Senior Reporter

Monthly Trailer Orders Up 24%, Passes 26,000

This story appears in the March 27 print edition of Transport Topics.

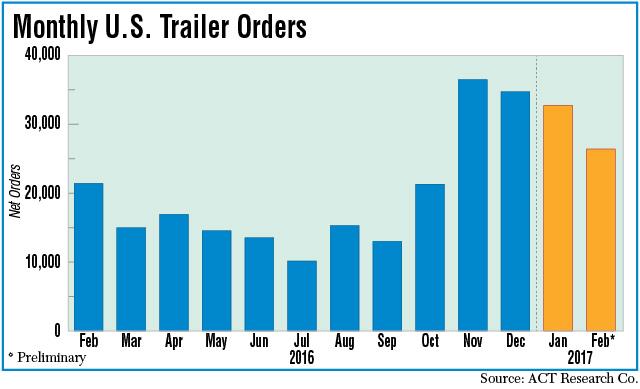

U.S. trailer orders in February pushed past 26,000, up 24% year-over-year, as dealers restocked and fleets continued to extend orders, experts said, adding that industry backlog is below last year’s pace and freight demand has not fully returned.

Orders were 26,400, ACT Research Co. reported, citing preliminary net data it will revise later in the month. That is up from 21,412 a year earlier.

“Fleets came into this order cycle with some overarching caution, but once they made the decisions to make the investments, they have been moving pretty solidly,” Frank Maly, ACT’s director of commercial vehicle transportation analysis and research, told Transport Topics.

January orders were 32,737, according to ACT.

Research firm FTR pegged February final net orders at 25,800.

The market continues to improve as orders are extended deeper into the year, said Don Ake, FTR’s vice president of commercial vehicles.

“Orders are still good. … What we are seeing is both markets [Class 8 and trailer] are kind of operating the same,” he said, with demand from dealers and small fleets.

Fleets are “in this business confidence thing,” since the presidential election, Ake said, referring to sentiment that freight, the economy and capacity will be headed up in the second half of the year.

Trailer makers called the current demand cycle a return to normalcy from a timing standpoint on quote and order activity.

“The prior two years were the anomalies, where customers were engaging a lot earlier in the process to try and lock up build slots, and it sent a message that it was the new normal, but it wasn’t,” Wabash National Corp. CEO Richard Giromini said.

The pace now is more in tune with the 15 years prior to the past two, he said.

David Giesen, vice president of sales at Stoughton Trailer, agreed the industry wait time, “driven by backlog, has come back to more normal levels.”

“In the previous two years, a customer would need to place their order earlier in order to get equipment when they want to take delivery,” he said.

Backlog, though, continues to lag, Maly said.

“In the last couple of order cycles, we peaked out at something like a backlog in the mid-180,000s. This year, we will be peaking at about 150,000, and we certainly are peaking later,” he said.

Business is pretty good on most fronts, said Glenn Harney, chief sales officer at Hyundai Translead.

“Dealers in particular had to delay as they worked down inventory in the third and fourth quarters. They are now coming back with orders for inventory,” he said. “We have not seen very much cancellation activity. The pace is not quite as fast across the board as we saw in 2015 and [the] first half of 2016, but still above average.”

Stifel, Nicolaus & Co. analyst John Larkin wrote in a note to investors in March, “No one is characterizing freight as strong, with the possible exception of some flatbed/open-deck/specialized/heavy-haul/unsided carriers.”

At Strick Group, quoting and order writing for dry vans already is “extremely zesty,” said Charles Willmott, the trailer maker’s chief sales officer.

Since late in the fourth quarter of 2016, there has been a “mad scramble for production space” resulting in extended lead times similar to those for Strick in 2015-2016, Willmott said.

“This has come with a few cancellations by customers ‘right-sizing’ their actual purchases, but nothing out of the ordinary,” he said.

Meanwhile, Harney said Hyundai Translead’s added capacity turned out to be well-timed.

“We have now filled the space into mid-third quarter,” he said, “and there are still orders pending that we hope to participate in.”

At Great Dane Trailers, orders are similar to 2016 overall, said David Gilliland, vice president of national accounts.

“We do expect orders for vans and [refrigerated trailers] to be similar to 2016. The flatbed segment is flat but improving, with oil prices and potential infrastructure spending being something positive to keep an eye on,” Gilliland said.

He added that Great Dane is not seeing significant cancellations, either.

One trend of some significance that Stick’s Willmott has seen could affect the trailer sector’s longer-term picture.

One difference between now and most of 2015-2016 is that raw material and component prices “have shown unexpected and unwelcome increases, which are difficult to explain to the fleet buyers,” Willmott said.

He added that he’s not sure if this is a result of supply and demand pricing or looming inflation, but that the development is something to watch closely.