Emerging Markets Offer Investment Opportunity During Trade War

[Stay on top of transportation news: Get TTNews in your inbox.]

Rocked by trade disputes, the possibility of a U.S. recession and the ever-present threat of political conflagration, the backdrop for emerging and frontier markets rarely has seemed less settled. Dare to look past the turmoil, though, and opportunities abound.

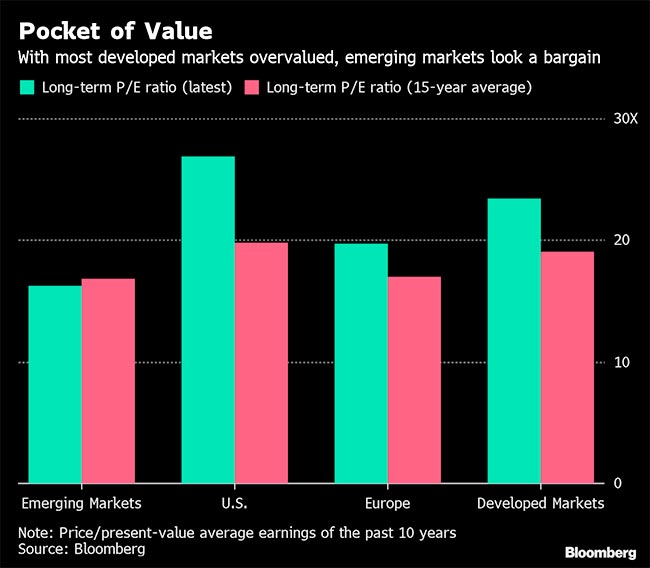

Higher bond yields are attractive at a time when the world’s richest nations house about $13 trillion in negative-yielding debt. At the same time, superior economic growth provides a hedge against a global slowdown sparked by the U.S.-China trade war, and equities offer a bargain relative to the overvalued stocks of advanced markets.

Ever since President Donald Trump ratcheted up trade tensions in early 2018, a brutal sell-off has underscored how vulnerable developing nations can be to global events. Yet investor pessimism may have been overdone. An expected collapse in economic growth in the wake of Trump’s punitive tariffs against China hasn’t materialized.

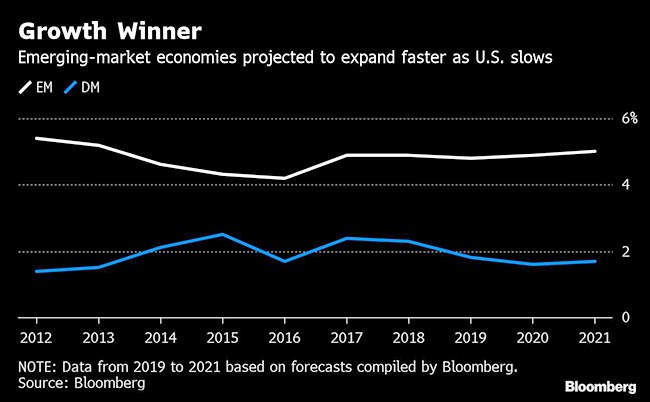

In fact, the opposite is true. Economists estimate that emerging markets may suffer less than developed ones from the trade war. Their growth rates already are double those of wealthier nations, and that gap is projected to widen in the next two years. That’s because rising consumer spending in China and India is cushioning the impact of trade losses.

Central banks moved last year to safeguard their currencies against the twin impact of trade wars and Federal Reserve tightening, restoring the extra yield investors demand for owning emerging-market bonds rather than U.S. Treasuries. Now, slowing inflation is adding to the allure.

Average price-growth in developing countries is near a record low, boosting real yields. And it’s not just the most vulnerable countries — such as Turkey and Argentina — that offer such juicy returns, but even the stronger economies in India, Russia and Mexico. The hunt for higher yields continues more than three years after the Fed resumed interest-rate hikes.

On the surface, falling earnings estimates for the next 12 months give the impression that developing-nation stocks are expensive. Yet analysts’ pessimism over earnings has much to do with the lingering risks of a prolonged trade war. Any truce between the U.S. and China could lead to a reassessment of the profit outlook.

Given that economic-growth projections favor emerging markets, it may be more pertinent to look at valuations without the jitters surrounding the trade war. A comparison based on cyclically adjusted long-term price-earnings ratios, which factor in inflation-adjusted profits of the past decade, shows most developed markets to be overvalued relative to their historical averages. Emerging markets, on the other hand, are slightly undervalued.