Job Growth Misses Estimates in August With 130,000 Increase

[Stay on top of transportation news: Get TTNews in your inbox.]

Companies’ hiring stumbled in August, likely cementing expectations for a second straight Federal Reserve interest-rate cut as trade uncertainty and softer global growth weigh on the outlook.

Private payrolls rose 96,000, a three-month low, after a downwardly revised 131,000 advance the prior month, according to a Labor Department report Sept. 6 that trailed the median estimate of economists for a 150,000 gain. Total nonfarm payrolls climbed a below-forecast 130,000, which was boosted by 25,000 temporary government workers to prepare for the 2020 Census count.

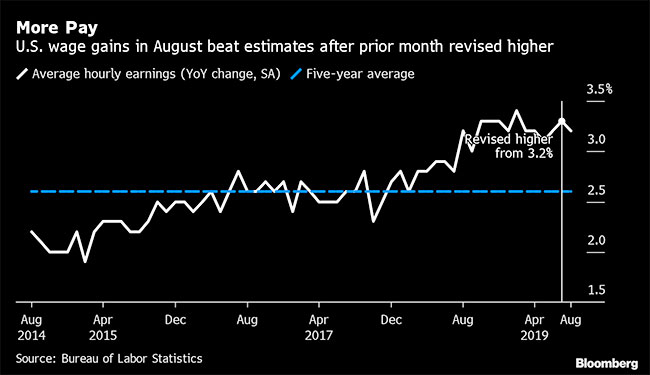

The jobless rate held at 3.7%, near a half-century low, while average hourly earnings topped forecasts with a 3.2% gain from a year earlier and 0.4% from the prior month.

The data suggest bigger cracks are forming in the labor market, which could threaten the chief U.S. economic engine of consumer spending and the record-long expansion itself.

With the U.S.-China trade war and weakness abroad already causing concern and Treasury yields down sharply this year, calls may grow for the Fed to cut interest rates this month by a half point instead of a quarter point.

The amount of Fed easing priced in for 2019 was little changed after the jobs report was released. Treasuries rallied slightly on the figures, with the yield on the 10-year note at about 1.58% versus 1.6% before the data was released.

“The bottom line is that payroll growth is slowing and that is a worrying trend,” Torsten Slok, chief economist at Deutsche Bank said on Bloomberg Television. “The general picture here is certainly of a slowing economy.”

The U.S. expansion is becoming increasingly dependent on steady job gains that have been powering strong consumer spending. Concerns about a recession have intensified because of weakness in manufacturing partly is the result of the trade war and slowing global demand.

Fed Chairman Jerome Powell will have a chance to clarify the central bank’s view of the economy Sept. 6.

Economists surveyed by Bloomberg had projected 160,000 new nonfarm jobs with unemployment at 3.7% and annual wage gains at 3%.

Revisions subtracted 20,000 jobs from the prior two months, bringing the three-month nonfarm average to 156,000.

Private employers added an average 129,000 jobs over the past three months. The latest figures contrast with ADP Research Institute data this week showing U.S. companies added 195,000 jobs in August.

Still, there were several signs the labor market remains solid. The participation rate, or share of working-age people in the labor force, increased to 63.2%, while the employment-population ratio rose to 60.9%, both up 0.2 percentage point from the prior month.

That reflected the household survey’s count of employment rising by 590,000, while the number of unemployed people fell by 19,000 to 6.04 million.

In addition, two key early indicators of weakness in the U.S. jobs market — hiring for temporary-help positions and weekly working hours — strengthened in August.

But the payroll figures showed weakness in several sectors. Manufacturing added an anemic 3,000 jobs, retailers cut positions for a seventh straight month and education and health services hired the fewest people since February.

Industries with solid gains included construction at 14,000 and professional and business services at 37,000.

The U-6, or underemployment rate, rose to 7.2% from an 18-year low of 7%. The gauge includes part-time workers who would prefer a full-time position and people who want a job but aren’t actively looking.