Senior Reporter

Industry Leaders React to Soaring Used Class 8 Prices

[Stay on top of transportation news: Get TTNews in your inbox.]

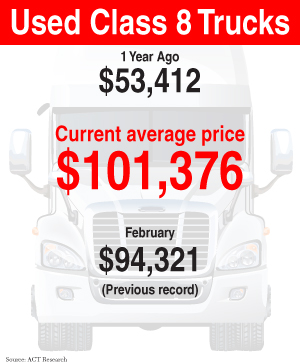

CHARLOTTE, N.C. — With the average cost of used Class 8 trucks soaring in March to more than $101,000, trucking officials attending fleet management company Corcentric’s annual conference say they fear some in the industry — especially smaller and medium companies — may be priced out of the used truck market.

During an April 27 panel discussion, talk touched on the rising cost of trucks, the availability of new vehicles and its impact on the movement of freight, and the ongoing supply chain challenges.

Dale Tower, vice president of used truck dealer AmeriQuest, said that during the past year prices have increased by 90%. He cited the latest report from ACT Research that showed used Class 8 trucks cost $53,412 year ago, and that today fleets are finding little inventory on the market.

ACT Research's State of the Industry: U.S. Classes 3-8 Used Trucks report provides data on the average selling price, miles, and age based on a sample of industry data.https://t.co/BuzC3o0T6N#UsedTrucks, #Trucking #semitruck #transportation #truck #trucking, #ACTResearch pic.twitter.com/VAhQyHH80B — ACT Research (@actresearch) April 27, 2022

“It’s really incredible. It’s been astronomical. I’ve been in the business a long time and we have shifts, cyclical shifts in the value of equipment all of the time, but we’ve never had anything like this,” Tower said. “In some cases, specialty equipment, the prices have gone up even higher, maybe 2½ times, where they were at 18 months ago.”

Panelists said one of the biggest factors pushing up the price of used trucks is the difficulty fleets and owner-operators are having obtaining new equipment, in some cases having to wait 18 months from the time of order to the day of delivery. Original equipment manufacturers have said the worldwide shortage of computer semiconductors is one reason why it takes so long to get a new truck.

“What you’re going to see is a repeat from this year to next year. It’s not going to get much better,” said Sean Storey, Corcentric vice president of capital equipment. “Most of the OEMs are not running at capacity. They are building as much as they can, but the things that are hurting them are the ongoing supply chain disruptions. It’s now different types of components besides semiconductors that are being difficult to get.”

Hello, Silicon Heartland! With a $20b investment just announced by our CEO @PGelsinger, Licking County in Ohio is set to become the new epicenter of leading-edge tech! #IntelOhio pic.twitter.com/hkMhneKMJj — Intel (@intel) January 21, 2022

Tower said the semiconductor shortage could begin to improve with more plants in Asia coming back to full capacity as the COVID-19 pandemic recedes. Also, Intel Corp. said in January that it plans to build a $20 billion facility in New Albany, Ohio, and begin producing components in 2025. Ohio Gov. Mike DeWine, who helped negotiate the deal, said Intel’s announcement is the largest private sector investment in the state’s history.

It’s not only Class 8 trucks that are becoming harder and more expensive to get, but because of the extensive growth of e-commerce, the panelists said vehicles that handle the bulk of final-mile deliveries have surged in cost, and the backlog to receive a new truck after it has been ordered may take longer than a year.

Panelists also addressed ongoing supply chain issues. They said the shortage of new and used trucks and their increasing costs are key reasons why the nation’s ports may continue to have difficulties moving freight that many port officials say is expected to grow in volume by as much as 50% during the next 10 years. The challenges of shipping products more than 5,000 miles by ocean carrier, Corcentric’s Rob Garcia said, is leading some suppliers to consider moving manufacturing back closer to home. Garcia is senior vice president of supply management.

“There is not a lot that’s being done in the short run to solve many of the challenges at the ports,” he said. “There have been a lot of industries, including the tire suppliers who moved a lot of their production to within the countries where they sell the majority of their product, so they do not have to ship as far.

“The obvious thing is to have domestic supply versus global supply. No processes are usually changed until they’re broken, and so much has been broken the last couple of years.”

As many OEMs and companies that did not exist 10 years ago partner and develop and market electric trucks, the panelists forecast the acceptance of those vehicles will depend in part on how fast high-speed electric charging systems are built on a large scale.

“This is happening, electric vehicles are coming,” Storey said. “The No. 1 thing you need to do if you’re doing a battery-electric program is understanding your fleet and how battery-electric vehicles are going to fit into that. Right now, battery-electric vehicles are specialty vehicles. You have to look at the range, when they can be built. This is a very long-term, expensive project for your company,”

Want more news? Listen to today's daily briefing below or go here for more info: