Oil Climbs Above $71 as Threat of Gordon Mounts in Gulf

Oil gained above $71 a barrel in New York as Tropical Storm Gordon forced evacuations at fields along the U.S. Gulf Coast and threatened supply.

Futures rose as much as 2.3% from Friday, skipping Sept. 3 because of Labor Day. Anadarko Petroleum Corp. stopped production and removed all personnel from two Gulf of Mexico platforms as Gordon neared the mouth of the Mississippi River. The risk to supply pushed up prices despite data showing rising OPEC output.

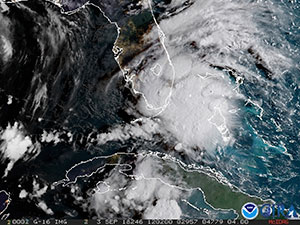

In this image released by NOAA's GOES-16 on Sept. 3, Tropical Storm Gordon appears south of Florida. (NOAA via AP)

A hurricane warning has been posted for the Gulf Coast from eastern Louisiana to the Florida-Alabama state line, raising concerns that work at more oil installations may be disrupted. The region produces about 17% of U.S. crude, according to the Energy Information Administration, while onshore plants account for about 45% of the country’s refining capacity.

“The U.S. hurricane season has been very quiet so far, but as we approach the annual peak it may attract increased attention and, with that, some underlying support for crude oil,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank A/S.

In our third episode of RoadSigns, we ask: Will your next truck be a plug-in? Hear a snippet from Mike Roeth, executive director of the North American Council for Freight Efficiency, above, and get the full program by going to RoadSigns.TTNews.com.

West Texas Intermediate for October delivery rose as much as $1.60 to $71.40 a barrel on the New York Mercantile Exchange and was at $71.10 as of 9:09 a.m. local time. Sept. 3 trades will be booked Sept. 4 because of the U.S. holiday. Average volume traded Sept. 4 was 70% above the 100-day average.

Brent for November settlement advanced $1.14 to $79.29 a barrel on the ICE Futures Europe exchange, after climbing 51 cents on Sept. 3. The global benchmark crude traded at an $8.62 premium to WTI for the same month.

Iran Sanctions

Oil has rebounded more than 9% from the lows of August as buyers of Iranian crude start to shun shipments from the Persian Gulf nation even before renewed U.S. sanctions take full effect in November. India is said to be mulling a 50% cut in purchases, while shipments to South Korea plunged 40% in July and Europe’s imports have dropped by 45% since May.

“As sanctions directly targeting Iranian oil will be imposed on Nov. 4, increasing worries of disruptions to global crude supply are allegedly affecting the crude price as well,” Global Risk Management wrote in a research note.

Traders are closely watching for signs the Organization of Petroleum Exporting Countries and its allies will fill any potential deficit. OPEC produced 32.74 million barrels a day last month, an increase of 420,000 a day from July, according to a Bloomberg News survey of analysts, oil companies and ship-tracking data. Russia maintained output near a post-Soviet record.