Harbor Truckers Express Cautious Optimism on Turn Times in 2017

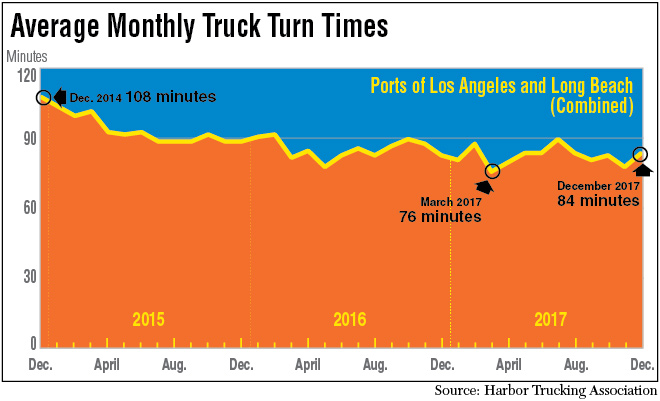

Truck drivers took one minute longer, on average, to enter and exit the two large ports in Southern California in December 2017 compared with the same month in 2016, although the full-year average was three minutes faster than a year ago.

The average time across the entire San Pedro Bay complex was 84 minutes. At the Port of Los Angeles, the busiest in North America, the average was 90 minutes. At the Port of Long Beach, No. 2, it was 77 minutes.

Harbor Trucking Association teams with Geostamp using GPS and geofencing technology to measure the time between trucks entering the queue outside the gate to exiting the complex,. The organization said it is working with carriers to ensure drivers’ time isn’t wasted at the facilities.

“There is a lot of collaboration. Terminals are looking at truckers more than ever on how they can meet the needs of their customers. They’re looking at the trucker as their consumer and the BCO [beneficial cargo owner] as their customer,” said Weston LaBar, CEO of the Harbor Trucking Association. “But we’re still missing the ocean carriers at the table. There is so many decisions that they make that really impacts what happens at the terminal for the trucker, such as shutting off the return of empty containers without notice.”

The quickest terminal was the lightly used Matson terminal in Long Beach at 35 minutes. Long Beach Container Terminal took 54 minutes, on average, a figure that represents the combination of the automated Middle Harbor complex (Pier E) that is being merged with the Pier F facility.

At the Port of Los Angeles, the quickest turn time was 64 minutes, at Yusen Terminals International. HTA has praised the Yusen staff for engaging with the trucking community in 2017 to test ideas on improving efficiency in the terminal.

The slowest terminal was West Basin Container Terminal in Los Angeles at 111 minutes. It was the second consecutive month that the terminal was the slowest. In Long Beach, the slowest location was International Transportation Service at 100 minutes.

Fred Johring, president of Golden State Express, noted that while all of the averages offer a report card on the 12 terminals at the two ports, there are a wide variety of experiences within the data. For example, about 21% of the truck trips took longer than two hours to complete. Plus, more than 20% of truck turns last year took longer than two hours in 10 of the 12 months, matching the frequency in 2016.

“The deviation from the average on a transaction-by-transaction basis is so dramatically significant that it makes a dispatcher’s job very difficult,” said Johring, who wants more consistency and predictability.

But LaBar noted the data also do not take into account what percentage of the trips were “dual transaction,” or situations in which the trucker drops off an export and picks up an import during one trip to the same location.

“If you can have a terminal that would guarantee a dual transaction with an 80 minute turn, 90% of the time, that would be better than a terminal with a 60 minute average, but half of the time is three hours and the other half is 45 minutes on a single transaction,” he said.

ICYMI: #PortofLA handled 9.3 million TEUs in 2017 – a 5.5% increase over our 2016 record-setting volumes. These numbers are unprecedented in L.A.’s history. https://t.co/FfguDHWAHq pic.twitter.com/dBpU8wRmlL — Port of Los Angeles (@PortofLA) January 17, 2018

The Port of Los Angeles announced that while cargo traffic decreased 2.2% year-over-year in December, it still shattered the Western Hemisphere container traffic record that it set in 2016. Dockworkers moved 779,210 industry-standard 20-foot-equivalent units, or TEUs, in December, ending the year with 9.34 million. The 2017 results were up 5.5% from 2016.

Loaded imports in December decreased 2.2% to 385,492, and exports dropped 7.3% to 152,865.

Nevertheless, Port of Los Angeles Executive Director Gene Seroka said 2017 exceeded his expectations.

“Our growth is a direct result of a concerted, multiyear effort by the port and its many partners to maximize efficiency throughout the supply chain. All the collaborative work by a broad range of global maritime stakeholders has delivered these remarkable results,” he said.

“We are extremely proud of the role our workforce has played in achieving this cargo milestone, and in keeping the San Pedro Bay port complex the No. 1 trade gateway in the U.S.,” added Mark Mendoza, president of the International Longshore and Warehouse Union Local 13.

The Port of Long Beach will not release data until the State of the Port address Jan. 24, although Executive Director Mario Cordero gave a sneak peek at the Transportation Research Board annual meeting Jan. 9. He said the full-year container count will be between 10% and 11% higher than 2016.

Based on the statement, December’s total traffic likely will fall between 605,000 and 673,000 TEUs compared with 548,929 in December 2016.

Based on historical percentages, loaded imports probably will be between 299,000 and 354,000 TEUs and loaded exports between 102,500 and 162,000.

In December 2016, the Port of Long Beach processed 271,599 imports and 122,933 exports.

“All I can say for now is that we had a very good year in 2017,” Cordero told Transport Topics during the conference.