Senior Reporter

March Medium-Duty Sales Highlight Stable Market

U.S. sales of medium-duty trucks in March held steady, settling above 21,000, WardsAuto.com reported.

Classes 4-7 hit 21,105 units, down 0.2% compared with 21,135 a year earlier, according to Ward’s.

“Nobody is looking for a lot of incremental demand to come out of this space. I think it is largely sated at this point,” Steve Tam, vice president of ACT Research, told Transport Topics.

“Much of what we are going to see is replacement as opposed to people trying to increase fleet size,” he said. “The amount of work is not going to change appreciably through the year.”

Year-to-date, sales improved 2% to 56,166 compared with 55,041 a year earlier.

“I am calling for a 2.5% gain this year. Again, no surprises,” Tam said.

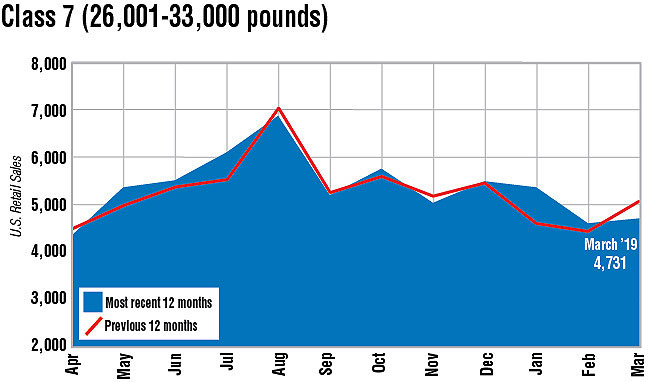

Class 7 sales fell 6.2% to 4,731. Freightliner notched a leading 43% share on sales of 2,041. Many vehicles in this class are destined for municipal customers, Tam said, and these include single-axle dumps and work trucks with booms and digger derricks that lift and place utility poles, for example.

In related news, Kenworth Truck Co. announced an expanded list of options for its Class 7 medium-duty cabover models.

For the Kenworth K370 Class 7 cabover, these options include the Dana Spicer S23-172E 23K high-entry axle, Reyco 23,000-pound rear suspension, Dana 1710 driveline series, 8,000-pound lift-axle pusher, pusher tires and wheels, and upsized park and spring brakes. These options are appropriate for heavy freight delivery, dump trucks, small concrete mixers and cranes, while also opening the door for other vocational uses, such as a larger concrete mixers or 43,000-pound dump applications.

The Kenworth cabover has 55-degree wheel cut for a tight turning radius, which aids in maneuverability when operating in crowded urban environments, according to the Kirkland, Wash.-based company, a unit of Paccar Inc.

“It will be fun to see [heavier cabovers] come back into the marketplace. In 2005 or 2006, before the housing bubble imploded, I think all the mainstream manufacturers had announced cabovers, and the timing of the introduction could not have been worse,” Tam said. “It fell apart just as they were getting their trucks to market, so, they tucked tail and ran.”

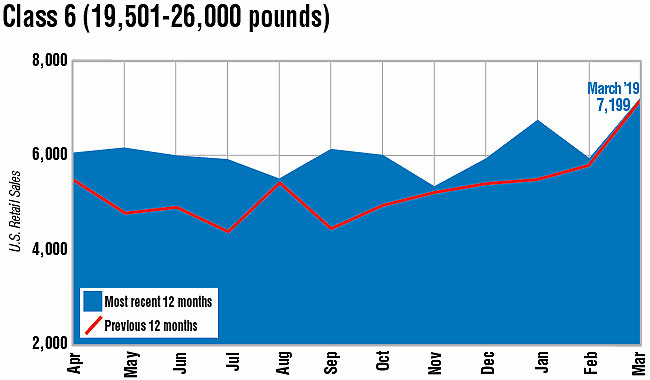

Meanwhile, Class 6 sales were flat at 7,199, or two trucks more than a year ago.

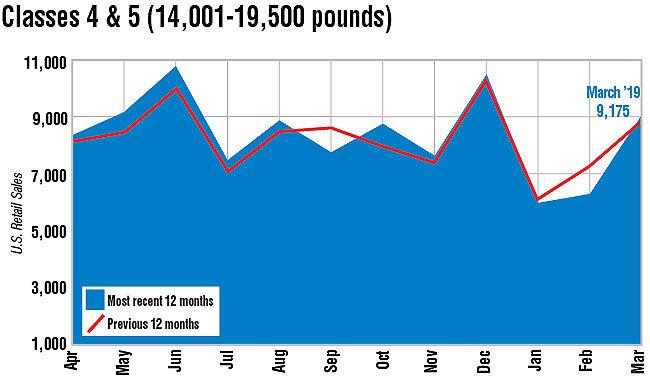

Classes 4-5 rose 3.2% to 9,175 compared with 8,892 a year earlier.