the central bank is ready to use all tools available to help the U.S. economy endure the coronavirus pandemic, and U.S. Treasury Secretary Steven Mnuchin said he sees the economy improving in the second half of this year.

Some of the hardest-hit areas are moving ahead with restarting their economies. Restaurants in Italy reopened, and New York Gov. Andrew Cuomo said the state would open a sixth region. Meanwhile, U.S. biotechnology company Moderna Inc. said its vaccine showed signs it can create an immune-system response to the coronavirus.

Want more news? Listen to today's daily briefing: