Senior Reporter

Medium-Duty Sales Advance Again on Class 6 Strength

U.S. retail sales of medium-duty trucks rose 13.7% in May to 20,801, driven by large gains in demand for Class 6 trucks, a highly competitive sector.

Sales of Class 4 through Class 7 trucks a year earlier hit 18,302, according to WardsAuto.com, which reported the results June 13.

Year-to-date, sales have climbed 7% to 94,628 compared with the same period a year ago.

These sales indicate that more than just the lease and rental companies are pulling forward demand for medium-duty trucks, Steve Tam, vice president at ACT Research Co., told Transport Topics.

“We are starting to see, maybe a little bit, broader-based strength in demand from outside of that lease-rental space,” he said, as the economy remains strong and tax reform kicks in “leaving people feeling a little flush with cash or investment dollars and acting accordingly.”

Tam said he raised his medium-duty production and sales forecast slightly as a result, for the first time in six months.

“I’m capitulating,” he said. “It’s a small increase, about 8,000 units, or between 1% and 2%.”

Class 7 posted a 9.7% gain, climbing to 5,390 units. Freightliner, a unit of Daimler Trucks North America, cinched a 53% share, selling 2,880.

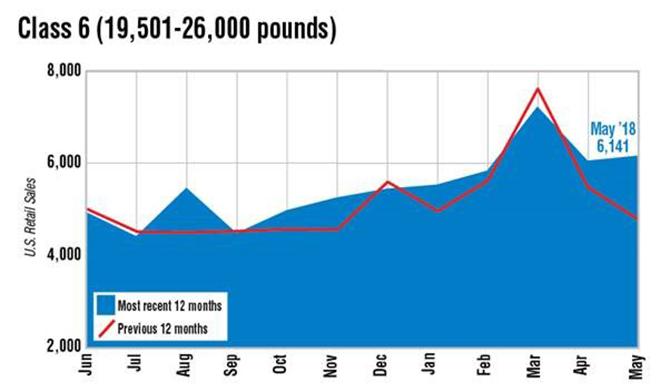

Class 6 sales soared 27.9% to 6,141 trucks.

Ford Motor Co. with 1,962 sales, edged out Freightliner, with 1,720, for the top spot. International took the third spot, selling 1,354.

International is a brand of Navistar Inc.

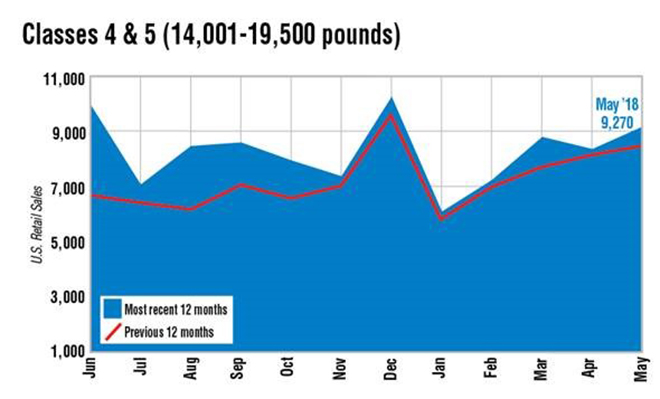

Class 4 through Class 5 sales rose 8.5% to 9,270.

Ford dominated the Class 5 segment with sales of 4,601.

Isuzu Commercial Truck of America sold the most Class 4 vehicles, 1,248.

In related news, Navistar reported in its latest quarterly earnings call that it will start production on the Class 4 and Class 5 CV model at the end of 2018.

“It delivers in the early next year,” Persio Lisboa, Navistar’s chief operating officer, said during the call June 5.

The CV models are a collaboration between Navistar and General Motors Inc., which has been out of the medium-duty sector since 2009.

The frames are Navistar’s and it will build the trucks at its Springfield, Ohio, plant.

Also, Eaton Cummins Automated Transmission Technologies expanded its medium-duty application coverage for the Procision 7-speed dual-clutch automatic transmission to include utility, construction, tanker, refuse and municipal trucks in Class 6 and Class 7.

Procision features IntelliConnect, a telematics-capable system. More medium-duty fleets are using telematics to help reduce unplanned downtime, according to the company.