FreightRover Gets Backing to Launch Freight Payment Service

FreightRover, a company launched a year ago by a former top executive at Celadon Group to provide technology to automate vendor payments, has secured a financing facility of up to $500 million from Crayhill Capital Management and other investors to support a new business that will offer trade finance and freight factoring services.

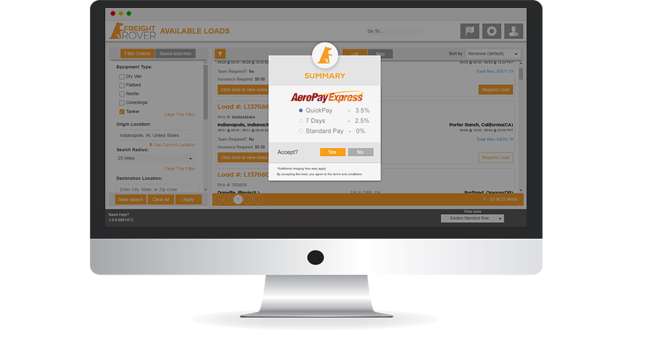

The new entity, named Rover180, will offer quick pay options for transportation service providers and other vendors that may be experiencing delays in getting paid by shippers.

Since the recession in 2008-09, many companies have extended payment cycles to conserve working capital with the current average days to pay being 57 days, according to FreightRover CEO Eric Meek.

Meek

At the same time, smaller fleets have been growing faster than large fleets and are carrying a bigger percentage of the nation’s freight.

“These smaller fleets typically struggle with cash flow,” Meek told Transport Topics, “so shippers extending pay terms may actually be limiting their capacity in a market where the loads to trucks [ratio] has increased 29% from 2017 to 2018.”

Meek, who joined Celadon as a financial analyst in 2004 and rose through the ranks to become president and chief operating officer in 2015, resigned from his position in April 2017 amid allegations of financial irregularities regarding an equipment leasing subsidiary.

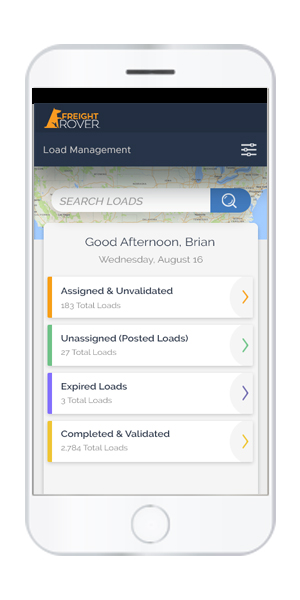

Rendering of the mobile app. (FreightRover)

Meek was retained by Celadon as a consultant for 10 months and negotiated the purchase of Prosair Technologies, a subsidiary of Celadon that had developed a load-matching app called FreightRover for owner-operators.

Meek explained that while Celadon offered a very basic load exchange for its owner-operators, FreightRover “has taken that concept to a new level” and that the current supply chain financing and factoring services “were designed and built independently.”

Meek said the market for freight payments is huge but highly fragmented with many small service providers.

“The primary competition is a wide range of factoring entities and logistics firms that offer quick payment solutions,” Meek said. “Most shippers do not offer a quick payment solution. Our solution is also a perfect fit for logistics firms who do not want to consume their working capital for this type of payment.”

Josh Eaton, a managing partner at Crayhill Capital in New York, said the company will work with FreightRover’s management team to scale up the Rover180 platform.

“We are impressed by FreightRover’s ability to offer value-added technological and management solutions in the transportation industry,” he said.

Crayhill Capital was formed in 2015 to provide private debt financing and asset management services.