Intermodal Volumes See Solid Gains in First Quarter

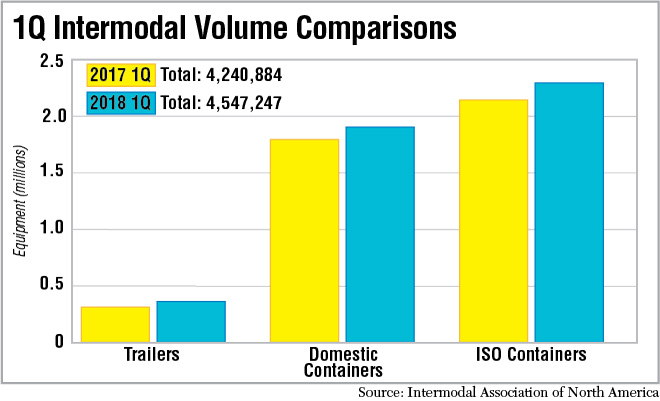

Intermodal volumes rose 7.2% in the first quarter compared with the same period a year ago, the best gain since the second quarter of 2014, according to the Intermodal Association of North America.

The Intermodal Market Trends & Statistics report from IANA found that growth in the quarter was across-the-board, with domestic containers rising 6.2%, international intermodal volumes up 7.0% and trailers jumping 14.5%.

A number of factors combined to send growth higher, according to Joni Casey, CEO of Calverton, Md.-based IANA.

“Drivers for first-quarter growth were an overall strong economy, the continued growth of imports, higher fuel prices, tight over-the-road capacity and weak comparisons to lower 2017 volumes in some markets,” Casey said.

This was the third quarter in a row in which trailers led overall growth. But the increase was due to growth for 28- and 53-foot trailers with other sizes declining in the quarter.

“Volume grew stronger as the quarter progressed. March volume was up 23%. April was up 30% on a weekly basis,” said Todd Tranausky, senior transportation analyst with FTR Transportation Intelligence in Bloomington, Ind.

The growth is a positive, but the challenge is that shippers can’t get enough containers to move their freight and that could be a headwind to the market in the second half of the year, Tranausky said.

Trailers represent about 8% of total intermodal volume, down from more than 10% in the first quarter of 2015, according to IANA. Trailer growth has helped it to make up for declines in 2016, and it may be back to 2015 load levels by the end of this year.

The rise for domestic containers may be due primarily to a comparison with a weak first quarter of 2017, when the sector grew just 1.3%, according to IANA. Still, factors that push freight from the road to the rails, including the tight capacity in the trucking sector, has been a boost to domestic volume.

The international segment benefited from rising container import volumes, and that should continue for 2018, IANA reports. For now, the major threat to growth is any change in international trade policy as threatened by the United States in recent months.

On a regional basis, Mexico recorded the best gain in North America with a rise of 14.4% in volumes. Canada followed with an 8.8% increase, and the United States brought up the rear with a 6.6% increase.

Seven corridors that IANA tracks account for nearly 63% of total volumes. This high-density group was up a collective 6.2%, with the Northeast-Midwest corridor leading the pack with a 12.3% increase. Other lanes in the group include South Central-Southwest, gaining 8%, while trans-Canada grew 6.7%, and both intra-Southeast and Southeast-Southwest rising 6.5%.

The only loser among corridors was the Midwest-Northeast lane, seeing load volume dropping 4.8%. This was the fourth consecutive quarterly loss for the lane with the weakness due to declining container imports in the Northwest region. International volume declined 14.3%, offsetting 7.2% growth in domestic volumes.

Much looks positive for continuing growth in the intermodal sector this year, though it probably won’t continue at as healthy a pace as seen in the first quarter, IANA reported. Part of the volume growth in intermodal was due to the capacity issues that challenged trucking as the electronic logging device mandate took hold and some carriers strained to find enough drivers to carry loads.

At the moment, the “biggest risk“ to intermodal growth in 2018 comes from U.S. trade policy, according to IANA’s quarterly report.

“If large tariffs are applied to Chinese imports, it can have a significant impact on container volume,” the association concluded, noting that about 47% of U.S. container import volume in 2017 originated in China.

“Short term, the impact would be rising import prices from China, pushing container import volume lower.”