Fleet Failures Accelerate in 2Q

This story appears in the July 18 print edition of Transport Topics.

Fleet failures, measured in the number of trucks pulled off the road, more than doubled in the second quarter on a year-over-year basis, but the resulting reduction in capacity isn’t enough to change the sluggish freight market truckers face, a new report said.

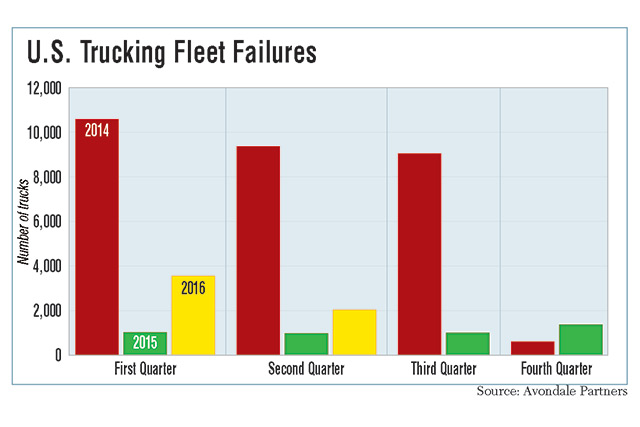

A total of 2,050 trucks from 120 fleets were taken off the road, compared with 995 from 70 carriers in last year’s second quarter, Avondale Partners analyst Donald Broughton told Transport Topics last week.

The second-quarter result was lower than the 3,565 trucks pulled off the highways in the first quarter, Broughton said, continuing the pattern of fewer failures sequentially from the first to the second quarter.

“The number of failures is up,” Broughton said, “but it isn’t anywhere near the magnitude that the industry needs to right-size the balance between capacity and demand,” said Broughton, who has been tracking fleet failure trends for about two decades.

He noted that the number of failures in the 2014 second quarter was far higher, at 9,435, to underscore his point about the second quarter rate. That quarter was a recent peak, which was followed by a sharp drop-off in failures last year that was helped by a precipitous drop in diesel prices. The result was a record-low failure rate for all of 2015.

In fact, this year’s 5,615 reduction in trucks already has surpassed last year’s total of 4,405.

The latest American Trucking Associations truckload shipment statistics illustrate the weak second-quarter truckload market, where overall volumes were virtually flat year-over-year. In addition, spot market freight was well below last year in April and May before improving in June.

“I’m a little surprised the numbers weren’t higher as the spot market has become tough,” ATA Chief Economist Bob Costello said. “Looking ahead, unless freight really picks up and capacity tightens, I think we could see some more fleets close shop in the quarters ahead, but at lower levels than the past.”

Supply and demand are far enough out of whack that Broughton believes it will take two or three quarters with capacity reductions of 2% or 3% each quarter to make the trucking market fully healthy.

Last month, Broughton said there was about 4% too much available trucking capacity. “History shows that to get a large exodus of capacity, you need a precipitous drop in demand and a strong rise in the price of diesel,” the analyst said. “Neither of those is happening now. Instead, there is a modest drop in demand and a modest rise in diesel, so the failure rate is modest.”

Broughton, the Avondale analyst, believes the excess capacity likely won’t be removed until at least the first quarter of 2018, when the federal electronic logging mandate is scheduled to be in full effect. However, he added that unexpected, substantial changes in demand and diesel prices could affect that forecast.

The latest report also was issued against the backdrop of some reported improvement in freight markets, such as stronger June volumes on DAT and Truckstop.com load boards.

Cowen & Co. analyst Jason Seidl said in a July 12 report, “Truckload demand appears to have improved materially in June. Capacity is slowly coming in line.” He based his assessment on comments by privately held truckers and 3PLs that reported the uptick continued this month.

Truckload freight rates, which have been declining in recent months, could hasten the pace of failures if there is further pricing deterioration, Broughton said.

In his report, he also noted two other factors in today’s market.

One is that used-truck values have plummeted at least 30% since the beginning of 2016 as the influx of trucks sold at a blistering pace in 2014 and 2015 has led to the current overabundance of available equipment. Falling used-truck prices actually tend to keep fleets in business because banks and other finance companies can’t get much for used trucks if they take back the equipment.

“If I thought I could close you down and get something for the truck, I would, but if I can’t, I won’t,” Broughton said, taking a banker’s stance.

There also is a notable survivor effect that lowers failures, he noted, because companies that survived cycles such as the recession must be running a decent operation.

The 2016 drop-off in truck sales and orders won’t be an immediate help in capacity reduction, he said, because the overall size of the nation’s truck fleet, which are long-lived assets, doesn’t drop quickly.

Another factor that is keeping fleets in business is that costs aren’t rising.

Broughton added that with driver pay little-changed and moderate fuel prices, the only significant inflationary price pressure is from insurance. Those costs typically are less than 5%, based on industry statistics.