Bloomberg News

New England May Be One Cold Snap Away From Heating Fuel Crunch

[Stay on top of transportation news: Get TTNews in your inbox.]

Heating oil prices in the northeast U.S. may jump during cold snaps this winter, as the closing of the region’s biggest refinery and new clean-fuel rules for ships trim supply.

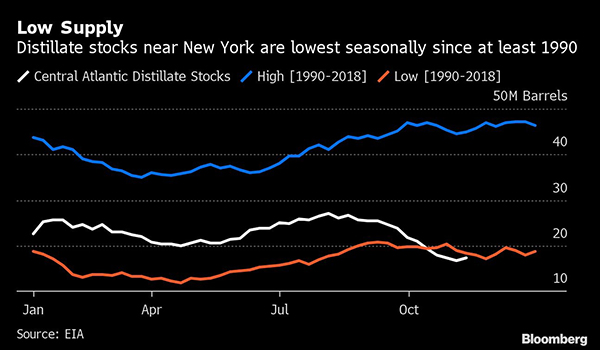

Forecasts for a mild winter have so far kept a lid on prices, even as inventories around New York Harbor are at the lowest level for early November in three decades. While there’s ample supply from eastern Canada and the Gulf Coast to supplement local production during normal weather, a prolonged cold snap may drive prices sharply higher for short periods to attract cargoes from farther away.

Tight supplies could boost East Coast distillate fuel prices, including home heating oil, in the coming weeks, the Energy Information Administration said in its latest short-term outlook. Bank of America Merrill Lynch analysts, meanwhile, said in a note Nov. 15 that the low inventories and switch to lower-sulfur bunker fuel for ships could spur price spikes in some markets.

The Northeast heads to winter needing an extra 100,000 barrels a day of heating oil and diesel that would have been produced by Philadelphia Energy Solutions, said Robert Campbell, head of oil products research at Energy Aspects in New York. Uncertainty over how the Philadelphia supply will be replaced “means we are going to draw stocks heading into the winter and are going to have a fairly tight market,” he said.

The Philadelphia refinery closed earlier this year after a fire, leaving just four facilities along the East Coast. Some of the lost supply may be replaced eventually when the Limetree Bay refinery on the Caribbean island of St. Croix starts up some units during the first quarter of 2020.

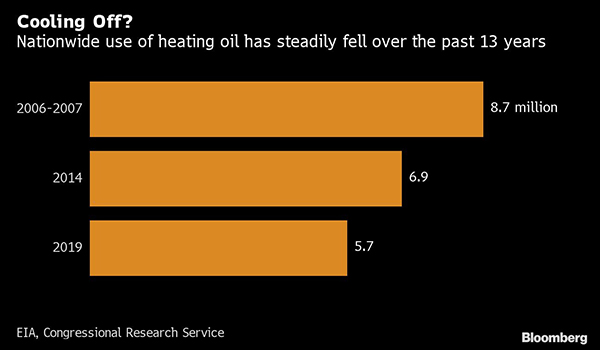

While just 4% of U.S. homes are kept warm with heating oil — similar chemically to diesel for cars and trucks — most of those are in the Mid-Atlantic and New England, especially in rural areas where natural gas distribution lines haven’t been laid.

South Portland, Maine, resident Anne Pelletier gets four deliveries of 200 gallons each a year at her 60-year-old house. Her heating oil bill increased from $1,274 in 2017 to $1,499 last year, and she added cellulose insulation to the attic so the house will burn less fuel.

Homeowners will also have to compete with tankers and containerships come January, when new cleaner-fuel rules — referred to as IMO 2020 — go into effect around the world. That will divert some diesel that could be burned in home furnaces for use in vessels.

Speculators Sanguine

The relatively tight supplies around New York may be moot if temperatures are mild, and investors seem to be betting on a no-parka winter. Money managers’ net-long position in CME diesel futures was just 13,204 contracts as of Nov. 5, well below the level of the previous two years.

Eastern Canada, as it has for years, will keep Americans warm. Irving Oil Ltd.’s refinery in Saint John, New Brunswick, delivered 50 batches of heating oil to New York and New England in September and October, according to data compiled by Bloomberg. The ship Nor’easter alone made the trip six times in two months. Irving didn’t respond to a request for comment.

Across the Atlantic, Western Europe looks to be well supplied. Even in the event of a cold snap, “the refinery system is resilient enough, and even though middle-distillate stocks are a little bit lower year-on-year, there’s enough in stock to ride out any particular bad-weather period,” said Steve Sawyer, an analyst for consultant Facts Global Energy.

The region is looking at milder weather patterns in November than across the Atlantic. “What we’re not calling right now is Armageddon,” says Jim Dale, senior meteorology consultant at British Weather Services, who sees a “reasonably traditional sort of pattern” for the end of this year.

Olivia Konotey-Ahulu contributed to this report.

Want more news? Listen to today's daily briefing: