Fleet Failures Rise Sharply

This story appears in the April 18 print edition of Transport Topics.

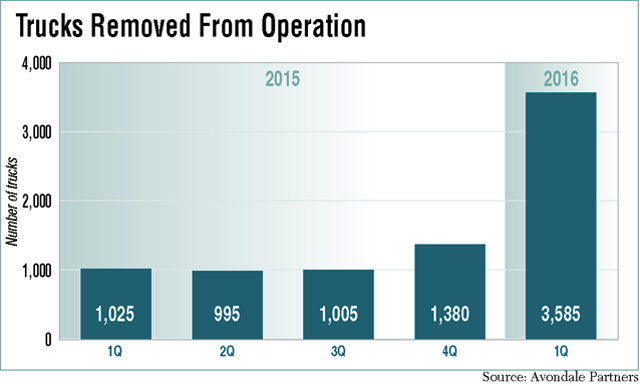

Fleet failures rose sharply in the first quarter as slackening demand, stagnant freight rates and other factors sidelined 3,585 trucks, about three times more than the same quarter last year as well as the final three months of 2015, according to a new Avondale Partners report.

Failures totaled 1,025 in the first quarter of last year and 1,380 in the fourth quarter.

The first-quarter 2016 failures were the highest since the third quarter of 2014, Avondale analyst Donald Broughton told Transport Topics, and approached the lowest-ever full-year total of 4,405 trucks that was recorded last year.

“Conditions have become more challenging,” he said April 12. “Fuel no longer is down every week. Residual values [for trucks] have plummeted. Freight is not as plentiful. Pricing power is nonexistent. Carriers that were just managing to get by during a great time when things were fabulous are now at risk.”

Last year’s failures were “so abnormally low” that it was easy to predict that they would pick up from 2015’s all-time lows, Broughton said.

“Things were so good in 2014 and early in 2015 that they could only get worse,” the Avondale analyst said, citing a market that was “almost perfect,” with good freight demand, high rates, low fuel prices and strong residual values for trucks.

That combination resulted in margin enhancement and a cash flow windfall that buoyed fleets, making it nearly impossible to kill a trucker financially, he added.

American Trucking Associations Chief Economist Bob Costello said, “While the numbers are up from the fourth quarter and first quarter of 2015, they remain quite low historically.” For example, the 2014 total was nearly 30,000 trucks in failed fleets, which in turn was far below the 61,975 reduction in the U.S. truck fleet in 2010, based on reports compiled by Broughton.

“I do believe that the relatively higher numbers are reflective of a truck freight market with softer demand growth and more capacity available,” Costello said. “As a result, conditions have become a little more difficult for fleets without much cushion.”

A wide range of numbers illustrates the shift in the trends. While diesel prices bottomed out in mid-February, they have risen in seven of the past eight weeks. More increases are looming as crude oil prices have jumped more than 50% since hitting their lowest point two months ago. On the used-truck market, prices are down 25% or more since December, Broughton said.

Avondale and Cass Information Systems’ index of truckload rates has slipped from an average increase of 5.2% in the first half of last year to 2.5% in the second half. Over the past three months, rates have risen less than 1% in each month. Given that trajectory, Broughton now predicts that freight rates on average this year will be between 2% higher and 1% lower.

From an earnings and cash flow standpoint, the slippage in used-truck prices is notable, Broughton said, since some publicly traded fleets can derive 30% to 50% of their profits from used-truck sales.

While fuel, pricing, freight demand and used-truck prices affect the trend in fleet failures, the overall supply and demand trends remain the most important, Broughton said, because all of the other factors are dependent on the supply-demand balance.

Given current market conditions, Broughton said he believes failure rates will remain higher in 2016 than 2015, though he shied away from citing a percentage.

“There is a real potential for failures to get noticeably worse this year, depending on supply and demand and diesel prices,” he said.

One factor that won’t come into play this year, the Avondale analyst said, is the federal mandate for fleets to install electronic logging devices by the end of 2017. The reason, he said, is that fleets that haven’t already installed that equipment will wait until the last possible moment to do so, given the current pricing environment.

“With shippers sending out massive amounts of bid requests now to get rates lowered,” he said, “why would anyone think shippers are ready to be charged more so that a fleet can pay for ELDs?”

At the same time, Broughton said, with a weak rate environment, there is strong pressure for fleets that don’t have ELDs to wait and hope that pricing improves.

As a result, he said, ELDs won’t affect fleet failures until the fourth quarter of next year, when they become mandatory, or the first quarter of 2018.

However, Broughton added, “This round of failures … may look minuscule once EOBRs are enforced on a ‘wholesale’ basis.”