Bloomberg News

Oil Dives After CDC Warns of Potential Virus Outbreak in US

[Stay on top of transportation news: Get TTNews in your inbox.]

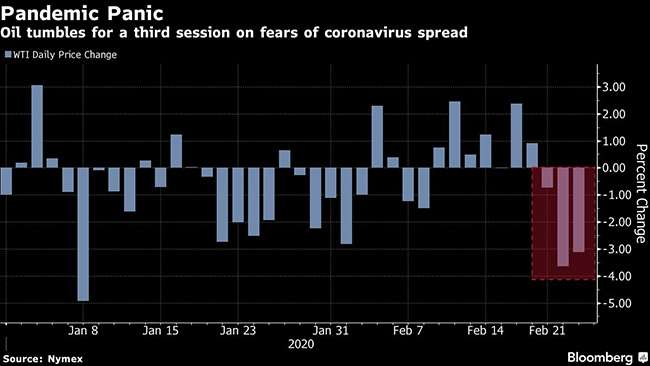

Oil deepened a three-day rout as panic over a coronavirus outbreak in the U.S. gripped investors and sent shockwaves through commodity, equity and debt markets.

Futures fell 3% in New York to the lowest level in more than two weeks. The U.S. Centers for Disease Control and Prevention warned Americans to brace for an outbreak at home. A spike in infections in other parts of Asia as well as the Middle East and Europe has raised fears of a global pandemic impacting the stability of the global economy.

The Dow Jones Industrial Average sank 3.3% to 27,081.50, the lowest in four months.

The S&P 500 Index decreased 3.2% to 3,128.43, the lowest in more than 11 weeks on the largest dip in almost 15 months.

Host Seth Clevenger went to CES 2020 in Las Vegas and met with Rich Mohr of Ryder Fleet Management Solutions and Stephan Olsen of the Paccar Innovation Center to discuss how high-tech the industry has become. Listen to a snippet above, and to hear the full episode, go to RoadSigns.TTNews.com.

“This virus has had a violent effect across markets,” said David Tawil, president of Maglan Capital in New York. “There may be more shocks to come as the virus spreads, prolonging the time for oil to regain its footing. No one knows how long or painful this will be.”

Oil declined in tandem with U.S. equities and the 10-year U.S. Treasury yield, which fell to a record low, as investors grappled with the prospect of the virus disrupting the world’s largest economy.

The slump in prices comes as the Organization of Petroleum Exporting Countries and allied producers prepare to meet in Vienna next week. Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said the group hasn’t made a decision yet on whether to extend or modify production cuts in response to the outbreak.

West Texas Intermediate for April delivery fell $1.53 to settle at $49.90 a barrel on the New York Mercantile Exchange. The Feb. 25 decline brought the three-session slump to more than 7%.

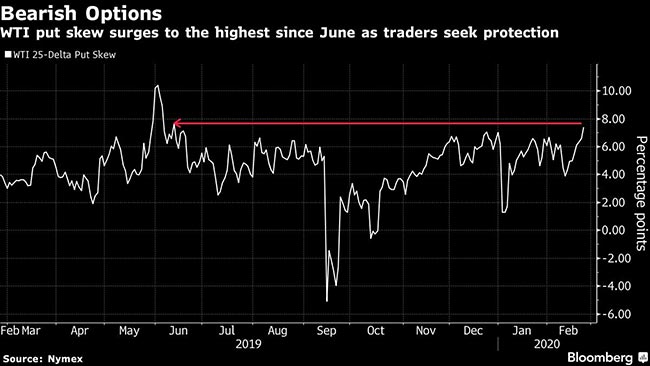

Amid the slump in prices, investors were paying more to protect against price swings, especially declines. Implied volatility on WTI options rose to the highest level since September, according to a CBOE/CME index. Also, the so-called put skew — the premium traders will pay for options protecting against a drop in prices over those protecting against a rise — closed at the highest level since June.

Want more news? Listen to today's daily briefing: