Bloomberg News

Oil Clings to Gains After US Supplies Shrink by Most This Year

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

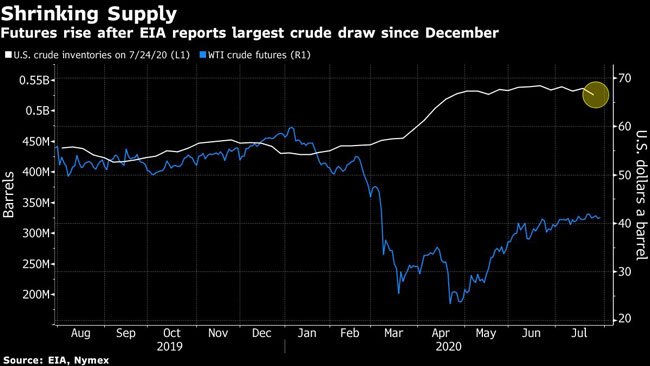

Oil was propped up by the biggest decline in U.S. crude stockpiles this year, signaling a bright spot in a market weakened by the COVID-19 pandemic.

Futures in New York rose as much as 1.3%. Domestic oil inventories tumbled by more than 10 million barrels last week, the biggest decline since December, according to an Energy Information Administration report. Oil imports declined, with shipments from Saudi Arabia falling to the lowest since April.

“Imports were down pretty big, which on the crude side, explains most of the change week-over-week,” said Matt Sallee, portfolio manager at Tortoise, which manages about $11 billion in energy-related assets. The Saudi crude overhang “seems to be getting behind us.”

Still, the recovery in West Texas Intermediate crude futures has stalled near $40 a barrel with the pandemic flaring up again around the world, keeping demand depressed. Even though stockpiles in the U.S. are shrinking, production has remained stubbornly high above 11 million barrels a day. Further looming over the market, the OPEC+ alliance is preparing to pull back from unprecedented production cuts within days.

“It does appear some of the U.S. producers are bringing back production, so with oil at 40 bucks, we do face a bit of a headwind,” Salle said. Prices will likely rise from here, “but it will be at a very measured pace.”

Meanwhile, investors are also awaiting the conclusion of a Federal Reserve policy meeting July 29, with the U.S. central bank expected to signal it will keep interest rates near zero as the coronavirus continues to spread.

The futures curve is another indication of continued weakness. The U.S. crude benchmark’s three-month time spread was 70 cents a barrel in contango — where near-dated contracts are cheaper than later-dated ones — compared with 31 cents at the end of June.

As the market recovery teeters, the world’s largest independent oil storage company, Royal Vopak NV, said its tanks are filling and almost all space is booked. While not necessarily a repeat of the scramble for storage that pushed prices below zero earlier in the year, it’s a reminder of the level of uncertainty that persists in the oil market.

“The pandemic is the elephant [in the] room,” said Michael Lynch, president of Strategic Energy & Economic Research. “It really kind of overshadows everything at this point.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More